Question: QUESTION : What are the data and sample in this article? Investor Rationality and Financial Decisions Gil Cohen The Max Stern Academic College of Emek

QUESTION : What are the "data" and "sample" in this article?

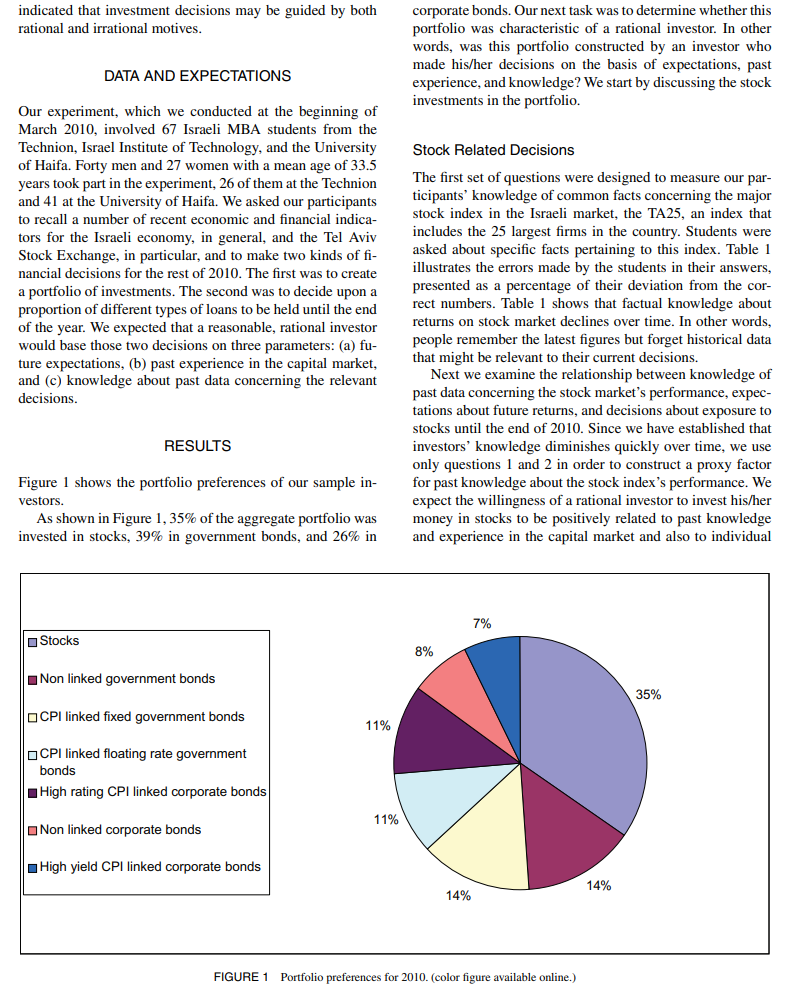

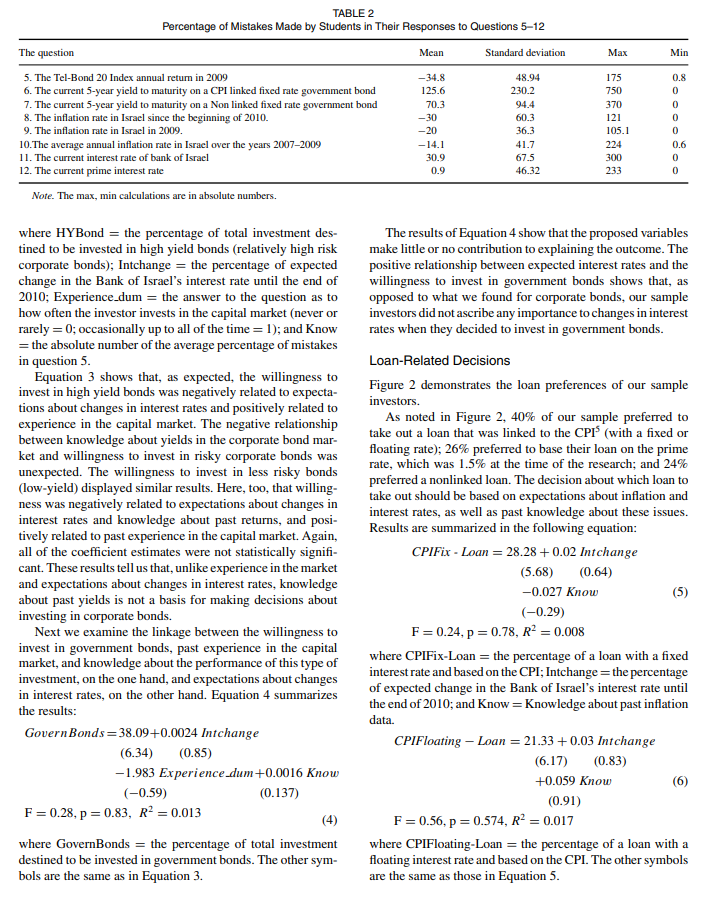

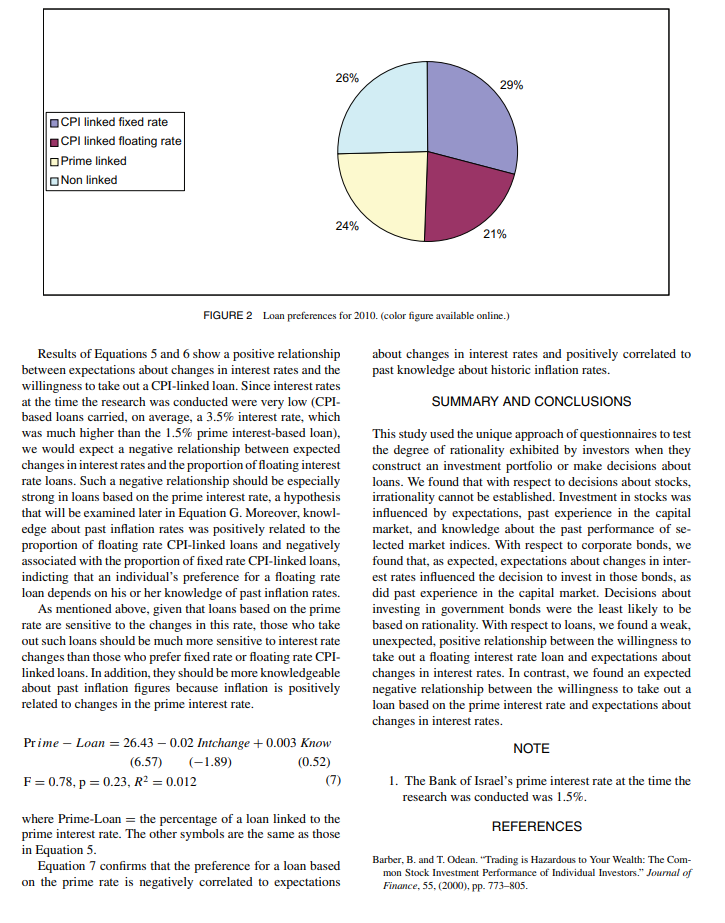

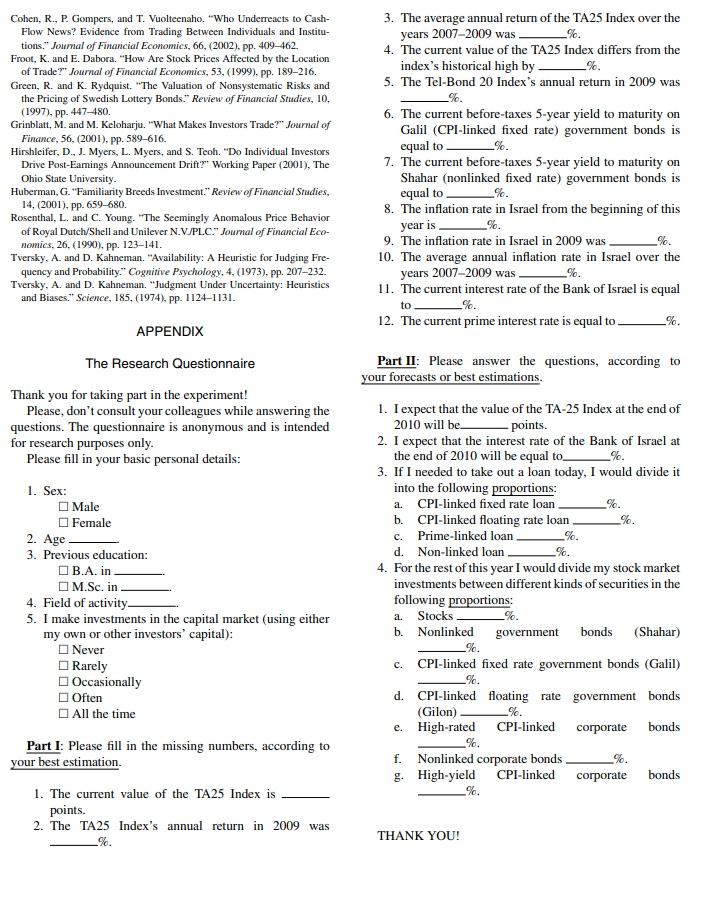

Investor Rationality and Financial Decisions Gil Cohen The Max Stern Academic College of Emek Yezreel Andrey Kudryavtsev University of Haifa This study used questionnaires completed by MBA finance students to test the degree of investors' rationality when the latter construct a portfolio or make loan decisions. We found that with respect to stock decisions, irrationality cannot be established. Investment in stocks was found to be influenced by expectations, past experience in the capital market, and knowledge about the past performance of selected market indices. With respect to corporate bonds, we found that, as expected, expectations about interest rate changes influenced the decision to invest in those bonds, as did past experience in the capital markets. The decision to invest in government bonds was the decision least likely to be based on rationality. With respect to loans, we found an expected negative relationship between the willingness to take out loans based on the prime interest rate and expectations about changes in interest rates. Keywords: Rationality, Survey, Behavioral INTRODUCTION Much has been written about investors' irrationality since the pioneering work of Tversky and Kahneman [1973, 1974]. This study attempts to estimate the degree to which financial decisions are based on rational expectations and knowledge of relevant facts. Our research employs questionnaires completed by Israeli MBA students at the University of Haifa and the Technion who were nearing the completion of their master's degree. The questionnaire, a copy of which appears in Appendix 1, includes questions that assess the students' knowledge of basic financial facts, their predictions for 2010 , their suggested investment allocations among a number of investment tools for the rest of 2010 , and their decisions about the type of loan they would favor taking out. The goal of the study is to examine whether students' financial behavior is based on knowledge of facts and expectations. The results should help us determine to what extent financial behavior is based on rational decisions or has other bases. Address correspondence to Gil Cohen, Economics and Management Department, The Max Stern Academic College of Emek Yezreel, Emek Yezreel 19300, Israel. E-mail: gilc@yvc.ac.il LITERATURE REVIEW The classic paradigm of financial theory assumes that investors make rational decisions. Given this assumption, investors should base their financial decisions upon knowledge, expectations, and experience in the capital markets. However, Tversky and Kahneman [1973, 1974] argued that rationality is imperfect, if it exists at all. Other studies have followed in their footsteps. Froot and Dabora [1999] and Rosenthal and Young [1990] showed that securities that are similar financial instruments could sometimes sell at different prices, a claim that contradicts the rationality of investors and allows arbitragers to make an easy profit. Many other studies have pointed to additional arguments supporting the irrationality of investors. Investors trade too much, maintain undiversified portfolios, hold losing positions too long, and overinvest in their own companies' stock (see, e.g., Barber and Odean [2000], Cohen, Gompers, and Vuolteenaho [2002], Green and Rydquist [1997], Grinblatt and Keloharju [2001], Hirshleifer, Myers, Myers, and Theoh [2001]; Huberman [2001]). Our study made an effort to shed more light on the issue of rationality in financial behavior. The experiment we carried out allowed us to establish the participants' competence in financial market matters, as well as their expectations with respect to future values of basic financial indicators and respective investment preferences. Overall, our results indicated that investment decisions may be guided by both rational and irrational motives. DATA AND EXPECTATIONS Our experiment, which we conducted at the beginning of March 2010, involved 67 Israeli MBA students from the Technion, Israel Institute of Technology, and the University of Haifa. Forty men and 27 women with a mean age of 33.5 years took part in the experiment, 26 of them at the Technion and 41 at the University of Haifa. We asked our participants to recall a number of recent economic and financial indicators for the Israeli economy, in general, and the Tel Aviv Stock Exchange, in particular, and to make two kinds of financial decisions for the rest of 2010 . The first was to create a portfolio of investments. The second was to decide upon a proportion of different types of loans to be held until the end of the year. We expected that a reasonable, rational investor would base those two decisions on three parameters: (a) future expectations, (b) past experience in the capital market, and (c) knowledge about past data concerning the relevant decisions. RESULTS Figure 1 shows the portfolio preferences of our sample investors. As shown in Figure 1,35\% of the aggregate portfolio was invested in stocks, 39% in government bonds, and 26% in corporate bonds. Our next task was to determine whether this portfolio was characteristic of a rational investor. In other words, was this portfolio constructed by an investor who made his/her decisions on the basis of expectations, past experience, and knowledge? We start by discussing the stock investments in the portfolio. Stock Related Decisions The first set of questions were designed to measure our participants' knowledge of common facts concerning the major stock index in the Israeli market, the TA25, an index that includes the 25 largest firms in the country. Students were asked about specific facts pertaining to this index. Table 1 illustrates the errors made by the students in their answers, presented as a percentage of their deviation from the correct numbers. Table 1 shows that factual knowledge about returns on stock market declines over time. In other words, people remember the latest figures but forget historical data that might be relevant to their current decisions. Next we examine the relationship between knowledge of past data concerning the stock market's performance, expectations about future returns, and decisions about exposure to stocks until the end of 2010 . Since we have established that investors' knowledge diminishes quickly over time, we use only questions 1 and 2 in order to construct a proxy factor for past knowledge about the stock index's performance. We expect the willingness of a rational investor to invest his/her money in stocks to be positively related to past knowledge and experience in the capital market and also to individual Stocks Non linked government bonds CPI linked fixed government bonds CPI linked floating rate government bonds High rating CPI linked corporate bonds Non linked corporate bonds High yield CPI linked corporate bonds FIGURE 1 Portfolio preferences for 2010. (color figure available online.) TABLE 2 Percentage of Mistakes Made by Students in Their Responses to Questions 5-12 Note. The max, min calculations are in absolute numbers. where HYBond = the percentage of total investment destined to be invested in high yield bonds (relatively high risk corporate bonds); Intchange = the percentage of expected change in the Bank of Israel's interest rate until the end of 2010; Experience_dum = the answer to the question as to how often the investor invests in the capital market (never or rarely =0; occasionally up to all of the time =1 ); and Know = the absolute number of the average percentage of mistakes in question 5. Equation 3 shows that, as expected, the willingness to invest in high yield bonds was negatively related to expectations about changes in interest rates and positively related to experience in the capital market. The negative relationship between knowledge about yields in the corporate bond market and willingness to invest in risky corporate bonds was unexpected. The willingness to invest in less risky bonds (low-yield) displayed similar results. Here, too, that willingness was negatively related to expectations about changes in interest rates and knowledge about past returns, and positively related to past experience in the capital market. Again, all of the coefficient estimates were not statistically significant. These results tell us that, unlike experience in the market and expectations about changes in interest rates, knowledge about past yields is not a basis for making decisions about investing in corporate bonds. Next we examine the linkage between the willingness to invest in government bonds, past experience in the capital market, and knowledge about the performance of this type of investment, on the one hand, and expectations about changes in interest rates, on the other hand. Equation 4 summarizes the results: \[ \begin{array}{l} \text { GovernBonds }= 38.09+0.0024 \text { Intchange } \\ (6.34) \quad(0.85) \\ - 1.983 \text { Experience_dum }+0.0016 \text { Know } \\ (-0.59) \\ \mathrm{F}=0.28, \mathrm{p}=0.83, R^{2}=0.013 \end{array} \] where GovernBonds = the percentage of total investment destined to be invested in government bonds. The other symbols are the same as in Equation 3 . The results of Equation 4 show that the proposed variables make little or no contribution to explaining the outcome. The positive relationship between expected interest rates and the willingness to invest in government bonds shows that, as opposed to what we found for corporate bonds, our sample investors did not ascribe any importance to changes in interest rates when they decided to invest in government bonds. Loan-Related Decisions Figure 2 demonstrates the loan preferences of our sample investors. As noted in Figure 2, 40% of our sample preferred to take out a loan that was linked to the CPI5 (with a fixed or floating rate); 26% preferred to base their loan on the prime rate, which was 1.5% at the time of the research; and 24% preferred a nonlinked loan. The decision about which loan to take out should be based on expectations about inflation and interest rates, as well as past knowledge about these issues. Results are summarized in the following equation: CPIFixLoan=28.28+0.02Intchange(5.68)(0.64)0.027Know(0.29)F=0.24,p=0.78,R2=0.008 where CPIFix-Loan = the percentage of a loan with a fixed interest rate and based on the CPI; Intchange = the percentage of expected change in the Bank of Israel's interest rate until the end of 2010 ; and Know = Knowledge about past inflation data. CPIFloating-Loan=21.33+0.03Intchange(6.17)(0.83)+0.059Know(0.91) where CPIFloating-Loan = the percentage of a loan with a floating interest rate and based on the CPI. The other symbols are the same as those in Equation 5. CPI linked fixed rate CPI linked floating rate Prime linked Non linked FIGURE 2 Loan preferences for 2010. (color figure available online.) Results of Equations 5 and 6 show a positive relationship between expectations about changes in interest rates and the willingness to take out a CPI-linked loan. Since interest rates at the time the research was conducted were very low (CPIbased loans carried, on average, a 3.5% interest rate, which was much higher than the 1.5% prime interest-based loan), we would expect a negative relationship between expected changes in interest rates and the proportion of floating interest rate loans. Such a negative relationship should be especially strong in loans based on the prime interest rate, a hypothesis that will be examined later in Equation G. Moreover, knowledge about past inflation rates was positively related to the proportion of floating rate CPI-linked loans and negatively associated with the proportion of fixed rate CPI-linked loans, indicting that an individual's preference for a floating rate loan depends on his or her knowledge of past inflation rates. As mentioned above, given that loans based on the prime rate are sensitive to the changes in this rate, those who take out such loans should be much more sensitive to interest rate changes than those who prefer fixed rate or floating rate CPIlinked loans. In addition, they should be more knowledgeable about past inflation figures because inflation is positively related to changes in the prime interest rate. Prime - Loan =26.430.02 Intchange +0.003 Know (6.57)(1.89) F=0.78,p=0.23,R2=0.012 where Prime-Loan = the percentage of a loan linked to the prime interest rate. The other symbols are the same as those in Equation 5. Equation 7 confirms that the preference for a loan based on the prime rate is negatively correlated to expectations about changes in interest rates and positively correlated to past knowledge about historic inflation rates. SUMMARY AND CONCLUSIONS This study used the unique approach of questionnaires to test the degree of rationality exhibited by investors when they construct an investment portfolio or make decisions about loans. We found that with respect to decisions about stocks, irrationality cannot be established. Investment in stocks was influenced by expectations, past experience in the capital market, and knowledge about the past performance of selected market indices. With respect to corporate bonds, we found that, as expected, expectations about changes in interest rates influenced the decision to invest in those bonds, as did past experience in the capital market. Decisions about investing in government bonds were the least likely to be based on rationality. With respect to loans, we found a weak, unexpected, positive relationship between the willingness to take out a floating interest rate loan and expectations about changes in interest rates. In contrast, we found an expected negative relationship between the willingness to take out a loan based on the prime interest rate and expectations about changes in interest rates. NOTE 1. The Bank of Israel's prime interest rate at the time the research was conducted was 1.5%. REFERENCES Barber, B. and T. Odean. "Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors." Joumal of Finance, 55, (2000), pp. 773-805

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts