Question: Question: Using the data in the student spreadsheet file Ethan Allen Financials.xlsx (to find the student s... Using the data in the student spreadsheet file

Question: Using the data in the student spreadsheet file Ethan Allen Financials.xlsx (to find the student s...

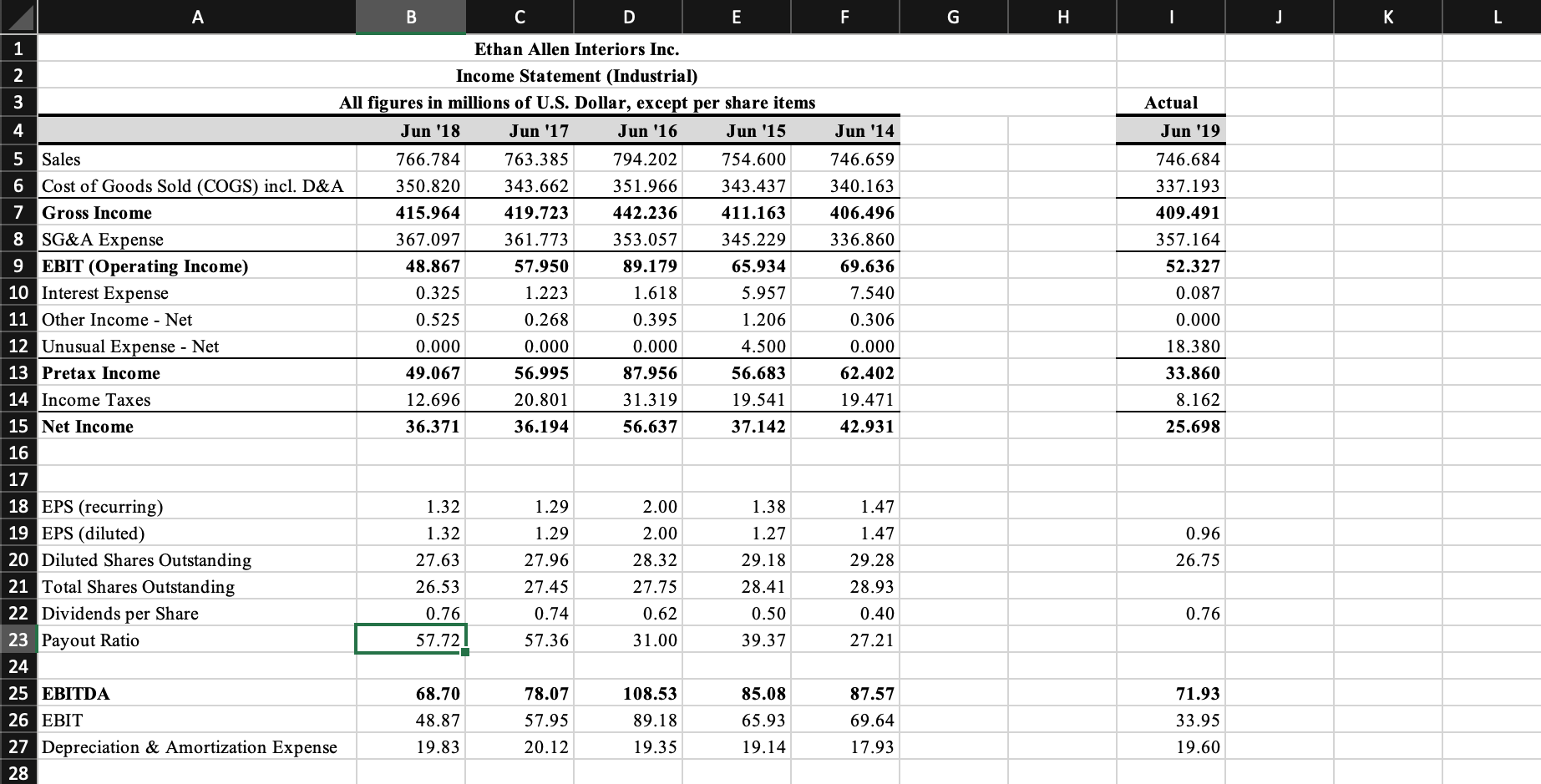

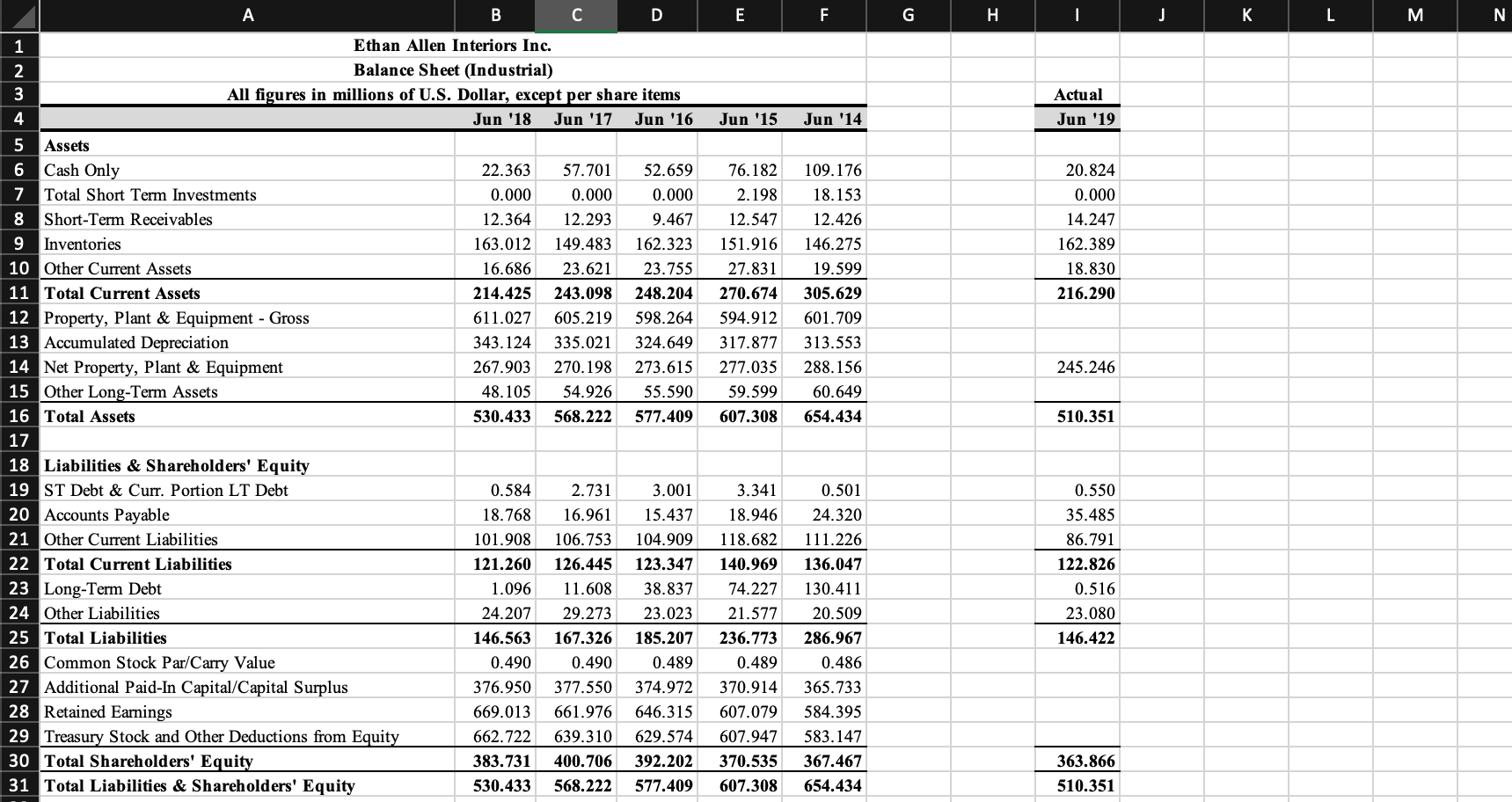

Using the data in the student spreadsheet file Ethan Allen Financials.xlsx (to find the student spreadsheets for Financial Analysis with Microsoft Excel, ninth edition, go to (www.cengage.com/finance/mayes/analysis/9e), forecast the June 30, 2019 income statement and balance sheet for Ethan Allen. Use the percent of sales method and the following assumptions: (1) Sales in FY 2019 will be $761.20; (2) The tax rate will be 25%; (3) Each item that changes with sales will be the five-year average percentage of sales; (4) Property, Plant & Equipment - Gross will increase to $675; and (5) The dividend will be $0.90 per share. Use your judgment on all other items.

A. What is the DFN in 2019? Is this a surplus or deficit?

B. Assume that the DFN will be absorbed by long-term debt and that the interest rate is 4% of LTD. Set up an iterative worksheet to eliminate it.

C. Create a chart of cash vs. sales and add a trend line. Is cash a consistent percentage of sales? Does this fit your expectations?

D. Use the regression tool to verify your results from part c. Is the trend statistically significant? Use at least three methods from the regression output to show why or why not.

Turn off iteration, and use the Scenario Manager to set up three scenarios:

1)Best CaseSales are 5% higher than expected. 2)Base CaseSales are exactly as expected. 3)Worst CaseSales are 5% less than expected. What is the DFN under each scenario?

Please show how you got the answers!

A B C D E F G H . I J L Actual Jun '14 Jun '19 1 Ethan Allen Interiors Inc. 2 Income Statement (Industrial) 3 All figures in millions of U.S. Dollar, except per share items 4 Jun '18 Jun '17 Jun '16 Jun '15 5 Sales 766.784 763.385 794.202 754.600 6 Cost of Goods Sold (COGS) incl. D&A 350.820 343.662 351.966 343.437 7 Gross Income 415.964 419.723 442.236 411.163 8 SG&A Expense 367.097 361.773 353.057 345.229 9 EBIT (Operating Income) 48.867 57.950 89.179 65.934 10 Interest Expense 0.325 1.223 1.618 5.957 11 Other Income - Net 0.525 0.268 0.395 1.206 12 Unusual Expense - Net 0.000 0.000 0.000 4.500 13 Pretax Income 49.067 56.995 87.956 56.683 14 Income Taxes 12.696 20.801 31.319 19.541 15 Net Income 36.371 36.194 56.637 37.142 16 17 18 EPS (recurring) 1.32 1.29 2.00 1.38 19 EPS (diluted) 1.32 1.29 2.00 1.27 20 Diluted Shares Outstanding 27.63 27.96 28.32 29.18 21 Total Shares Outstanding 26.53 27.45 27.75 28.41 22 Dividends per Share 0.76 0.74 0.62 0.50 23 Payout Ratio 57.72 57.36 31.00 39.37 24 25 EBITDA 68.70 78.07 108.53 85.08 26 EBIT 48.87 57.95 89.18 65.93 27 Depreciation & Amortization Expense 19.83 20.12 19.35 19.14 28 746.659 340.163 406.496 336.860 69.636 7.540 0.306 0.000 62.402 19.471 42.931 746.684 337.193 409.491 357.164 52.327 0.087 0.000 18.380 33.860 8.162 25.698 1.47 1.47 0.96 26.75 29.28 28.93 0.40 0.76 27.21 71.93 87.57 69.64 17.93 33.95 19.60 A B D E F G H I J K L M N Actual Jun '19 Jun '15 Jun '14 76.182 2.198 12.547 151.916 27.831 270.674 594.912 317.877 277.035 59.599 607.308 1 Ethan Allen Interiors Inc. 2 Balance Sheet (Industrial) 3 All figures in millions of U.S. Dollar, except per share items 4 Jun '18 Jun '17 Jun '16 5 Assets 6 Cash Only 22.363 57.701 52.659 7 Total Short Term Investments 0.000 0.000 0.000 8 Short-Term Receivables 12.364 12.293 9.467 9 Inventories 163.012 149.483 162.323 10 Other Current Assets 16.686 23.621 23.755 11 Total Current Assets 214.425 243.098 248.204 12 Property, Plant & Equipment - Gross 611.027 605.219 598.264 13 Accumulated Depreciation 343.124 335.021 324.649 14 Net Property, Plant & Equipment 267.903 270.198 273.615 15 Other Long-Term Assets 48.105 54.926 55.590 16 Total Assets 530.433 568.222 577.409 17 18 Liabilities & Shareholders' Equity 19 ST Debt & Curr. Portion LT Debt 0.584 2.731 20 Accounts Payable 18.768 16.961 15.437 21 Other Current Liabilities 101.908 106.753 104.909 22 Total Current Liabilities 121.260 126.445 123.347 23 Long-Term Debt 1.096 11.608 38.837 24 Other Liabilities 24.207 29.273 23.023 25 Total Liabilities 146.563 167.326 185.207 26 Common Stock Par/Carry Value 0.490 0.490 0.489 27 Additional Paid-In Capital/Capital Surplus 376.950 377.550 374.972 28 Retained Earnings 669.013 661.976 646.315 29 Treasury Stock and Other Deductions from Equity 662.722 639.310 629.574 30 Total Shareholders' Equity 383.731 400.706 392.202 31 Total Liabilities & Shareholders' Equity 530.433 568.222 577.409 109.176 18.153 12.426 146.275 19.599 305.629 601.709 313.553 288.156 60.649 654.434 20.824 0.000 14.247 162.389 18.830 216.290 245.246 510.351 3.001 3.341 18.946 118.682 140.969 74.227 21.577 236.773 0.489 370.914 607.079 607.947 370.535 607.308 0.501 24.320 111.226 136.047 130.411 20.509 286.967 0.486 365.733 584.395 583.147 367.467 654.434 0.550 35.485 86.791 122.826 0.516 23.080 146.422 363.866 510.351 A B C D E F G H . I J L Actual Jun '14 Jun '19 1 Ethan Allen Interiors Inc. 2 Income Statement (Industrial) 3 All figures in millions of U.S. Dollar, except per share items 4 Jun '18 Jun '17 Jun '16 Jun '15 5 Sales 766.784 763.385 794.202 754.600 6 Cost of Goods Sold (COGS) incl. D&A 350.820 343.662 351.966 343.437 7 Gross Income 415.964 419.723 442.236 411.163 8 SG&A Expense 367.097 361.773 353.057 345.229 9 EBIT (Operating Income) 48.867 57.950 89.179 65.934 10 Interest Expense 0.325 1.223 1.618 5.957 11 Other Income - Net 0.525 0.268 0.395 1.206 12 Unusual Expense - Net 0.000 0.000 0.000 4.500 13 Pretax Income 49.067 56.995 87.956 56.683 14 Income Taxes 12.696 20.801 31.319 19.541 15 Net Income 36.371 36.194 56.637 37.142 16 17 18 EPS (recurring) 1.32 1.29 2.00 1.38 19 EPS (diluted) 1.32 1.29 2.00 1.27 20 Diluted Shares Outstanding 27.63 27.96 28.32 29.18 21 Total Shares Outstanding 26.53 27.45 27.75 28.41 22 Dividends per Share 0.76 0.74 0.62 0.50 23 Payout Ratio 57.72 57.36 31.00 39.37 24 25 EBITDA 68.70 78.07 108.53 85.08 26 EBIT 48.87 57.95 89.18 65.93 27 Depreciation & Amortization Expense 19.83 20.12 19.35 19.14 28 746.659 340.163 406.496 336.860 69.636 7.540 0.306 0.000 62.402 19.471 42.931 746.684 337.193 409.491 357.164 52.327 0.087 0.000 18.380 33.860 8.162 25.698 1.47 1.47 0.96 26.75 29.28 28.93 0.40 0.76 27.21 71.93 87.57 69.64 17.93 33.95 19.60 A B D E F G H I J K L M N Actual Jun '19 Jun '15 Jun '14 76.182 2.198 12.547 151.916 27.831 270.674 594.912 317.877 277.035 59.599 607.308 1 Ethan Allen Interiors Inc. 2 Balance Sheet (Industrial) 3 All figures in millions of U.S. Dollar, except per share items 4 Jun '18 Jun '17 Jun '16 5 Assets 6 Cash Only 22.363 57.701 52.659 7 Total Short Term Investments 0.000 0.000 0.000 8 Short-Term Receivables 12.364 12.293 9.467 9 Inventories 163.012 149.483 162.323 10 Other Current Assets 16.686 23.621 23.755 11 Total Current Assets 214.425 243.098 248.204 12 Property, Plant & Equipment - Gross 611.027 605.219 598.264 13 Accumulated Depreciation 343.124 335.021 324.649 14 Net Property, Plant & Equipment 267.903 270.198 273.615 15 Other Long-Term Assets 48.105 54.926 55.590 16 Total Assets 530.433 568.222 577.409 17 18 Liabilities & Shareholders' Equity 19 ST Debt & Curr. Portion LT Debt 0.584 2.731 20 Accounts Payable 18.768 16.961 15.437 21 Other Current Liabilities 101.908 106.753 104.909 22 Total Current Liabilities 121.260 126.445 123.347 23 Long-Term Debt 1.096 11.608 38.837 24 Other Liabilities 24.207 29.273 23.023 25 Total Liabilities 146.563 167.326 185.207 26 Common Stock Par/Carry Value 0.490 0.490 0.489 27 Additional Paid-In Capital/Capital Surplus 376.950 377.550 374.972 28 Retained Earnings 669.013 661.976 646.315 29 Treasury Stock and Other Deductions from Equity 662.722 639.310 629.574 30 Total Shareholders' Equity 383.731 400.706 392.202 31 Total Liabilities & Shareholders' Equity 530.433 568.222 577.409 109.176 18.153 12.426 146.275 19.599 305.629 601.709 313.553 288.156 60.649 654.434 20.824 0.000 14.247 162.389 18.830 216.290 245.246 510.351 3.001 3.341 18.946 118.682 140.969 74.227 21.577 236.773 0.489 370.914 607.079 607.947 370.535 607.308 0.501 24.320 111.226 136.047 130.411 20.509 286.967 0.486 365.733 584.395 583.147 367.467 654.434 0.550 35.485 86.791 122.826 0.516 23.080 146.422 363.866 510.351

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts