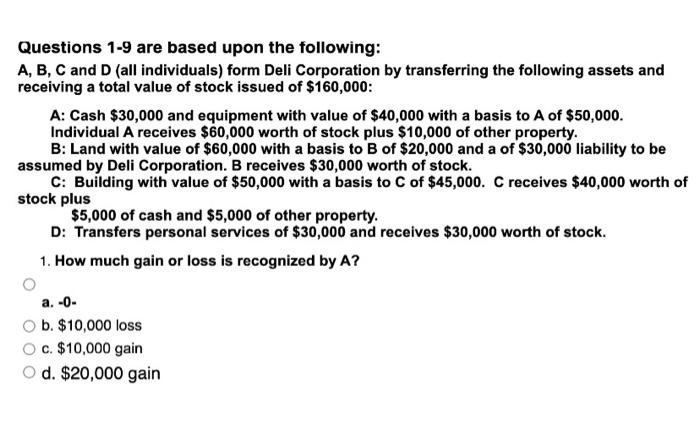

Question: Questions 1-9 are based upon the following: A, B, C and D (all individuals) form Deli Corporation by transferring the following assets and receiving a

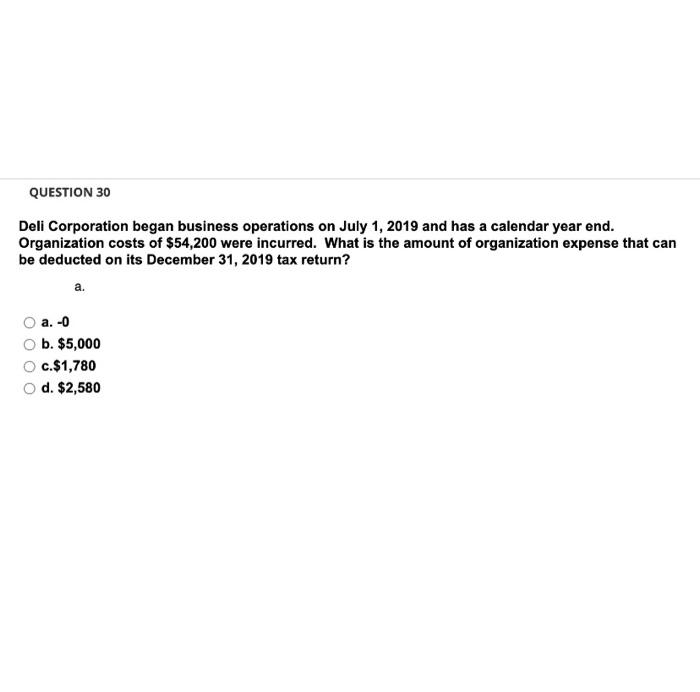

Questions 1-9 are based upon the following: A, B, C and D (all individuals) form Deli Corporation by transferring the following assets and receiving a total value of stock issued of $160,000: A: Cash $30,000 and equipment with value of $40,000 with a basis to A of $50,000. Individual A receives $60,000 worth of stock plus $10,000 of other property. B: Land with value of $60,000 with a basis to B of $20,000 and a of $30,000 liability to be assumed by Deli Corporation. B receives $30,000 worth of stock. C: Building with value of $50,000 with a basis to C of $45,000. Creceives $40,000 worth of stock plus $5,000 of cash and $5,000 of other property. D: Transfers personal services of $30,000 and receives $30,000 worth of stock. 1. How much gain or loss is recognized by A? a.-0- b. $10,000 loss c. $10,000 gain d. $20,000 gain QUESTION 30 Deli Corporation began business operations on July 1, 2019 and has a calendar year end. Organization costs of $54,200 were incurred. What is the amount of organization expense that can be deducted on its December 31, 2019 tax return? a. a.-0 b. $5,000 c.$1,780 d. $2,580

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts