Question: question1 question2 question3 question4 question5 question6 I only want the answers;I could find the processes by myself. Thanks!! Crane Company is considering a long-term investment

question1

question2

question2

question3

question3

question4

question4 question5

question5

question6

question6

I only want the answers;I could find the processes by myself. Thanks!!

I only want the answers;I could find the processes by myself. Thanks!!

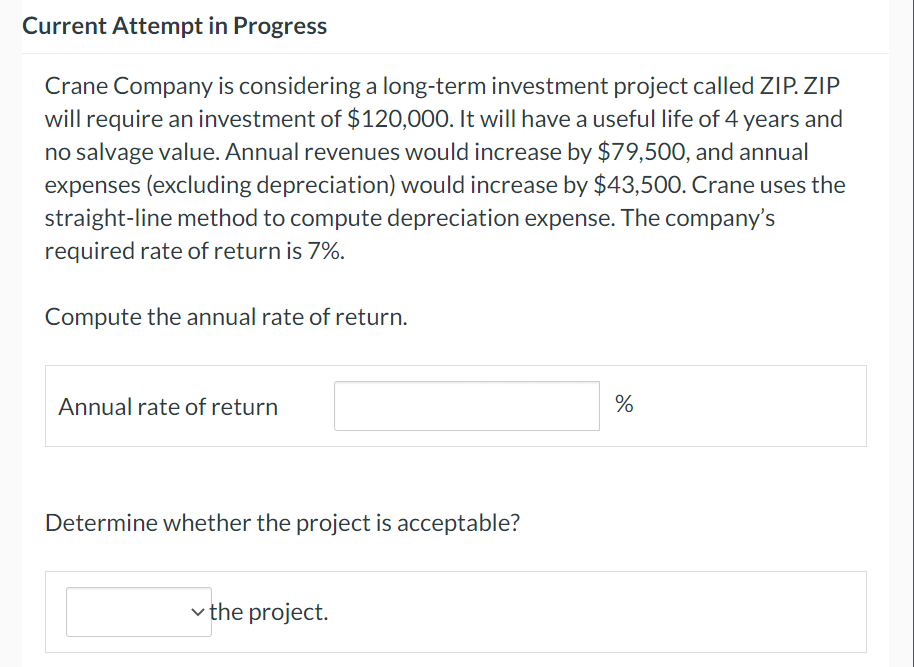

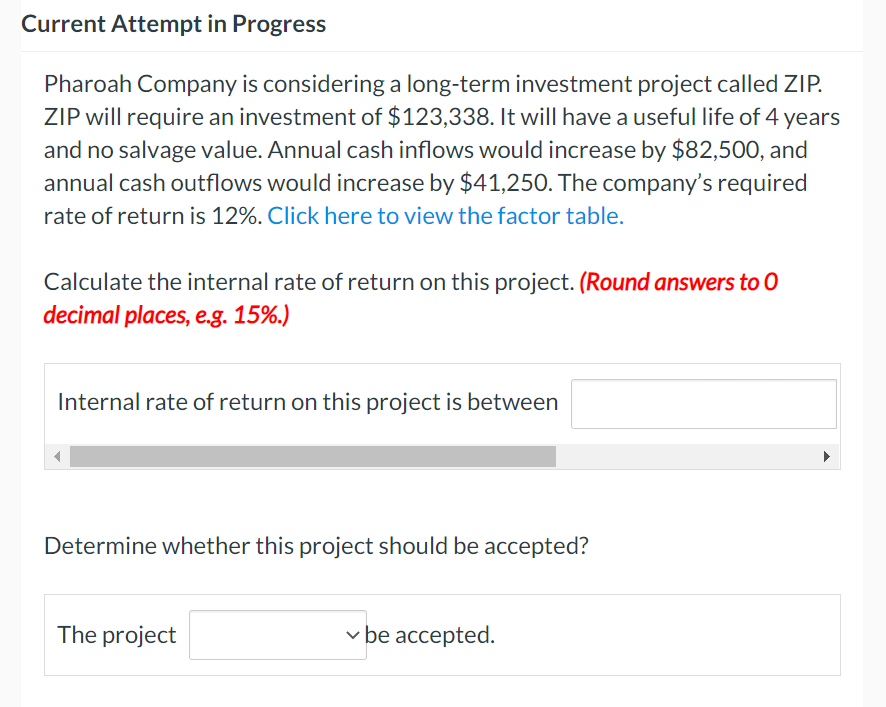

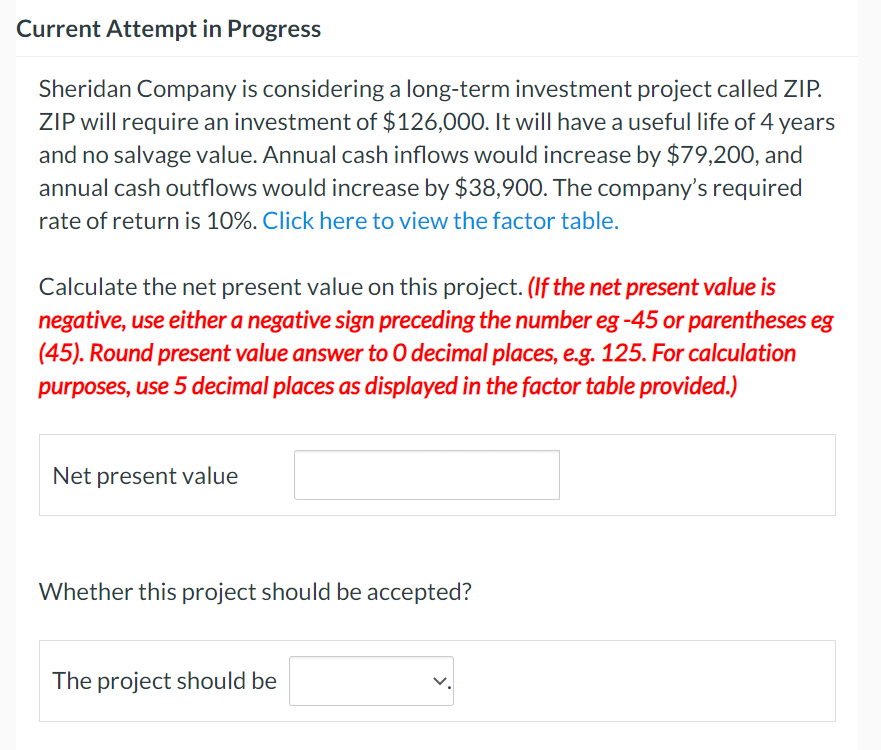

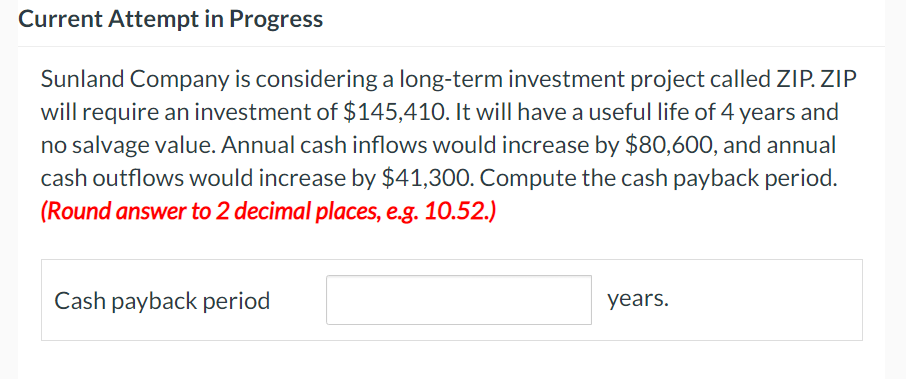

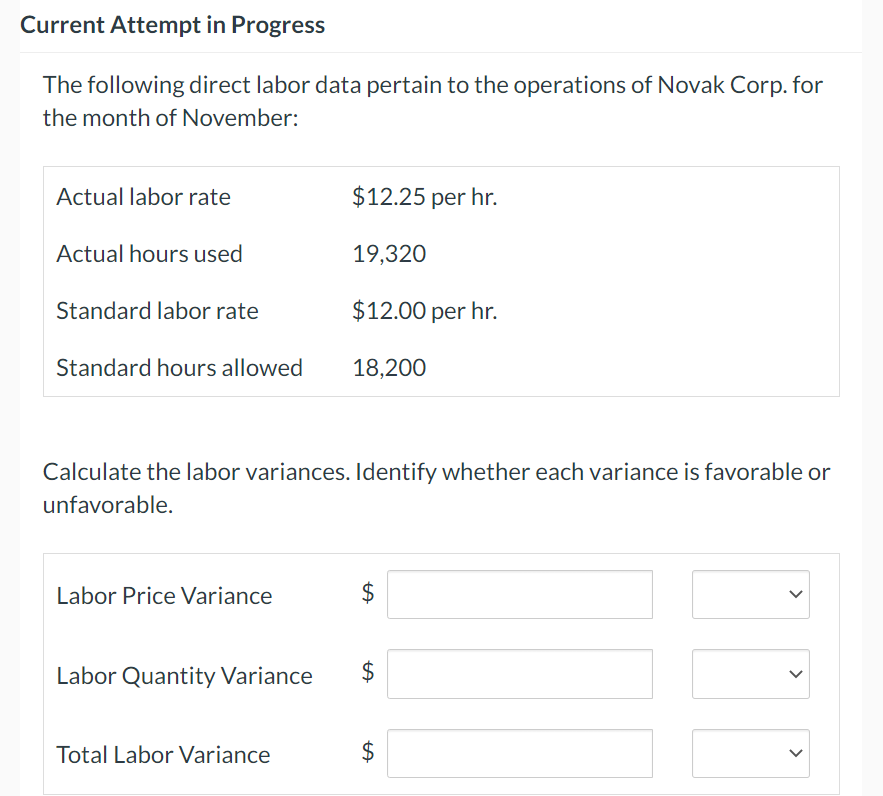

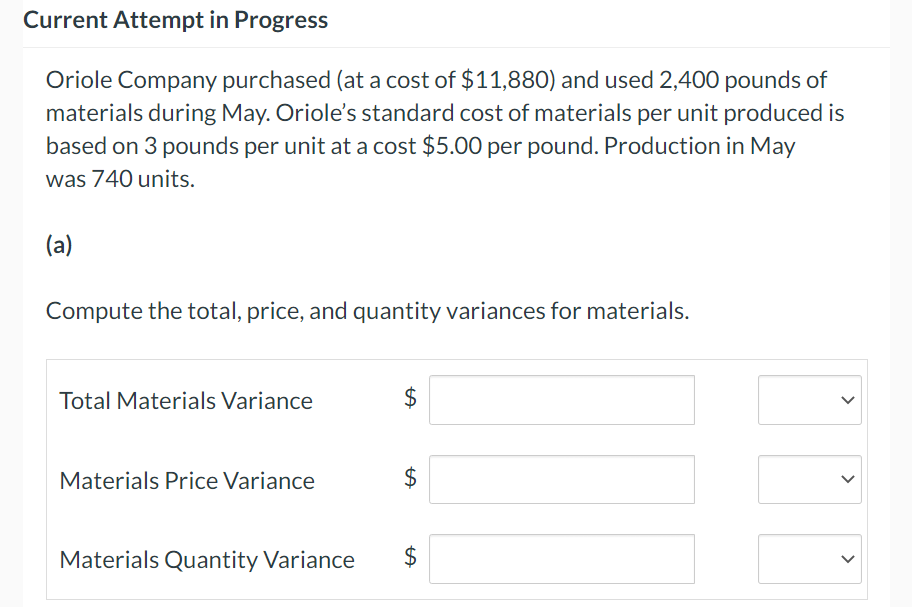

Crane Company is considering a long-term investment project called ZIP. ZIP will require an investment of $120,000. It will have a useful life of 4 years and no salvage value. Annual revenues would increase by $79,500, and annual expenses (excluding depreciation) would increase by $43,500. Crane uses the straight-line method to compute depreciation expense. The company's required rate of return is 7%. Compute the annual rate of return. Annual rate of return % Determine whether the project is acceptable? urrent Attempt in Progress Pharoah Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,338. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $82,500, and annual cash outflows would increase by $41,250. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to 0 decimal places, e.g. 15\%.) Internal rate of return on this project is between Determine whether this project should be accepted? The project se accepted. Sheridan Company is considering a long-term investment project called ZIP. ZIP will require an investment of $126,000. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,200, and annual cash outflows would increase by $38,900. The company's required rate of return is 10%. Click here to view the factor table. Calculate the net present value on this project. (If the net present value is negative, use either a negative sign preceding the number eg 45 or parentheses eg (45). Round present value answer to 0 decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value Whether this project should be accepted? The project should be Sunland Company is considering a long-term investment project called ZIP. ZIP will require an investment of $145,410. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $80,600, and annual cash outflows would increase by $41,300. Compute the cash payback period. (Round answer to 2 decimal places, e.g. 10.52.) Cash payback period years. The following direct labor data pertain to the operations of Novak Corp. for the month of November: Calculate the labor variances. Identify whether each variance is favorable or unfavorable. Labor Price Variance $ Labor Quantity Variance $ Total Labor Variance $ Oriole Company purchased (at a cost of $11,880 ) and used 2,400 pounds of materials during May. Oriole's standard cost of materials per unit produced is based on 3 pounds per unit at a cost $5.00 per pound. Production in May was 740 units. (a) Compute the total, price, and quantity variances for materials. Total Materials Variance $ Materials Price Variance $ Materials Quantity Variance $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts