Question: Questions 1 & 2 ask for cash flows only, no present values. Although they are a critical part of the problem, since the problem is

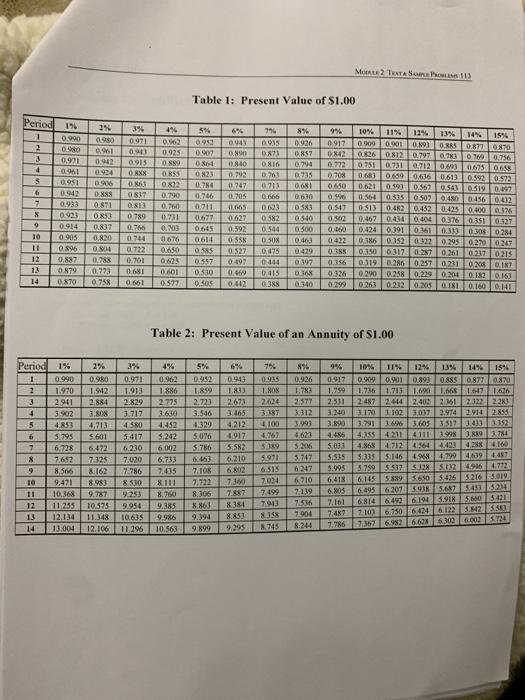

Questions 1 & 2 ask for cash flows only, no present values. Although they are a critical part of the problem, since the problem is primarily about capital budgeting, they are not worth any points, and you have unlimited tries. If your submissions are accepted as correct, but the answers that are provided (in bold) are different than your submissions, you should use the answers in bold when you answer Questions 3 and 4. Also, you should use the present value tables on page 113 in the Coursepack. The Brisbane Manufacturing Company produces a single model of a CD player. Each player is sold for $187 with a resulting contribution margin of $76. Brisbane's management is considering a change in its quality control system. Currently, Brisbane spends $41,000 a year to inspect the CD players. An average of 1,900 units turn out to be defective - 1,330 of them are detected in the inspection process and are repaired for $85. If a defective CD player is not identified in the Inspection process, the customer who receives it is given a full refund of the purchase price. The proposed quality control system involves the purchase of an X-ray machine for $180,000. The machine would tast for four years and would have salvage value at that time of $21,000. Brisbane would also spend $430,000 immediately to train workers to better detect and repair defective units. Annual inspection costs would increase by $20,000. Brisbane expects this new control system to reduce the number of defective units to 400 per year. 350 of these defective units would be detected and repaired at a cost of only $48 per unit. Customers who still receive defective players will be given a refund equal to 120% of the purchase price Questions 1 & 2 (0 points; unlimited tries] 1. What is the Year 3 cash flow if Brisbane keeps using its current system? Bom Ano Tries 0/99 2. What is the Year 3 cash flow if Brisbane replaces its current system? Submit Answer Tries 0/99 M2 TEATAS 113 Table 1: Present Value of $1.00 Period 196 0.990 796 DS 1 2 3 4 0.971 0961 0.951 0.942 0.933 0.923 0.914 0905 6% 004 090 0.840 0.792 0.747 0.705 7 29 90 0.961 0,942 0.934 0906 0.888 0.871 0853 0.837 0820 004 0.788 0.773 0.758 3% 0.971 093 0.915 ORXX 0.863 0817 0813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 4% 0.162 0925 OS OR$$ 02 0.790 0.700 0.71 0.103 0.676 0.650 0625 0.601 0.577 5% 0.95 0907 08 0,823 0.784 0.766 0.711 0.677 0.645 0.614 0385 0.357 0.330 0.505 8% 0.926 ORST 0.704 0.735 0.681 0610 053 0540 0.500 0.463 0.429 0.397 0.368 0.340 9% 0.917 0.842 0.772 0.708 0 650 OS 0.947 0.502 0.260 0422 ORS 0.356 0.326 0.816 0.763 0713 0666 0623 0582 0.544 DISON 0.75 0.444 0.415 0.388 10% 11% 12% 13% 14% 15% 09090.901 0.19 0.885 0.8770870 0926 0,812 0.797 0.78 0.700.756 0751 0.73101120.6193 0.675 068 0.683 0.659 0.616 0.613 0.5920572 0.621 0.591 0.567 0.5430519 0.97 0.564 0.5350507 0.480 04560.412 0.513 0.482 0.452 0.425 0.400 0.467 0.414 0404 0316 0.351 0.127 0.424 0.391 0.361 0.333 308 0.284 0.18 0.352 0.322 0.295 0.270 0.247 0.150 0.317 2ST 0.261 0.217 0.215 0.319 0.286 0.257 0.231.2018 0.290 0.258 0.229 0.20401820.163 0263 0.232 0.203 0.181 0.1600.141 8 9 10 0.627 0.592 OSSR 0.527 0.96 12 13 14 0.887 0.879 0870 2610 0990 CITO Table 2: Present Value of an Annuity of S1.00 5% 0.952 99% 0,917 1.759 2.531 3.240 3.80 2.723 31.546 Period 1% 1 0.990 2 1.970 3 2.941 4 3.902 5 4.833 6 5.795 7 6.728 7,657 9 8.566 10 9,471 11 10.368 12 11.255 13 12.134 14 13.004 0.980 1.9012 2.884 3.808 4,713 5.601 6.472 7.325 &162 8.983 9.787 10.575 11.348 12.106 396 0.971 1.913 2.829 3.717 450 5.417 6.230 7,020 7.786 8510 9253 9.954 10.635 11.29 4% 0.962 1886 2.775 3.630 4.452 $.242 6.002 6.733 7.415 8111 8.760 9.385 9.986 10.563 0.943 13 2.673 3.465 4.212 4.917 5582 6.210 6.802 7.360 7.87 8384 8.853 9.295 5.076 5.786 6.16) 7.108 7.722 8.306 * 863 9.394 9.899 0.935 1.NO 2.024 3.187 4.100 4.767 5159 5.971 6515 7.024 7.499 793 18 2.745 896 0.926 1.783 2.577 3312 3.99) 4.623 5.2016 5.747 6 247 6710 7,119 7:56 7.901 8:244 3019 109 12% 13% 14% 1596 0.600 0.901 0.893 0.885 0.8 0.870 1.7361.711.000 1.665 1.67 1.636 2.487 2.444 2.402 2361 2322 2.2) 2170 1 102 3,037 2.9743914 2NS 3.791 16 3.605 3.517 3.43 3.352 4.155 4231 41111998 3.8893.784 4868 1.712 4.56444214,288 4.100 5.335 5.146 4.968 4.7994639 3.7595337 5128 S02 1916 4.772 6.145 58895.650 5.365.216 6.4956 2073.93 5.07 5413514 6,814 6.4936194 5.91 5.60 5.421 7.1016.750 6.04 6. 122 3.842550 724 2.367 6,9826.638 6.3036.00 SOU 5.515 5.995 6.418 6 ROS 7.161 7.487 7.786

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts