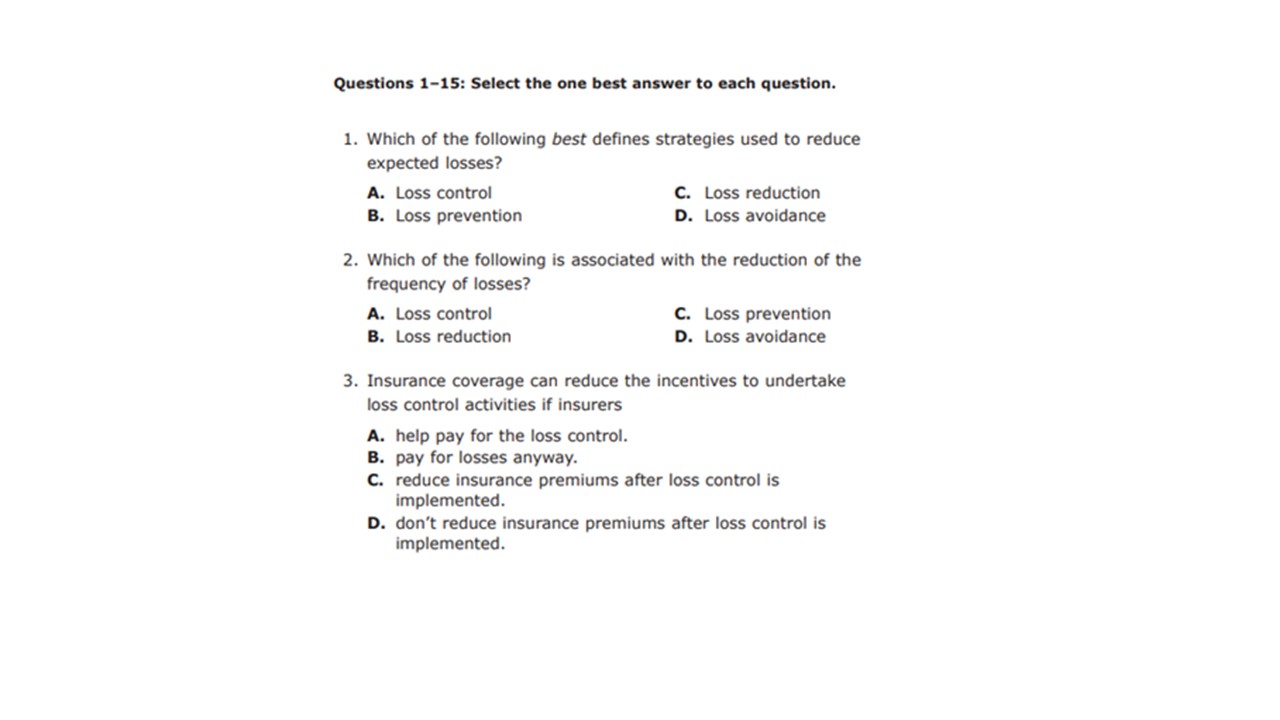

Question: Questions 1-15: Select the one best answer to each question. 1. Which of the following best defines strategies used to reduce expected losses? A. Loss

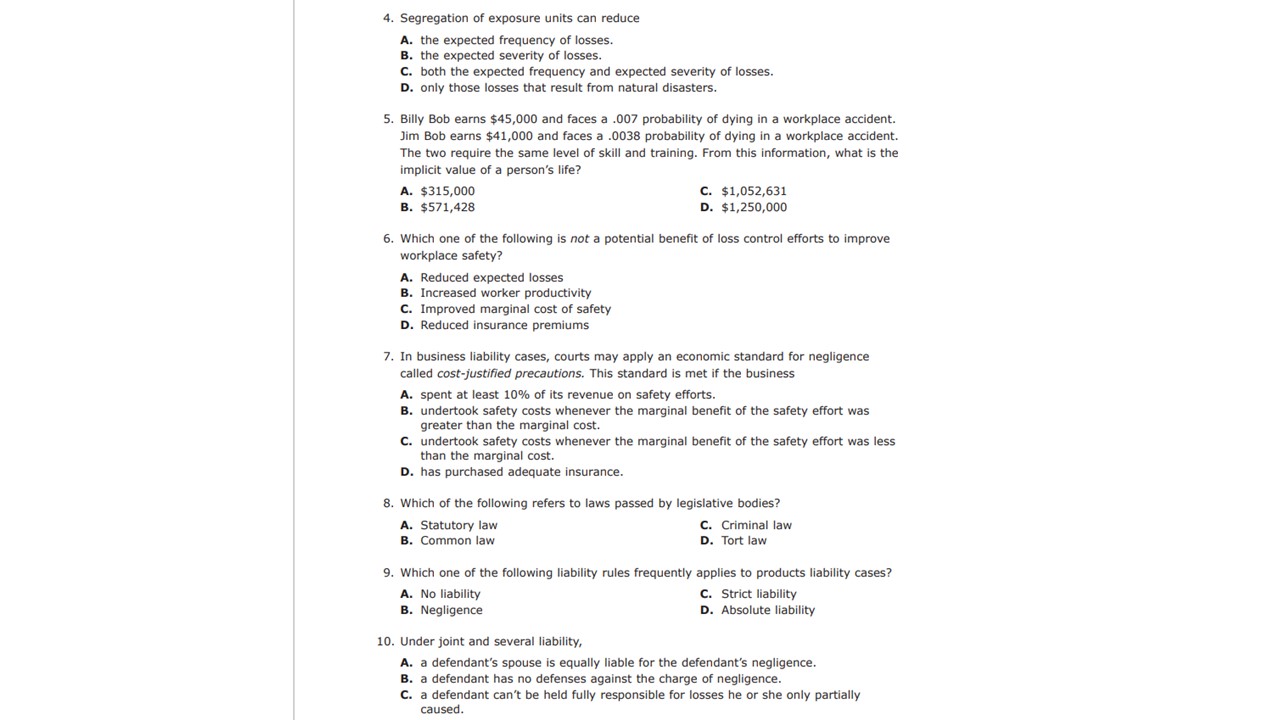

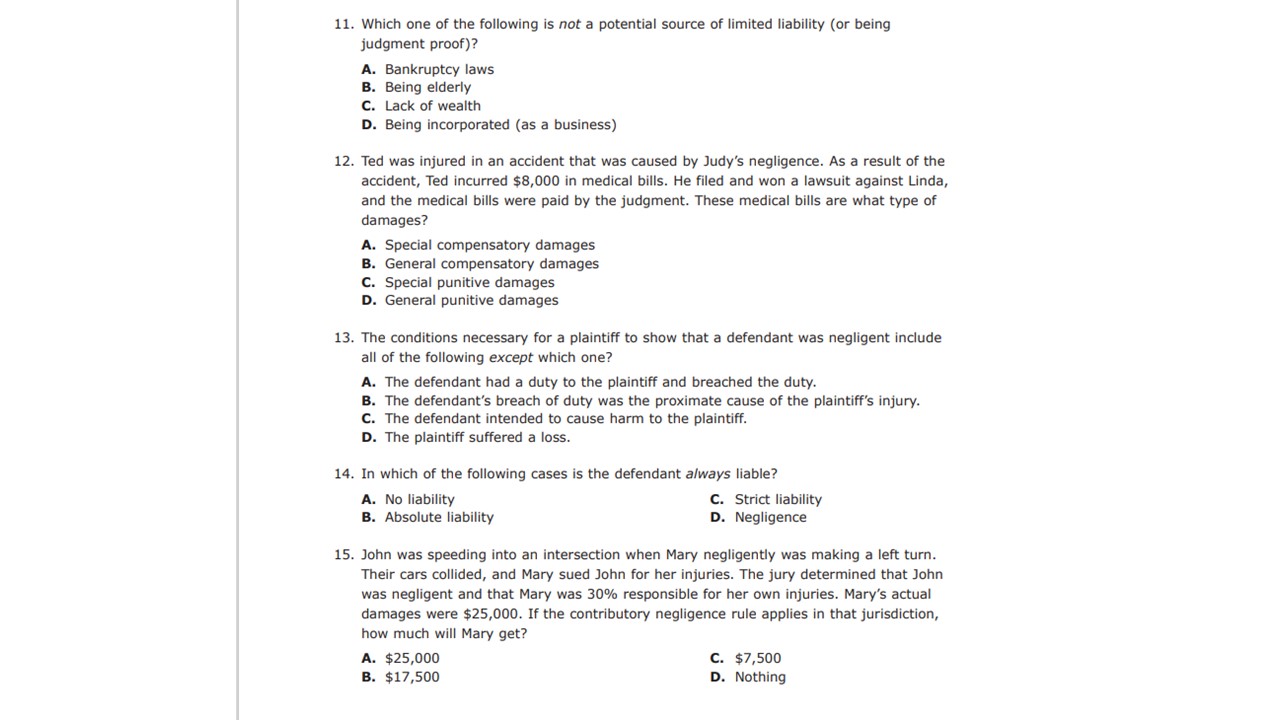

Questions 1-15: Select the one best answer to each question. 1. Which of the following best defines strategies used to reduce expected losses? A. Loss control C. Loss reduction B. Loss prevention D. Loss avoidance 2. Which of the following is associated with the reduction of the frequency of losses? A. Loss control C. Loss prevention B. Loss reduction D. Loss avoidance 3. Insurance coverage can reduce the incentives to undertake loss control activities if insurers A. help pay for the loss control. B. pay for losses anyway. C. reduce insurance premiums after loss control is implemented. D. don't reduce insurance premiums after loss control is implemented.7. 10. Segregation of exposure units can reduce A. the expected frequency of losses. B. the expected severity of losses. C. both the expected frequency and expected severity of losses. B. only those losses that result from natural disasters. Billy Bob earns $45,000 and faces a .00? probability of dying in a workplace accident. Jlm Bob earns $41,000 and faces a .0038 probability of dying in a workplace accident. The two require the same level of skill and training. From this information, what is the Implicit value of a person's life? A. $315,000 C. $1,052,631 3. $571,428 D. $1,250,000 Which one of the following is not a potential benet of loss control alert: to improve workplace safety? A. Reduced expected IDSeS B. Increased worker productivity C. Improved marginal cost of safety I). Reduced Insurance premiums in business liability cases, courts may apply an economic standard for negllgence cailed Cost-Justied precauons. This standard ls met if the business A. spent at least 10% of Its revenue on safety e'urts. I. undertook safety costs whenever the marginal benet of the safety eclrt was greatenhan the marglnal cost. c. undertook safety costs whenever the marginal benet of the safety effort was less than the marginal cost. D. has purchased adequate insurance. Which of the following refers to lav-rs passed by legislative bodies? A. Statutory law C. Criminal law B. Common law D. Tortlaw Which one of me following llablllty rules frequently applies to products llabillty am? A. Noliabllity c. Sh'ictllabllity a. Negligence o. Absolutellabllity Under joint and several llablllty. A. a defendant's spouse is equally liable for the defendant's neullgenoe. B. a defendant has no defenses against the charge of neg1l9e-ncie. C. a defendant can't be held fully responsible for losses he or she only parally caused. 11. 12. 13. 14. 15. Which one of the following is not a potential source of limited liability (or being judgment proof)? A. Bankruptcy laws 3. Being elderly C. Lack of wealth D. Being incorporated (as a business) Ted was injured In an accident that was caused by Judy's negligence. As a result of the accident, Ted incurred $8,000 in medical bills. He led and won a lawsuit against IJnda, and the medical bills were paid by the judgment. These medical bills are what type of damages? A. Special compensatory damages 3. General compensatory damages (3- Special DUHIUVE damages D. General punitive damages The conditions neoessary for a plaintiff to show that a defendant was negligent include all of the following except which one? A. The defendant had a duty to the plaintiff and breached the duty. 3. The defendant's breach of duty was the proximate cause of the plaintiff's injury. c. The defendant intended to cause harm to the plaintiff. D. The piaintiff suffered a loss. in whld'l of the following cases Is the defendant always liable? A. No liability C. Strict liability 3. Absolute liability D. Negligence John was speeding into an intersection when Mary negligently was making a lea mm. Their cars collided. and Mary sued John for her Injuries. The jury determined that John was negligent and that Mary was 30% responsible for her own injuries. Mary's actual damages were $25,000. if the contributory negligence rule applies in that jurisdiction. how much will Maryr get? A. $25,000 C. $7,500 3. $17,500 D. Nothing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts