Question: Question V: Credit Scoring (20 points) You decide that the most important factors in determining the probability of default for a potential borrower are its

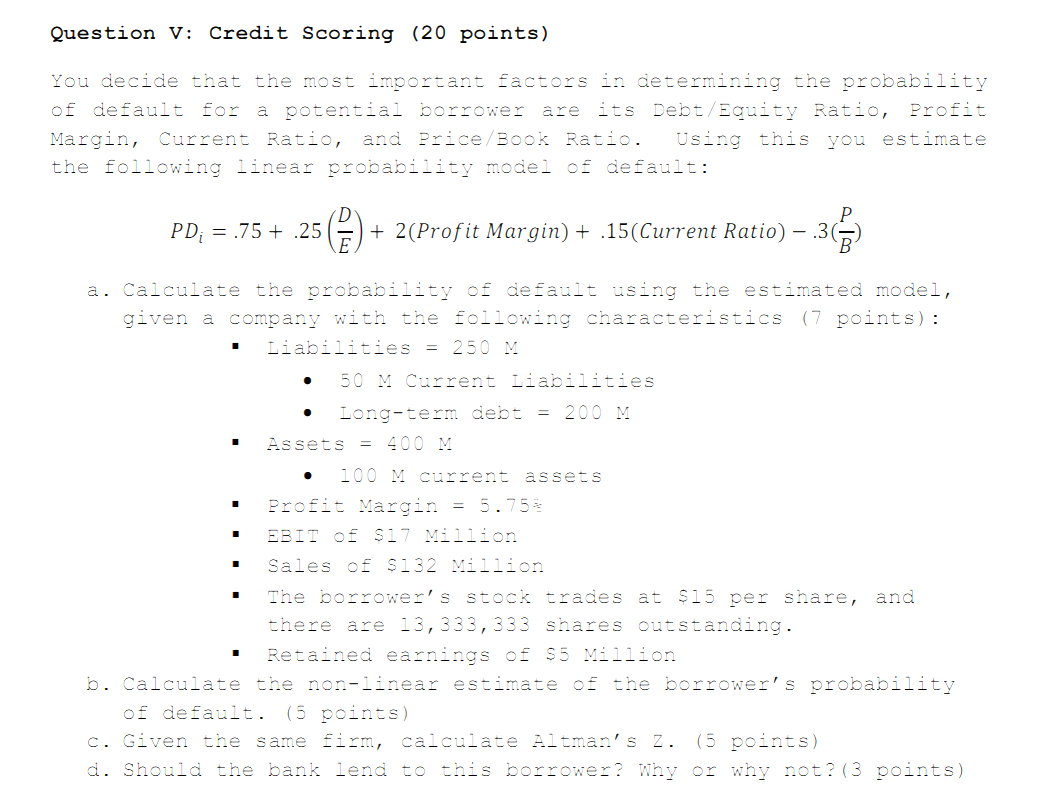

Question V: Credit Scoring (20 points) You decide that the most important factors in determining the probability of default for a potential borrower are its Debt/Equity Ratio, Profit Margin, Current Ratio, and Price Book Ratio. Using this you estimate the following linear probability model of default: PD; = .75 + .25 ) 1+ 2(Profit Margin) + .15(Current Ratio) - 3 . a. Calculate the probability of default using the estimated model, given a company with the following characteristics (7 points): Liabilities = 250 M 50 M Current Liabilities Long-term debt = 200 M Assets = 400 M 100 M current assets Profit Margin = 5.75% EBIT of $27 Million Sales of $132 Million The borrower's stock trades at $15 per share, and there are 13,333,333 shares outstanding. Retained earnings of $5 Million b. Calculate the non-linear estimate of the borrower's probability of default. (5 points) c. Given the same firm, calculate Altman's Z. (5 points) d. Should the bank lend to this borrower? Why or why not? (3 points) . Question V: Credit Scoring (20 points) You decide that the most important factors in determining the probability of default for a potential borrower are its Debt/Equity Ratio, Profit Margin, Current Ratio, and Price Book Ratio. Using this you estimate the following linear probability model of default: PD; = .75 + .25 ) 1+ 2(Profit Margin) + .15(Current Ratio) - 3 . a. Calculate the probability of default using the estimated model, given a company with the following characteristics (7 points): Liabilities = 250 M 50 M Current Liabilities Long-term debt = 200 M Assets = 400 M 100 M current assets Profit Margin = 5.75% EBIT of $27 Million Sales of $132 Million The borrower's stock trades at $15 per share, and there are 13,333,333 shares outstanding. Retained earnings of $5 Million b. Calculate the non-linear estimate of the borrower's probability of default. (5 points) c. Given the same firm, calculate Altman's Z. (5 points) d. Should the bank lend to this borrower? Why or why not? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts