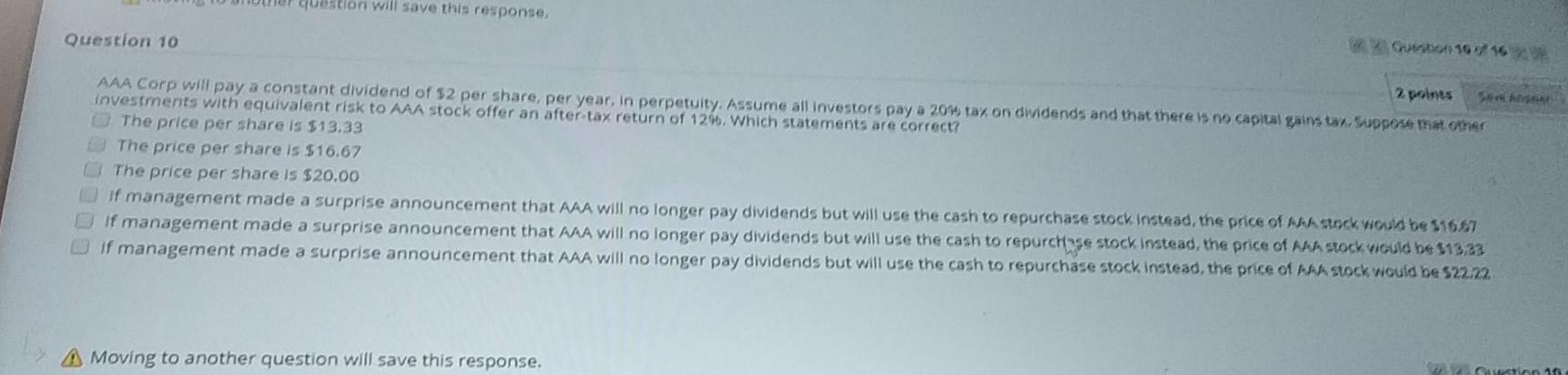

Question: question will save this response, 19716 Question 10 2 points AAA Corp will pay a constant dividend of 52 per share, per year, in perpetuity.

question will save this response, 19716 Question 10 2 points AAA Corp will pay a constant dividend of 52 per share, per year, in perpetuity. Assume all investors pay a 20% tay on dividends and that there is no capital gainstay. Suppose met other investments with equivalent risk to AAA stock offer an after-tax return of 1260. Which statements are correct? The price per share is $13.33 The price per share is $16.67 The price per share is $20.00 If management made a surprise announcement that AAA will no longer pay dividends but will use the cash to repurchase stock instead, the price of Ankstock was be 1166 If management made a surprise announcement that AAA will no longer pay dividends but will use the cash to repurchinge stock instead, the price of suck would be 113,33 if management made a surprise announcement that AAA will no longer pay dividends but will use the cash to repurchase stock instead, the price of a stock would be 52222 A Moving to another question will save this response. 2sion 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts