Question: Questions: 1: (10 pts) From the data in the table above, determine the amount of revenue that needs to be generated to meet hospital financial

Questions:

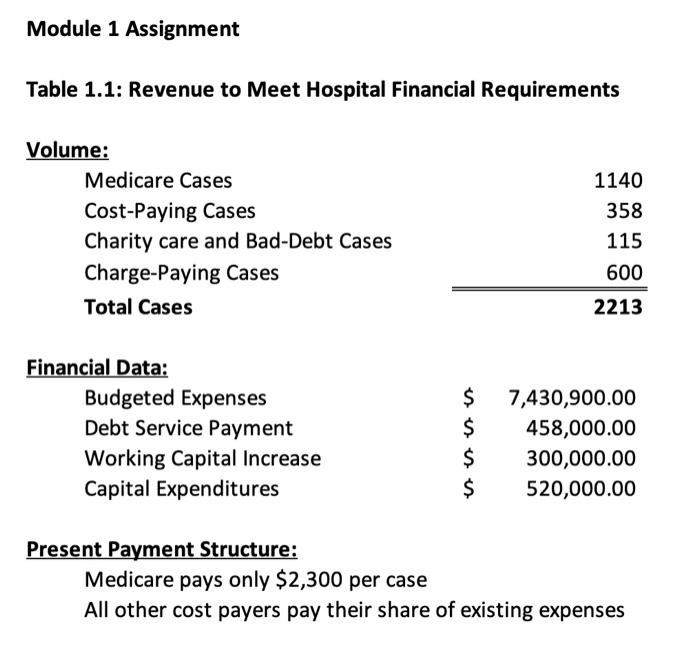

1: (10 pts) From the data in the table above, determine the amount of revenue that needs to be generated to meet hospital financial requirements.

2: (10 pts) Why is the accumulation of funded reserves for capital replacement more critical for non-profit healthcare entities than for investor-owned facilities?

3: (10 pts) Depreciation expense is recognized as reimbursable cost by a number of payers who pay prospective rates for operating costs. Would you prefer accelerated depreciation (sum of the year's digits) or price-level depreciation for a 5-year life asset with a $200,000 cost? Assume that inflation is projected to be 7% per year.

4: (10 pts) Using the data above, calculate the impact of a 8% reduction in operating expenses on the required revenue and rate structure. Discuss the implications of your findings.

5: (10 pts) Medicare currently reimburses hospitals for 68% of bad debts on Medicare patients, copayments, and deductibles. If your hospital had $1,200,000 in Medicare deductibles and copayments, what amount might Medicare pay for its bad debts if 12% of the total will remain uncollectable?

Module 1 Assignment Table 1.1: Revenue to Meet Hospital Financial Requirements Volume: Medicare Cases Cost-Paying Cases Charity care and Bad-Debt Cases Charge-Paying Cases Total Cases 1140 358 115 600 2213 Financial Data: Budgeted Expenses Debt Service Payment Working Capital Increase Capital Expenditures $ $ $ 7,430,900.00 458,000.00 300,000.00 520,000.00 Present Payment Structure: Medicare pays only $2,300 per case All other cost payers pay their share of existing expenses Module 1 Assignment Table 1.1: Revenue to Meet Hospital Financial Requirements Volume: Medicare Cases Cost-Paying Cases Charity care and Bad-Debt Cases Charge-Paying Cases Total Cases 1140 358 115 600 2213 Financial Data: Budgeted Expenses Debt Service Payment Working Capital Increase Capital Expenditures $ $ $ 7,430,900.00 458,000.00 300,000.00 520,000.00 Present Payment Structure: Medicare pays only $2,300 per case All other cost payers pay their share of existing expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts