Question: can you please explain this question step by step on paper, i dont understand it! here is the uppdate of the question and the solution

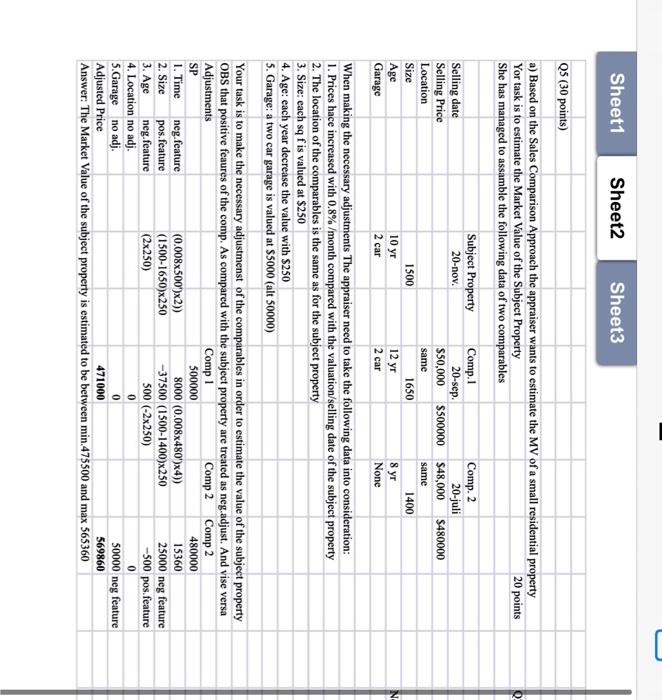

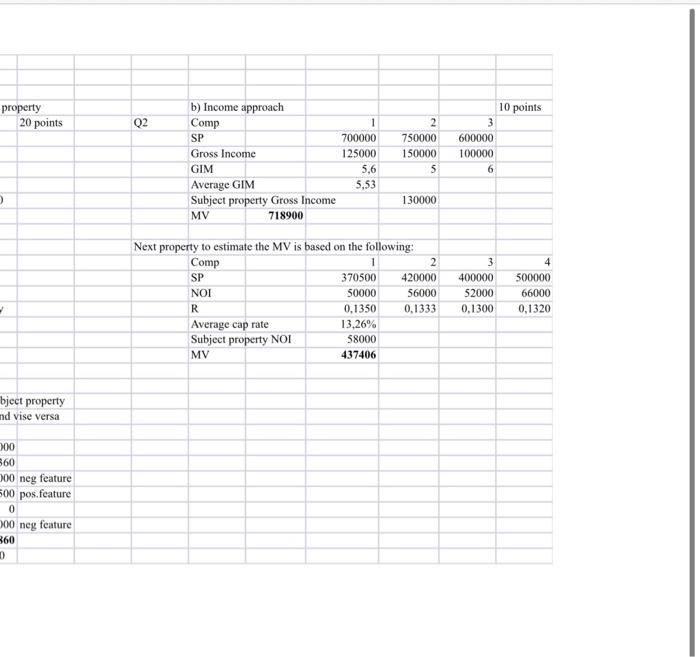

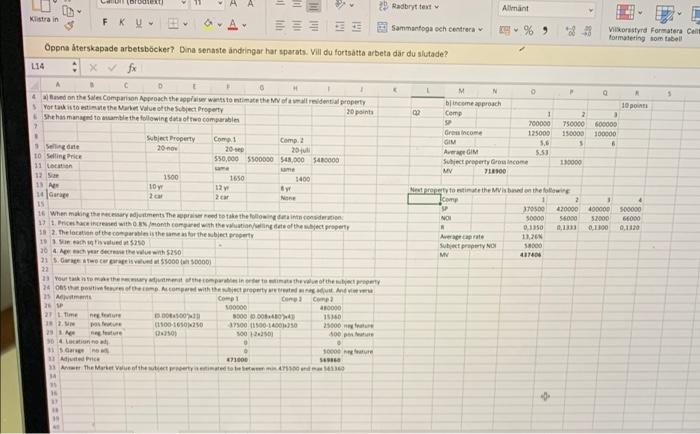

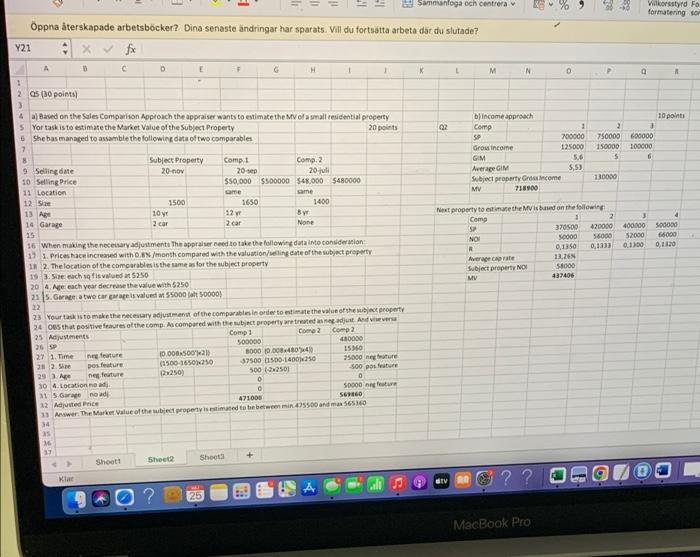

Sheet1 Sheet2 Sheet3 Q5 (30 points) a) Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property Yor task is to estimate the Market Value of the Subject Property 20 points She has managed to assamble the following data of two comparables Comp.1 Comp. 2 Subject Property 20-nov. Selling date 20-sep. 20-juli Selling Price $50,000 $500000 $48,000 $480000 Location same same Size 1500 1650 1400 Age 10 yr 12 8 yr Garage 2 car 2 car None When making the necessary adjustments The appraiser need to take the following data into consideration: 1. Prices hace increased with 0.8% /month compared with the valuation/selling date of the subject property 2. The location of the comparables is the same as for the subject property 3. Size: each sq f'is valued at $250 4. Age: each year decrease the value with $250 5. Garage: a two car garage is valued at $5000 (alt 50000) Your task is to make the necessary adjustmenst of the comparables in order to estimate the value of the subject property OBS that positive feaures of the comp. As compared with the subject property are treated as neg.adjust. And vise versa Adjustments Comp 1 Comp 2 Comp 2 SP 500000 480000 1. Time neg.feature (0.008x500)x2)) 15360 2. Size pos.feature 8000 (0.008x480')x4)) 37500 (1500-1400)x250 500 (-2x250) (1500-1650)x250 (2x250) 25000 neg feature 3. Age neg.feature -500 pos.feature 4. Location no adj. 0 5.Garage no adj. 0 50000 neg feature Adjusted Price 471000 569860 Answer: The Market Value of the subject property is estimated to be between min.475500 and max 565360 property 0 20 points + bject property and vise versa 000 560 000 neg feature 500 pos.feature 0 000 neg feature 860 D b) Income approach Comp 1 2 3 SP 750000 600000 700000 125000 Gross Income 150000 100000 GIM 5,6 5 6 Average GIM 5,53 Subject property Gross Income 130000 MV 718900 Next property to estimate the MV is based on the following: Comp 1 2 3 SP 370500 420000 400000 NOI 50000 56000 52000 R 0,1350 0,1333 0,1300 Average cap rate 13,26% 58000 Subject property NOI MV 437406 Q2 10 points 4 500000 66000 0,1320 Canon (Brode Radbryt text Klistra in FK U- A- HE Sammanfoga och centrera ppna terskapade arbetsbcker? Dina senaste ndringar har sparats. Vill du fortstta arbeta dr du slutade? L14 x fx A 0 H 1 K L 4 Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property Yor task is to estimate the Market Value of the Subject Property 20 points She has managed to assamble the following data of two comparables 7 Subject Property Comp. 1 Selling date 20-nov 20-sp Comp. 2 20jul 548,000 $480000 10 Selling Price $50,000 $500000 came 11 Location same 12 Se 1500 1650 1400 13 Apr 10 yr 12 y Byr 14 Garage 2 cam 2 car None 15 16 When making the necessary adjustments The appraiser need to take the following data into consideration 17 1. Prices hace increased with 0.8% /month compared with the valuation/selling date of the subject property 18 2. The location of the comparables is the same as for the subject property 19 3. Se each sq Fis valued at $250 204 Age each year decrease the value with $250 21 5. Garage Two car garage is valued at $5000 (50000) 22 23 Your task is to make the stary adjustment of the comparables in order to estimate the value of the subject property of the comp. As compared with the subject property are treated a nag adjust And 24 005 that positive feaures 25 Adjustments Comp Comp Comp 26 SP 100000 480000 27 1. Time 15340 38 2.5 neg feature pos future ng feature 100003 (1100-1650x250 (2x250) 8000 00084804 37500 (1500-14000 50012501 25000 ng feature 29 A 400 pos feature 304 Location no al 35 Garage 30000 ng feature 54980 33 Adjusted Price 473000 33 Anwer The Market Value of the subject property is estimated to be between min 475500 and ma 145360 14 21 16 31 Allmnt Vikorsstyrd Formatera Cellt formatering som tabell N O Q S M blincome approach 10 points Comp SP Grosincome GIM 700000 750000 600000 125000 150000 100000 5,6 S 6 5.53 Average GIM Subject property Grosincome MV 718900 130000 Next property to estimate the MVis based on the following Comp 2 3 SP 370500 420000 400000 500000 NOI 56000 52000 66000 50000 0,1350 R 0,1333 0,1300 0,1120 Average caprate 13,26% Subject property NO 18000 Mv 437406 02 " 848 4 37 Klar 25 li 11 0 il K 20 Sammanfoga och centrera ppna terskapade arbetsbcker? Dina senaste ndringar har sparats. Vill du fortstta arbeta dr du slutade? Y21 x fx A B C D E F G H 1 J K L M N 2 05 (30 points) 4a) Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property 5 Yor task is to estimate the Market Value of the Subject Property 20 points b) income approach Comp SP 1 2 6 3 700000 750000 600000 She has managed to assamble the following data of two comparables 7 125000 8 Comp.1 Comp. 2 150000 100000 5 5,6 6 Subject Property 20-nov 9 Selling date Gross income GIM Average GIM Subject property Gross come 20-sep 5,53 10 Selling Price 20-juli $48,000 $480000 $50,000 $500000 130000 11 Location same same MV 718900 12 Size 1500 1650 1400 13 Age 10 yr 12 yr Byr Next property to estimate the MV is based on the following 14 Garage 2 car 2 car 4 Comp 2 None 15 SP 370500 420000 400000 NO 50000 56000 52000 16 When making the necessary adjustments The appraiser need to take the following data into consideration 17 1. Prices hace increased with 0.8% /month compared with the valuation/selling date of the subject property 18 2. The location of the comparables is the same as for the subject property R 0,1350 0,1333 0.1300 Average cap rate 13,26% 19 3. Size each sq fis valued at $2.50 Subject property NO MV 20 4. Age each year decrease the value with $250 21 5. Garage a two car garage is valued at $5000 (alt 50000) 22 23 Your task is to make the necessary adjustment of the comparables in order to estimate the value of the subject property 24 Oes that positive feaures of the comp. As compared with the subject property are treated as negadjust. And vise versa 25 Adjustments Comp 1 Comp 2 Comp 2 26 SP 500000 480000 15360 27 1. Time 8000 (0.00848040 neg feature pos feature (0.008x500x2 (1500-1650)250 (2x250) 37500 1500-1400250 28 2.Size 25000 neg feature 500 pos feature 500 (2x250) 29 3. Age neg feature 0 0 30 4. Location no adj. 315 Garage no adj 50000 neg feature 569860 471000 32 Adjusted Price 33 Answer: The Market Value of the subject property is estimated to be between min 475500 and max 565360 34 35 36 + Shoot! Sheet2 Sheet 02 ?? MacBook Pro dtv R 0 18 $8000 437406 89 P Villkorsstyrd For formatering son A 10 points Q 500000 66000 0,1320 Sheet1 Sheet2 Sheet3 Q5 (30 points) a) Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property Yor task is to estimate the Market Value of the Subject Property 20 points She has managed to assamble the following data of two comparables Comp.1 Comp. 2 Subject Property 20-nov. Selling date 20-sep. 20-juli Selling Price $50,000 $500000 $48,000 $480000 Location same same Size 1500 1650 1400 Age 10 yr 12 8 yr Garage 2 car 2 car None When making the necessary adjustments The appraiser need to take the following data into consideration: 1. Prices hace increased with 0.8% /month compared with the valuation/selling date of the subject property 2. The location of the comparables is the same as for the subject property 3. Size: each sq f'is valued at $250 4. Age: each year decrease the value with $250 5. Garage: a two car garage is valued at $5000 (alt 50000) Your task is to make the necessary adjustmenst of the comparables in order to estimate the value of the subject property OBS that positive feaures of the comp. As compared with the subject property are treated as neg.adjust. And vise versa Adjustments Comp 1 Comp 2 Comp 2 SP 500000 480000 1. Time neg.feature (0.008x500)x2)) 15360 2. Size pos.feature 8000 (0.008x480')x4)) 37500 (1500-1400)x250 500 (-2x250) (1500-1650)x250 (2x250) 25000 neg feature 3. Age neg.feature -500 pos.feature 4. Location no adj. 0 5.Garage no adj. 0 50000 neg feature Adjusted Price 471000 569860 Answer: The Market Value of the subject property is estimated to be between min.475500 and max 565360 property 0 20 points + bject property and vise versa 000 560 000 neg feature 500 pos.feature 0 000 neg feature 860 D b) Income approach Comp 1 2 3 SP 750000 600000 700000 125000 Gross Income 150000 100000 GIM 5,6 5 6 Average GIM 5,53 Subject property Gross Income 130000 MV 718900 Next property to estimate the MV is based on the following: Comp 1 2 3 SP 370500 420000 400000 NOI 50000 56000 52000 R 0,1350 0,1333 0,1300 Average cap rate 13,26% 58000 Subject property NOI MV 437406 Q2 10 points 4 500000 66000 0,1320 Canon (Brode Radbryt text Klistra in FK U- A- HE Sammanfoga och centrera ppna terskapade arbetsbcker? Dina senaste ndringar har sparats. Vill du fortstta arbeta dr du slutade? L14 x fx A 0 H 1 K L 4 Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property Yor task is to estimate the Market Value of the Subject Property 20 points She has managed to assamble the following data of two comparables 7 Subject Property Comp. 1 Selling date 20-nov 20-sp Comp. 2 20jul 548,000 $480000 10 Selling Price $50,000 $500000 came 11 Location same 12 Se 1500 1650 1400 13 Apr 10 yr 12 y Byr 14 Garage 2 cam 2 car None 15 16 When making the necessary adjustments The appraiser need to take the following data into consideration 17 1. Prices hace increased with 0.8% /month compared with the valuation/selling date of the subject property 18 2. The location of the comparables is the same as for the subject property 19 3. Se each sq Fis valued at $250 204 Age each year decrease the value with $250 21 5. Garage Two car garage is valued at $5000 (50000) 22 23 Your task is to make the stary adjustment of the comparables in order to estimate the value of the subject property of the comp. As compared with the subject property are treated a nag adjust And 24 005 that positive feaures 25 Adjustments Comp Comp Comp 26 SP 100000 480000 27 1. Time 15340 38 2.5 neg feature pos future ng feature 100003 (1100-1650x250 (2x250) 8000 00084804 37500 (1500-14000 50012501 25000 ng feature 29 A 400 pos feature 304 Location no al 35 Garage 30000 ng feature 54980 33 Adjusted Price 473000 33 Anwer The Market Value of the subject property is estimated to be between min 475500 and ma 145360 14 21 16 31 Allmnt Vikorsstyrd Formatera Cellt formatering som tabell N O Q S M blincome approach 10 points Comp SP Grosincome GIM 700000 750000 600000 125000 150000 100000 5,6 S 6 5.53 Average GIM Subject property Grosincome MV 718900 130000 Next property to estimate the MVis based on the following Comp 2 3 SP 370500 420000 400000 500000 NOI 56000 52000 66000 50000 0,1350 R 0,1333 0,1300 0,1120 Average caprate 13,26% Subject property NO 18000 Mv 437406 02 " 848 4 37 Klar 25 li 11 0 il K 20 Sammanfoga och centrera ppna terskapade arbetsbcker? Dina senaste ndringar har sparats. Vill du fortstta arbeta dr du slutade? Y21 x fx A B C D E F G H 1 J K L M N 2 05 (30 points) 4a) Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property 5 Yor task is to estimate the Market Value of the Subject Property 20 points b) income approach Comp SP 1 2 6 3 700000 750000 600000 She has managed to assamble the following data of two comparables 7 125000 8 Comp.1 Comp. 2 150000 100000 5 5,6 6 Subject Property 20-nov 9 Selling date Gross income GIM Average GIM Subject property Gross come 20-sep 5,53 10 Selling Price 20-juli $48,000 $480000 $50,000 $500000 130000 11 Location same same MV 718900 12 Size 1500 1650 1400 13 Age 10 yr 12 yr Byr Next property to estimate the MV is based on the following 14 Garage 2 car 2 car 4 Comp 2 None 15 SP 370500 420000 400000 NO 50000 56000 52000 16 When making the necessary adjustments The appraiser need to take the following data into consideration 17 1. Prices hace increased with 0.8% /month compared with the valuation/selling date of the subject property 18 2. The location of the comparables is the same as for the subject property R 0,1350 0,1333 0.1300 Average cap rate 13,26% 19 3. Size each sq fis valued at $2.50 Subject property NO MV 20 4. Age each year decrease the value with $250 21 5. Garage a two car garage is valued at $5000 (alt 50000) 22 23 Your task is to make the necessary adjustment of the comparables in order to estimate the value of the subject property 24 Oes that positive feaures of the comp. As compared with the subject property are treated as negadjust. And vise versa 25 Adjustments Comp 1 Comp 2 Comp 2 26 SP 500000 480000 15360 27 1. Time 8000 (0.00848040 neg feature pos feature (0.008x500x2 (1500-1650)250 (2x250) 37500 1500-1400250 28 2.Size 25000 neg feature 500 pos feature 500 (2x250) 29 3. Age neg feature 0 0 30 4. Location no adj. 315 Garage no adj 50000 neg feature 569860 471000 32 Adjusted Price 33 Answer: The Market Value of the subject property is estimated to be between min 475500 and max 565360 34 35 36 + Shoot! Sheet2 Sheet 02 ?? MacBook Pro dtv R 0 18 $8000 437406 89 P Villkorsstyrd For formatering son A 10 points Q 500000 66000 0,1320

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts