Question: Question_^ x fx A B c D E F G H 1 J K L M 1 Financial Markets and Institutions Main Menu 2 3

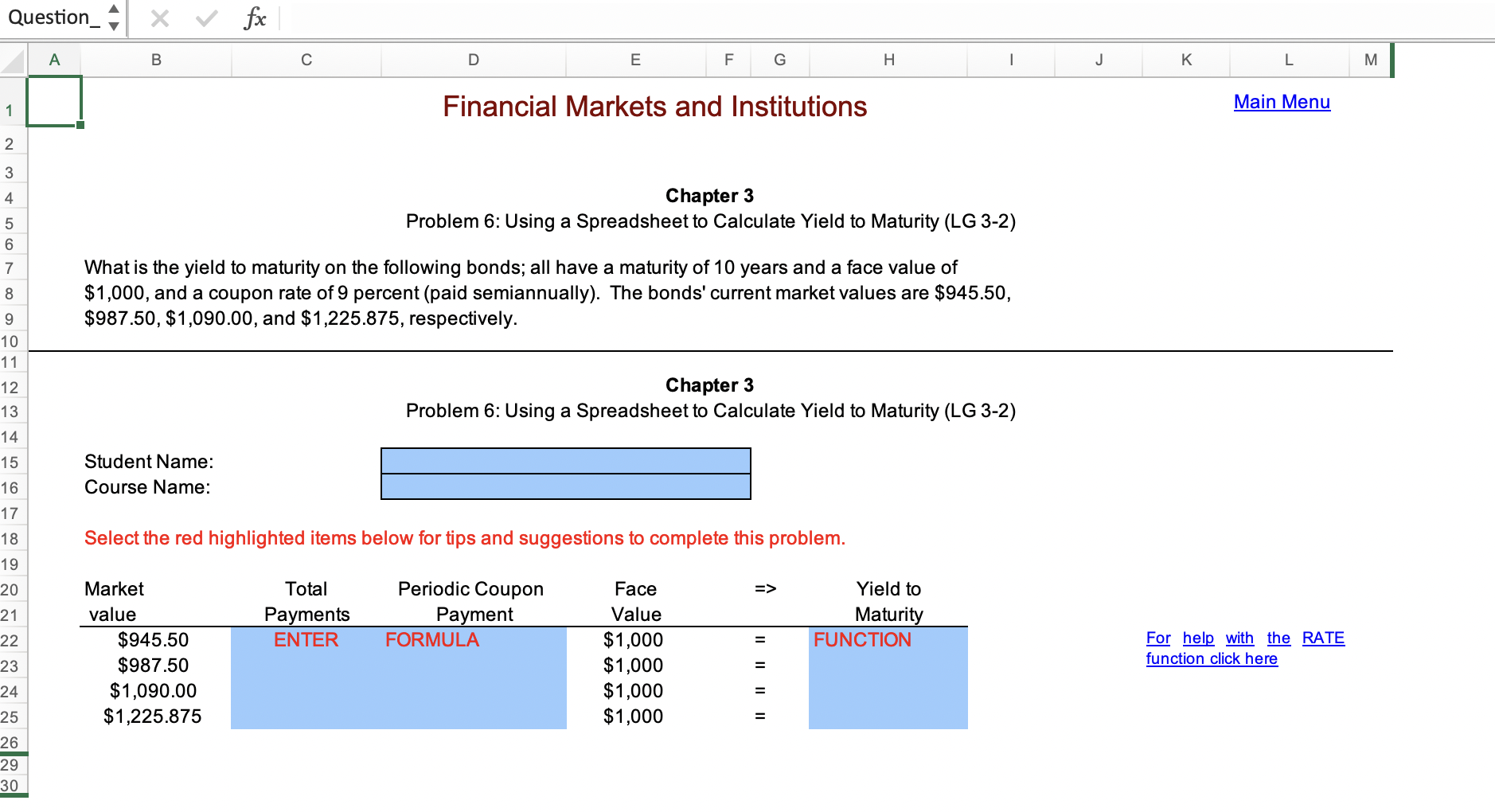

Question_^ x fx A B c D E F G H 1 J K L M 1 Financial Markets and Institutions Main Menu 2 3 4 Chapter 3 Problem 6: Using a Spreadsheet to Calculate Yield to Maturity (LG 3-2) 5 6 7 8 What is the yield to maturity on the following bonds; all have a maturity of 10 years and a face value of $1,000, and a coupon rate of 9 percent (paid semiannually). The bonds' current market values are $945.50, $987.50, $1,090.00, and $1,225.875, respectively. 9 10 11 Chapter 3 Problem 6: Using a Spreadsheet to Calculate Yield to Maturity (LG 3-2) Student Name: Course Name: 12 13 14 15 16 17 18 19 20 21 22 23 24 Select the red highlighted items below for tips and suggestions to complete this problem. => Total Payments ENTER Periodic Coupon Payment FORMULA Yield to Maturity FUNCTION Market value $945.50 $987.50 $1,090.00 $1,225.875 Face Value $1,000 $1,000 $1,000 $1,000 For help with the RATE function click here II II.1 11 25 26 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts