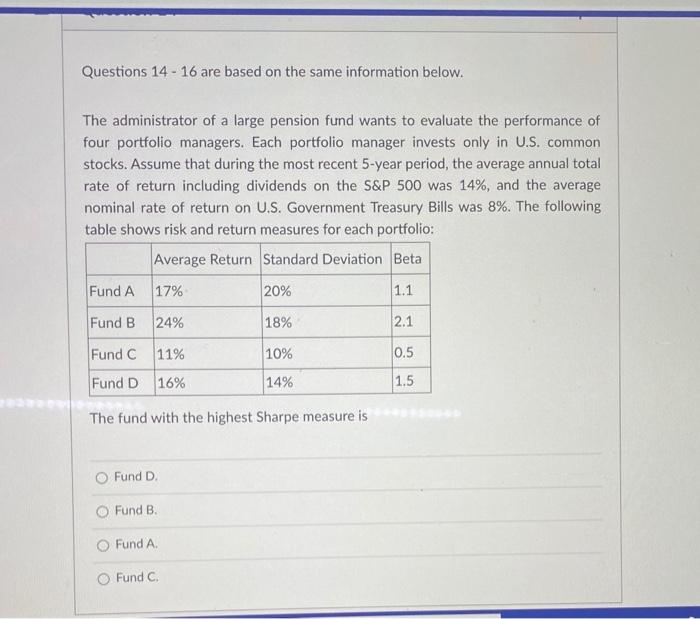

Question: Questions 14 - 16 are based on the same information below. The administrator of a large pension fund wants to evaluate the performance of four

Questions 14 - 16 are based on the same information below. The administrator of a large pension fund wants to evaluate the performance of four portfolio managers. Each portfolio manager invests only in U.S. common stocks. Assume that during the most recent 5-year period, the average annual total rate of return including dividends on the S&P 500 was 14%, and the average nominal rate of return on U.S. Government Treasury Bills was 8%. The following table shows risk and return measures for each portfolio: Average Return Standard Deviation Beta Fund A 17% 20% 1.1 Fund B 24% 18% 2.1 10% 0.5 Fund C 11% Fund D 16% 14% 1.5 The fund with the highest Sharpe measure is Fund D O Fund B. O Fund A O Fund C. Based on the information of Question 14, the fund with the highest Treynor measure is O Fund A. O Fund B. Fund D. O Fund C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts