Question: Question:1 Mallory Company occasionally embarks on research programs when special projects offer possibilities. In 2020, the company expends $325,000 on a research project, but by

Question:1 Mallory Company occasionally embarks on research programs when special projects offer possibilities. In 2020, the company expends $325,000 on a research project, but by the end of 2020, it is impossible to determine whether any benefit will be derived from it.

a. What account should be charged for the $325,000, and how should it be shown in the financial statements?

b. The project is completed in 2021, and a successful patent is obtained. The R&D costs to complete the project are $130,000 ($36,000 of these costs were incurred after achieving economic viability). The administrative and legal expenses incurred in obtaining patent number 477-1231-90 in 2021 total $24,000. The patent has an expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2021.

c. In 2022, the company successfully defends the patent in extended litigation at a cost of $47,200, thereby extending the patent life to December 31, 2029. What is the proper way to account for this cost? Also, record patent amortization (full year) in 2022.

d. Additional engineering and consulting costs incurred in 2022 required to advance the design of a new version of the product to the manufacturing stage total $60,000. These costs enhance the design of the product considerably, but it is highly uncertain if there will be a market for the new version of the product. Discuss the proper accounting treatment for this cost.

Question:2 The following isequipment owned by Pacini Company on December 31, 2022.

Cost (residual value $0) $9,000,000

Accumulated depreciation to date 1,000,000

Value-in-use 5,500,000

Fair value less cost of disposal 4,400,000

Assume that Pacini will continue to use this asset in the future. As of December 31, 2022, the equipment has a remaining useful life of 8 years. Pacini uses straight-line depreciation.

REQUIRED:

a.Prepare the journal entry (if any) to record the impairment of the asset on December 31, 2022.

b.Prepare the journal entry to record depreciation expense for 2023.

c.The recoverable amount of the equipment on December 31, 2023, is $6,050,000. Prepare the journal entry (if any) necessary to record this increase.

Question:3. Assuming the same information as in Problem 2, except that Pacini plans to dispose the equipment in the coming year.

REQUIRED

a. Prepare the journal entry (if any) to record the impairment of the asset on December 31, 2022.

b. Prepare the journal entry (if any) to record depreciation expense for 2023.

c. The asset was not sold by December 31, 2023. The fair value of the equipment on that date is $5,100,000. Prepare the journal entry (if any) necessary to record this increase. It is expected that the cost of disposal is $20,000.

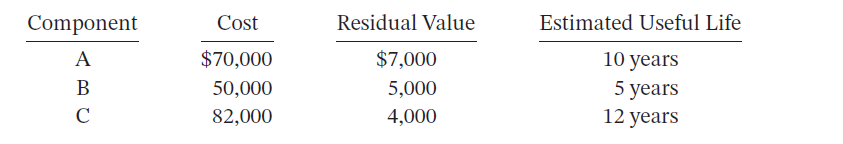

Question:4. Compute Component Depreciation Expense for Clarkson's Equipment that cost $202,000 on January 1, 2022.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts