Question: Question Z You are doing some consulting work for a communications firm in Thailand. You will be paid $479,511 (Thai Baht) seven months from now

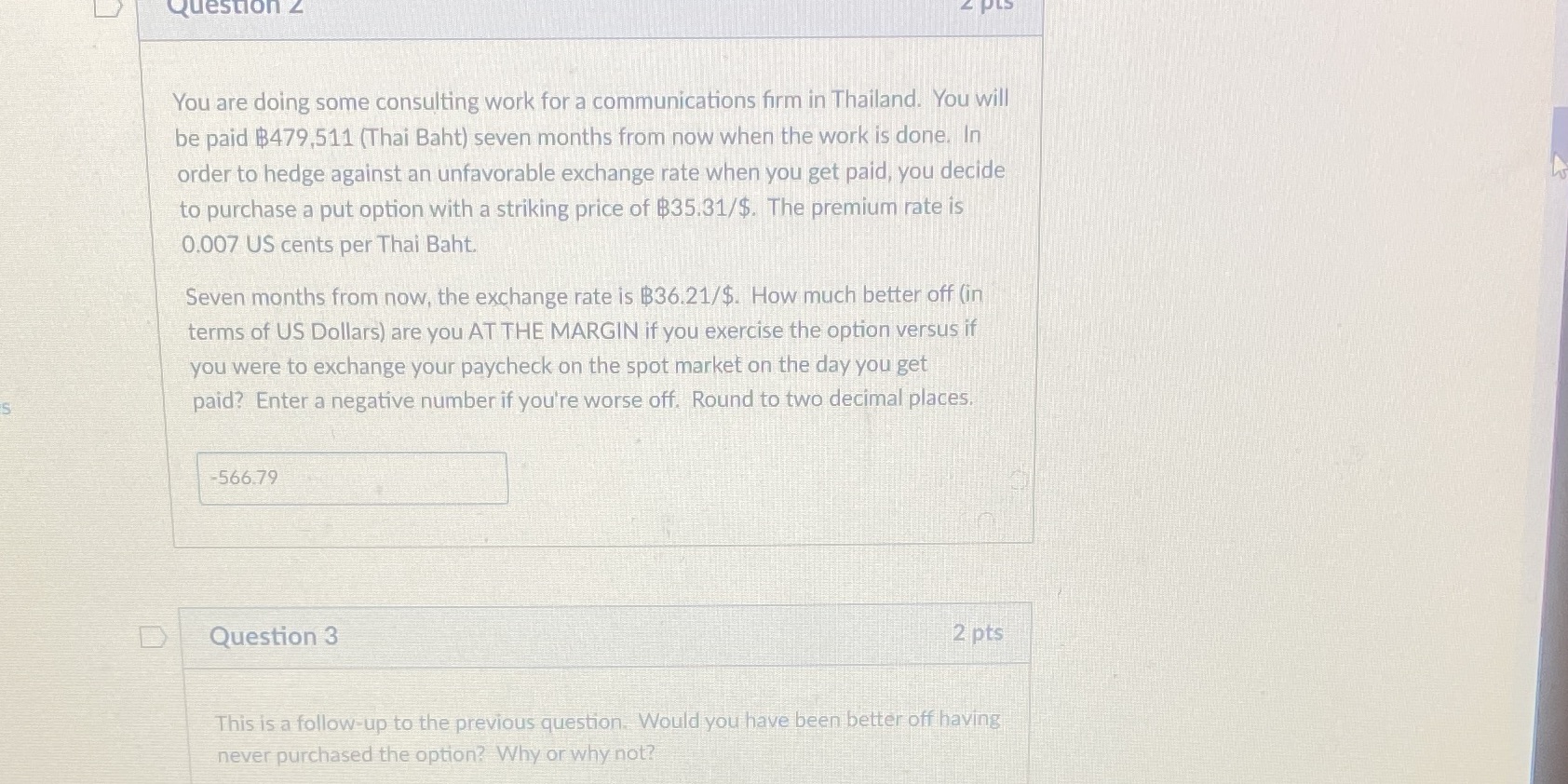

Question Z You are doing some consulting work for a communications firm in Thailand. You will be paid $479,511 (Thai Baht) seven months from now when the work is done. In order to hedge against an unfavorable exchange rate when you get paid, you decide to purchase a put option with a striking price of $35.31/$. The premium rate is 0.007 US cents per Thai Baht. Seven months from now, the exchange rate is $36.21/$. How much better off (in terms of US Dollars) are you AT THE MARGIN if you exercise the option versus if you were to exchange your paycheck on the spot market on the day you get paid? Enter a negative number if you're worse off. Round to two decimal places. -566.79 D Question 3 2 pts This is a follow-up to the previous question. Would you have been better off having never purchased the option? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts