Question: Questions 5 5 - 6 2 are based on the following. Harvey's Cuisine, Inc., is a midsized local restaurant specializing in Mediterranean cuisine. The restaurant

Questions are based on the following.

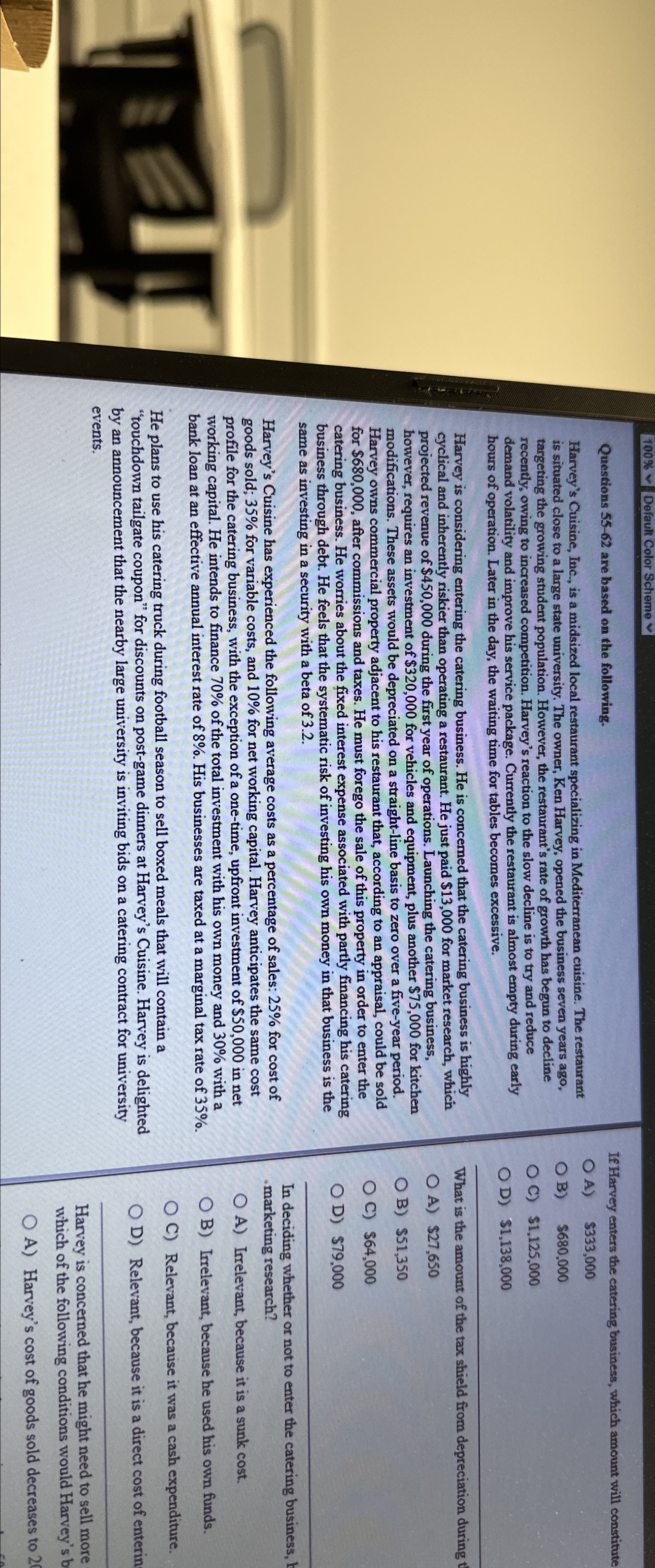

Harvey's Cuisine, Inc., is a midsized local restaurant specializing in Mediterranean cuisine. The restaurant is situated close to a large state university. The owner, Ken Harvey, opened the business seven years ago, targeting the growing student population. However, the restaurant's rate of growth has begun to decline recently, owing to increased competition. Harvey's reaction to the slow decline is to try and reduce demand volatility and improve his service package. Currently the restaurant is almost empty during early hours of operation. Later in the day, the waiting time for tables becomes excessive.

Harvey is considering entering the catering business. He is concerned that the catering business is highly cyclical and inherently riskier than operating a restaurant. He just paid $ for market research, whicin projected revenue of $ during the first year of operations. Launching the catering business, however, requires an investment of $ for vehicles and equipment, plus another $ for kitchen modifications. These assets would be depreciated on a straightline basis to zero over a fiveyear period. Harvey owns commercial property adjacent to his restaurant that, according to an appraisal, could be sold for $ after commissions and taxes. He must forego the sale of this property in order to enter the catering business. He worries about the fixed interest expense associated with partly financing his catering business through debt. He feels that the systematic risk of investing his own money in that business is the same as investing in a security with a beta of

Harvey's Cuisine has experienced the following average costs as a percentage of sales: for cost of goods sold; for variable costs, and for net working capital. Harvey anticipates the same cost profile for the catering business, with the exception of a onetime, upfront investment of $ in net working capital. He intends to finance of the total investment with his own money and with a bank loan at an effective annual interest rate of His businesses are taxed at a marginal tax rate of

He plans to use his catering truck during football season to sell boxed meals that will contain a "touchdown tailgate coupon" for discounts on postgame dinners at Harvey's Cuisine. Harvey is delighted by an announcement that the nearby large university is inviting bids on a catering contract for university events.

If Harvey enters the catering business, which amount will constitute

A $

B $

C $

D $

What is the amount of the tax shield from depreciation during

A $

B $

C $

D $

In deciding whether or not to enter the catering business, marketing research?

A Irrelevant, because it is a sunk cost.

B Irrelevant, because he used his own funds.

C Relevant, because it was a cash expenditure.

D Relevant, because it is a direct cost of enterin

Harvey is concerned that he might need to sell more which of the following conditions would Harvey's b

A Harvey's cost of goods sold decreases to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock