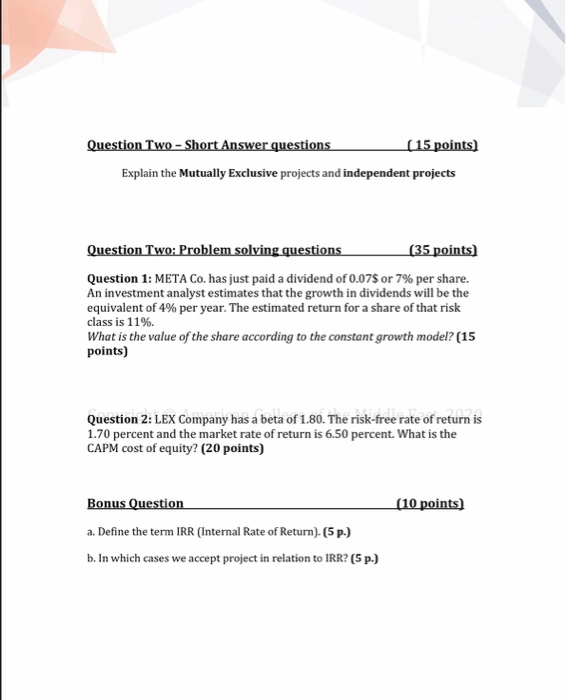

Question: Question Two - Short Answer questions (15 points) Explain the Mutually Exclusive projects and independent projects Question Two: Problem solving questions (35 points) Question 1:

Question Two - Short Answer questions (15 points) Explain the Mutually Exclusive projects and independent projects Question Two: Problem solving questions (35 points) Question 1: META Co. has just paid a dividend of 0.075 or 7% per share. An investment analyst estimates that the growth in dividends will be the equivalent of 4% per year. The estimated return for a share of that risk class is 11%. What is the value of the share according to the constant growth model? (15 points) Question 2: LEX Company has a beta of 1.80. The risk-free rate of return is 1.70 percent and the market rate of return is 6.50 percent. What is the CAPM cost of equity? (20 points) (10 points) Bonus Question a. Define the term IRR (Internal Rate of Return). (5 p.) b. In which cases we accept project in relation to IRR? (5 p.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts