Question: Question II: Credit Scoring ( 2 0 points ) You decide that the most important factors in determining the probability of default for a potential

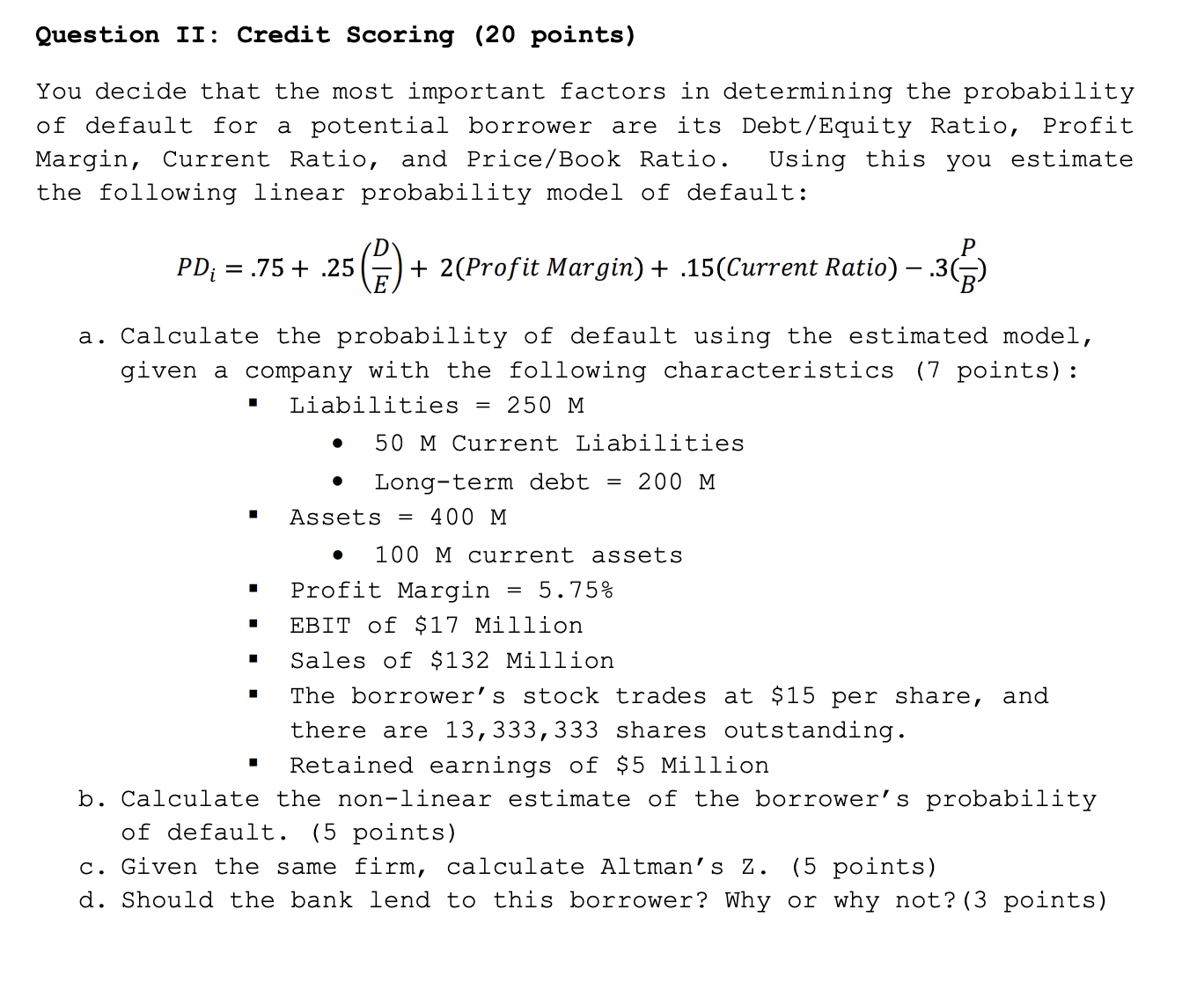

Question II: Credit Scoring points You decide that the most important factors in determining the probability of default for a potential borrower are its DebtEquity Ratio, Profit Margin, Current Ratio, and PriceBook Ratio. Using this you estimate the following linear probability model of default: PDiDE Profit Margin Current Ratio PB a Calculate the probability of default using the estimated model, given a company with the following characteristics points: Liabilities M M Current Liabilities Longterm debt M Assets M M current assets Profit Margin EBIT of $ Million Sales of $ Million The borrower's stock trades at $ per share, and there are shares outstanding. Retained earnings of $ Million b Calculate the nonlinear estimate of the borrower's probability of default. points c Given the same firm, calculate Altman's Z points d Should the bank lend to this borrower? Why or why not? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock