Question: 5. Use the following data to solve CFA Problems 4 and 5: The administrator of a large pension fund wants to evaluate the performance of

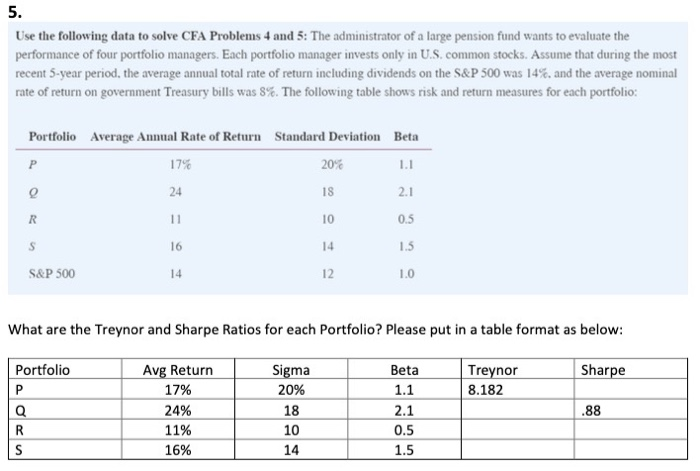

5. Use the following data to solve CFA Problems 4 and 5: The administrator of a large pension fund wants to evaluate the performance of four portfolio managers. Each portfolio manager invests only in U.S. common stocks. Assume that during the most recent 5-year period, the average annual total rate of return including dividends on the S&P 500 was 14%. and the average nominal rate of return on government Treasury bills was 8%. The following table shows risk and return measures for each portfolio: Portfolio Average Annual Rate of Return Standard Deviation Beta 17% 0.5 S&P 500 What are the Treynor and Sharpe Ratios for each Portfolio? Please put in a table format as below: Portfolio Sharpe Treynor 8.182 Avg Return 17% 24% 11% 16% Sigma 20% 18 10 Beta 1.1 2.1 0.5 1.5 .88 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts