Question: Questions 1-6: Select the correct answer 1) Dots Co. cares about efficiency, and under the assumption that if sales was constant and efficiency was by

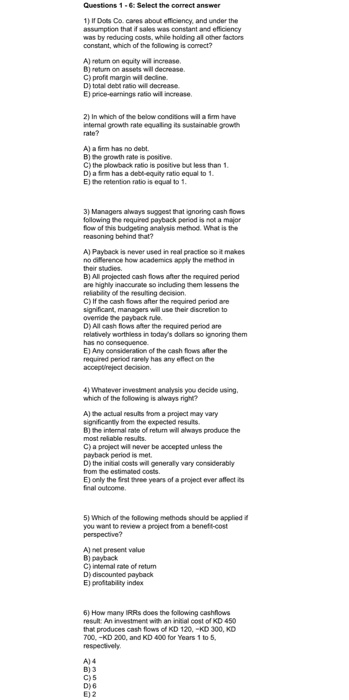

Questions 1-6: Select the correct answer 1) Dots Co. cares about efficiency, and under the assumption that if sales was constant and efficiency was by reducing costs, while holding all other factors constant, which of the following is correct? A) return on equity will increase B) return on assets wil decrease C) profit margin wil decline. D) tot de ratio will decrease E) price-earnings ratio will increase 2) In which of the below conditions wil afirm have intemal growth rate equaling its sustainable growth rate? A) a firm has no debt. By the growth rate is positive C) the plowback ratio is positive but less than 1. D) a firm has a debt equity ratio equal to 1. E) the retention ratio is equal to 1. 3) Managers always suggest that ignoring cash flows following the required payback period is not a major flow of this budgeting analysis method. What is the reasoning behind that? A) Payback is never used in real practice so it makes no difference how academics apply the method in their studies. B) All projected cash flows after the required period are highly inaccurates including the lessons the reliability of the resulting decision C) If the cash flows after the required periode significant, managers will use their discretion to override the payback rule D) All cash flows after the required period are relatively worthless in today's dollars so ignoring them has no consequence E) Any consideration of the cash flows after the required period rarely has any effect on the accept reject decision 4) Whatever investment analysis you decide using which of the following is always right? A) the actual results from a project may vary significantly from the expected results By the internal rate of retum will always produce the most reliable results. C) a project will never be accepted unless the payback period is met D) the initial costs wil generally vary considerably from the estimated costs E) only the first three years of a project ever affect is final outcome 5) Which of the following methods should be applied you want to review a project from a benefit-cost perspective? A) ne present value B) payback C) Internal rate of retum D) discounted payback E) profitability index 6) How many IRRs does the following cashflows result: An investment with an initial cost of KD 450 that produces cash flows of KD 120,-KD 300, KD 700.-KD 200, and KD 400 for Years 1 to 5, respectively A) 4 B) 3 C) D) 6 3)2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts