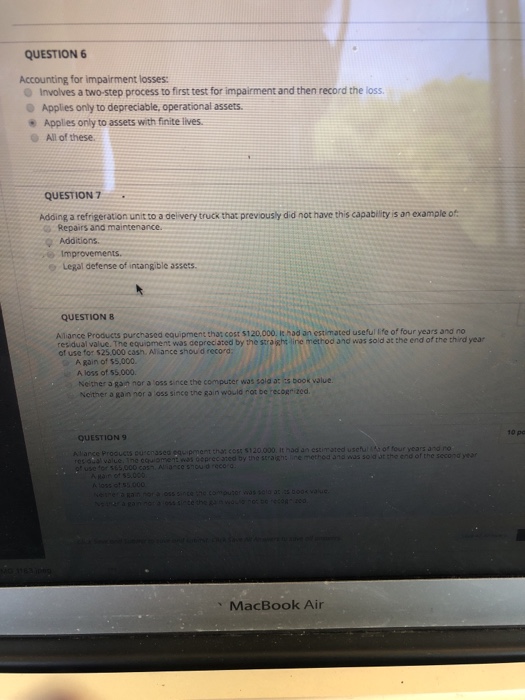

Question: QUESTION6 Accounting for impairment losses: Involves a two-step process to first test for impairment and then record the loss. Applies only to depreciable, operational assets

QUESTION6 Accounting for impairment losses: Involves a two-step process to first test for impairment and then record the loss. Applies only to depreciable, operational assets Applies only to assets with finite lives O All of these QUESTION 7 Adding a refrigeration unit to a delivery truck that previously did not have this capability is an example of Repairs and maintenance. e Legal defense of intangible 3ssets. QUESTION 8 Aliance Products purchased equipment tha: cost s120,000. IE had an estimated useful life of four years and no residual value. The equipment was depreciated by the straight line method and was sold at the end of the third year of use for $25.000 cash. Allance shou'd record; A Rain of $5,000. A loss of 55.000. Neither a gan nor a loss since the computer was saia a: ts book value. Ncither a gan nor a oss since the gain would rot be recogrized. 10 pa QUESTION 9 of four years and no Prooucts ourcnas value, Ine cquioment aas oeprec ared by the straisnalire methed and was so a bt the ens of the seconaye pment tha coss $120.000 It had an est MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts