Question: Question-3: Sonya Jared opened a law office on July 1, 2020. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies

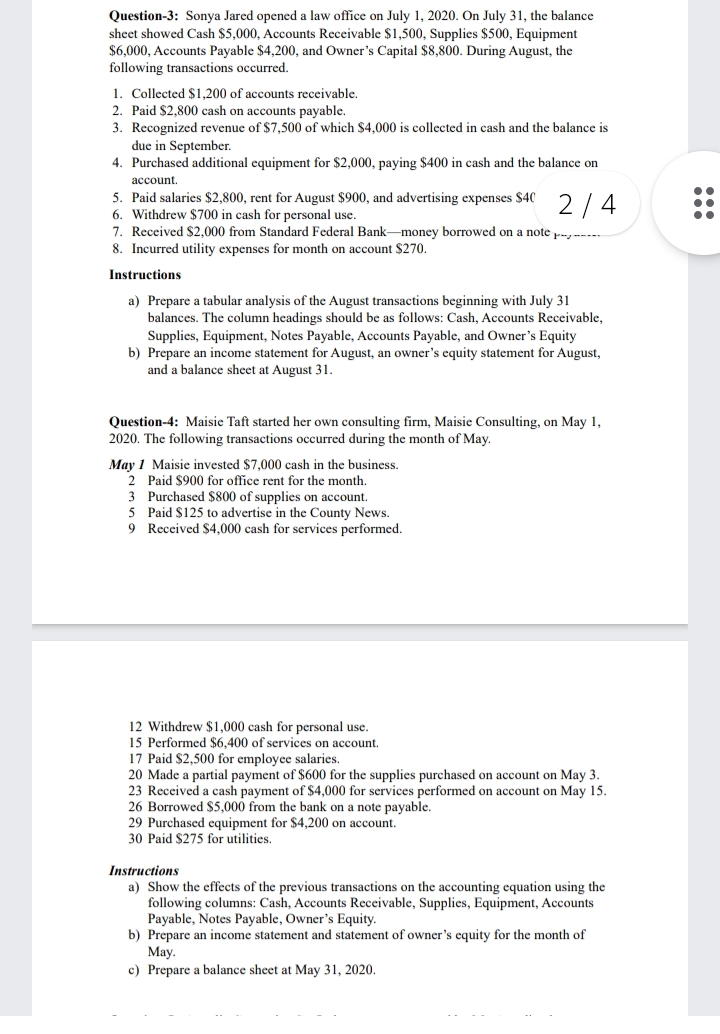

Question-3: Sonya Jared opened a law office on July 1, 2020. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner's Capital $8,800. During August, the following transactions occurred. 1. Collected $1,200 of accounts receivable. 2. Paid $2,800 cash on accounts payable. 3. Recognized revenue of $7,500 of which $4,000 is collected in cash and the balance is due in September. 4. Purchased additional equipment for $2,000, paying $400 in cash and the balance on account. 5. Paid salaries $2,800, rent for August $900, and advertising expenses $40 6. Withdrew $700 in cash for personal use. 7. Received $2,000 from Standard Federal Bank-money borrowed on a note 8. Incurred utility expenses for month on account $270. Instructions 2/4 a) Prepare a tabular analysis of the August transactions beginning with July 31 balances. The column headings should be as follows: Cash, Accounts Receivable, Supplies, Equipment, Notes Payable, Accounts Payable, and Owner's Equity b) Prepare an income statement for August, an owner's equity statement for August, and a balance sheet at August 31. Question-4: Maisie Taft started her own consulting firm, Maisie Consulting, on May 1, 2020. The following transactions occurred during the month of May. May 1 Maisie invested $7,000 cash in the business. 2 Paid $900 for office rent for the month. 3 Purchased $800 of supplies on account. 5 Paid $125 to advertise in the County News. 9 Received $4,000 cash for services performed. 12 Withdrew $1,000 cash for personal use. 15 Performed $6,400 of services on account. 17 Paid $2,500 for employee salaries. 20 Made a partial payment of $600 for the supplies purchased on account on May 3. 23 Received a cash payment of $4,000 for services performed on account on May 15. 26 Borrowed $5,000 from the bank on a note payable. 29 Purchased equipment for $4,200 on account. 30 Paid $275 for utilities. Instructions a) Show the effects of the previous transactions on the accounting equation using the following columns: Cash, Accounts Receivable, Supplies, Equipment, Accounts Payable, Notes Payable, Owner's Equity. b) Prepare an income statement and statement of owner's equity for the month of May. c) Prepare a balance sheet at May 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts