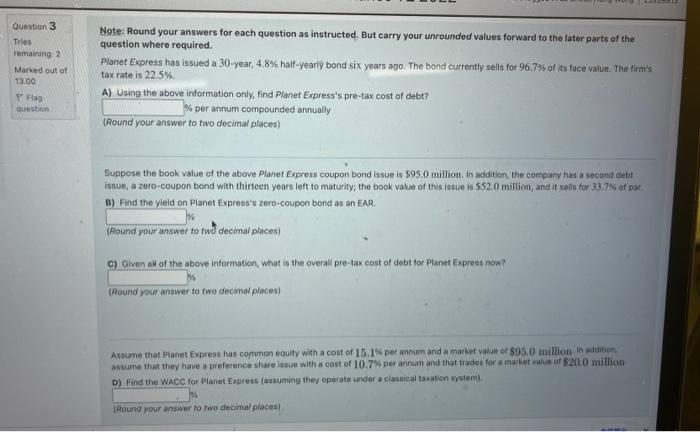

Question: question where required. Planet Express has issued a 30-year, 4.8% half-yearly bond six years ago. The bond currently selis for 96.7% of its face value.

question where required. Planet Express has issued a 30-year, 4.8% half-yearly bond six years ago. The bond currently selis for 96.7% of its face value. The -irm's tax rate is 22.5%. A) Using the above information only, find Planet Express's pre-tax cost of debt? \% per annum compounded annually (Round your answer to two decimal places) Suppose the book value of the above Planet Express coupon bond issue is $95.0 million. In additien, the campary has a second debt issue, a zero-coupon bond with thirteen years left to maturity; the book vakie of this issue is $52.0 million, and it sells for 33.7% of par. B) Find the vieid on Planet Express's zero-coupon bond as an EAR. (Round your answer fo twobl decimal places) c) Given all af the above information, what is the overall pre-tax cost at debt for Planet fxprese now? (Round your answer to fwo ecimal plices) Assume that Pianet fxpress has commen ecuity with a cost of 15.146 per annum and a market vakie of $95.0 million in additas, a imine that they have o preference share issue with a cost of 10.7 per annam and that trades for a market value of $20,0 million D) Find the WaCC for Planet Express (assuming they operate under a claseical tavation system) [Round your ans ywr to fwo decimal placeat)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts