Question: Questions 1-15: Select the one best answer to each question. 1. The most common types of voluntary benefits offered by employers include all of the

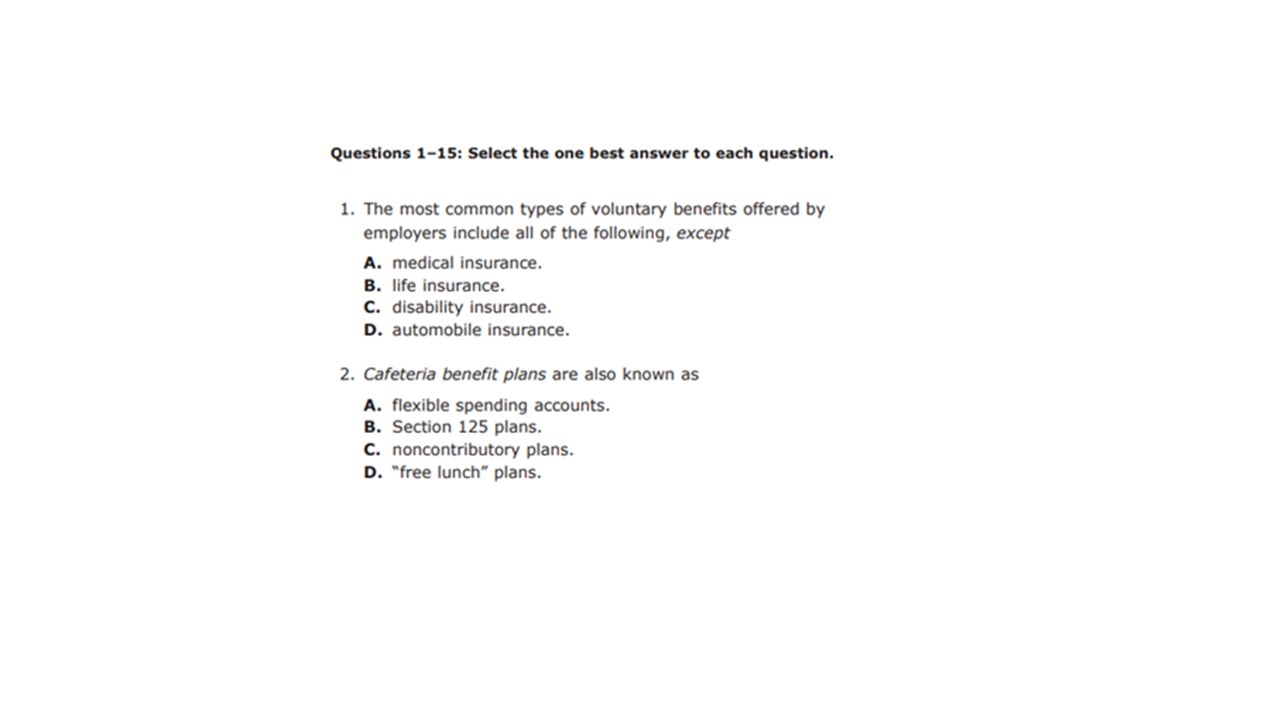

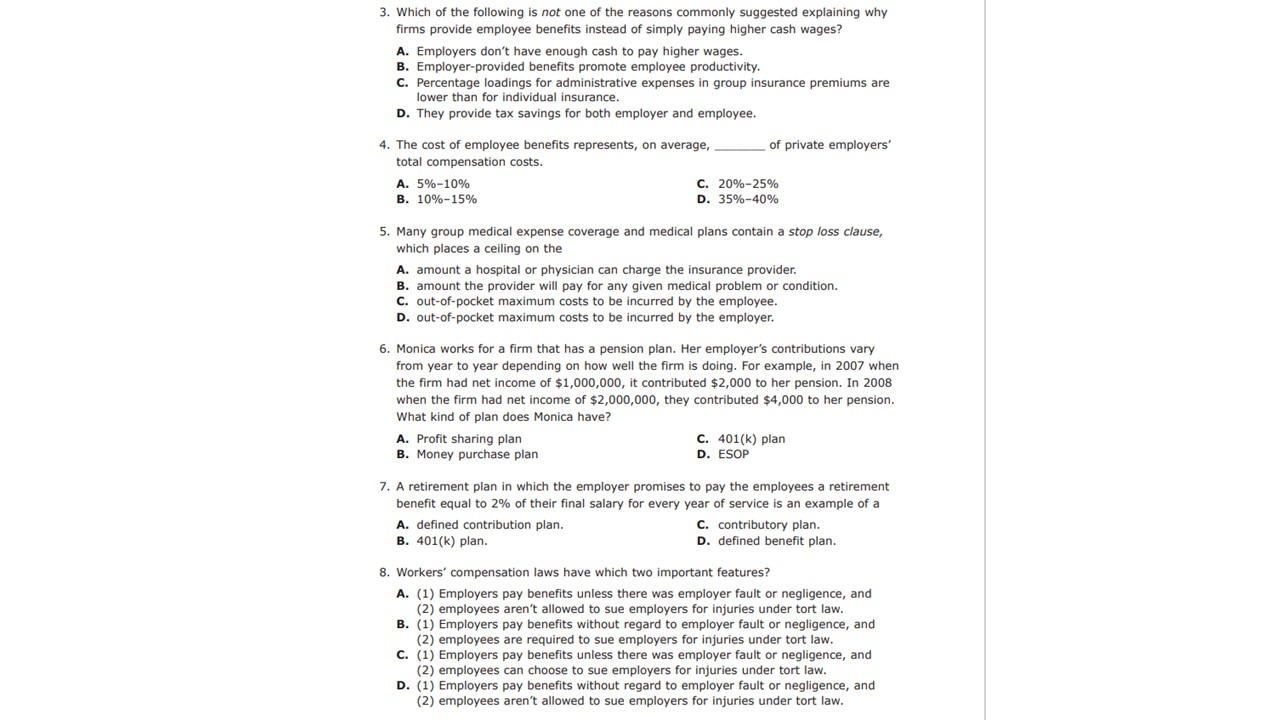

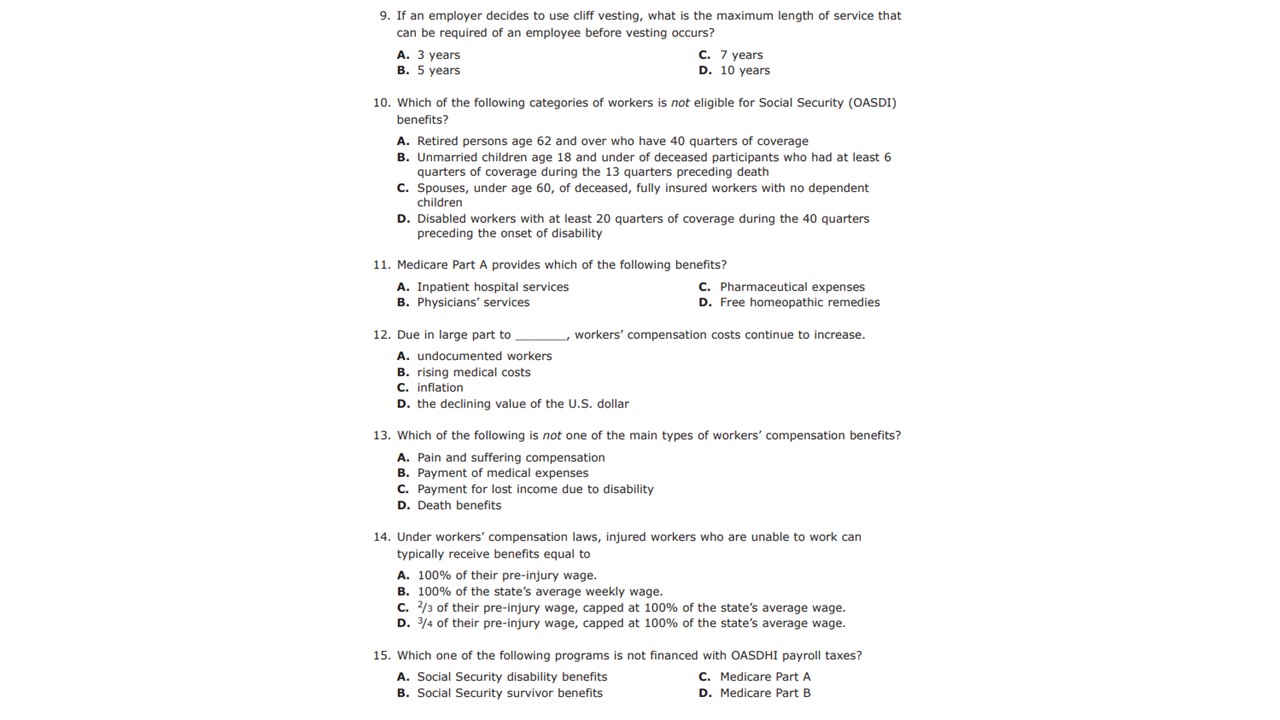

Questions 1-15: Select the one best answer to each question. 1. The most common types of voluntary benefits offered by employers include all of the following, except A. medical insurance. B. life insurance. C. disability insurance. D. automobile insurance. 2. Cafeteria benefit plans are also known as A. flexible spending accounts. B. Section 125 plans. C. noncontributory plans. D. "free lunch" plans.5. 7. which of are following Is no: one of the reasons commonly suggested explaining why rms provide employee benets instead of simply paying higher cash wages? A. Empioyers don't have enough cash to pay higher wags. B. Employer-provided benets promote employee productivity. [2. Percentage loadings for administrative expenses In group Insurance premiums are lower than for individual Insurance. D. They provide tax savings for both employer and employee. The cost oi employee benets represents. an average, l:rlr private employers' mtal compensadon cools. A. Eli-10% C. ZINE-25% B. 1096-1596 B. 35954095 Many group medical expense coverage and medical plans contain a stop loss clause, which places a ceiling on the A. amount a hospital or physician can charge the insurance provider. B. amount the provider will pay for any given medical problem or condition. It. oul-ofpoctet maximum costs to be incurred by the employee. D. out-of-poolcet maximum costs to be Incurred by the employer. Monica worls for a rm that has a pension plan. Her employer's oonolbotlons vary from year to year depending on how well the firm ls doing. For example, in 2007 when the firm had net Income of $1,000,000, it contributed $2,000 to her pension. In 2008 when die firm had net Income of $2,000,000, they contributed $4,000 to her pension. What kind of plan does Monica have? A. Prot sharing plan 1:. sum] plan 0. Money purchase plan I). ESOP A retirement plan in which the empioyer promises to pay the employees a retirement benefit qua! to 2% oftilelr final salary for every year of service is an example of a A. dened contribution plan. C. contributory plan. a. 401(k) plan. 0. defined benet plan. workers' compensation laws have which two imponant features? A. (1) Employers pay benets unless there was employer fault or negligence, and (2) employees aren't allowed to sue employers for Injuries under tort law. a. (1) Employers pay benets without regard no employer fault or negligence. and (2) employees are required to sue employers for injuries under tort law. C. (1) Employers pay beneftls unless drere was employer fault or negligenm, and (2) employees can choose to sue employers for injuries under um law. D. (1) Employers pay benets without regard to employer fault or negligence, and (2) employees aren't allowed to sue employers for Injuries under tort law. 9. If an employer decides to use cliff vesting, what is the maximum length of service that can be required of an employee before vesting occurs? A. 3 years C. 7 years B. 5 years D. 10 years 10. Which of the following categories of workers is not eligible for Social Security (OASDI) benefits? A. Retired persons age 62 and over who have 40 quarters of coverage B. Unmarried children age 18 and under of deceased participants who had at least 6 quarters of coverage during the 13 quarters preceding death C. Spouses, under age 60, of deceased, fully insured workers with no dependent children D. Disabled workers with at least 20 quarters of coverage during the 40 quarters preceding the onset of disability 11. Medicare Part A provides which of the following benefits? A. Inpatient hospital services C. Pharmaceutical expenses B. Physicians' services D. Free homeopathic remedies 12. Due in large part to , workers' compensation costs continue to increase. A. undocumented workers B. rising medical costs C. inflation D. the declining value of the U.S. dollar 13. Which of the following is not one of the main types of workers' compensation benefits? A. Pain and suffering compensation B. Payment of medical expenses C. Payment for lost income due to disability D. Death benefits 14. Under workers' compensation laws, injured workers who are unable to work can typically receive benefits equal to A. 100% of their pre-injury wage. B. 100% of the state's average weekly wage. C. 2/3 of their pre-injury wage, capped at 100% of the state's average wage. D. 3/4 of their pre-injury wage, capped at 100% of the state's average wage. 15. Which one of the following programs is not financed with OASDHI payroll taxes? A. Social Security disability benefits C. Medicare Part A B. Social Security survivor benefits D. Medicare Part B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts