Question: Questions 8 and 9 are based on following information: Ameri Textile Co. is considering opening a production and shipping facility in Dallas to keep up

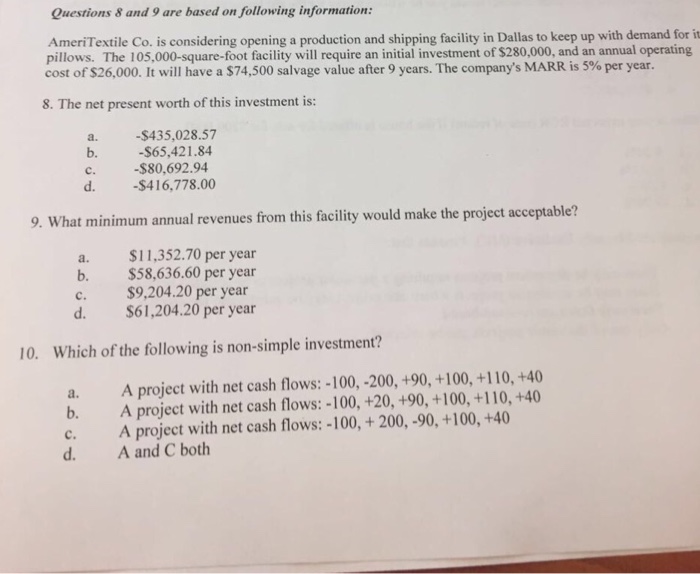

Questions 8 and 9 are based on following information: Ameri Textile Co. is considering opening a production and shipping facility in Dallas to keep up with demand for it pillows. The 105,000-square-foot facility will require an initial investment of $280,000, and an annual operating cost of S26,000. It will have a $74,500 salvage value after 9 years. The company's MARR is 5% per year. 8. The net present worth of this investment is: a. $435,028.57 -$65,421.84 -$80,692.94 d. $416,778.00 9. What minimum annual revenues from this facility would make the project acceptable? a. $11,352.70 per year b. $58,636.60 per year c. $9,204.20 per year d. $61,204.20 per year 10. Which of the following is non-simple investment? a. A project with net cash flows: -100, -200, +90, +100, +110, +40 b. A project with net cash flows: -100, +20, +90, +100, +110,+40 c. A project with net cash flows: -100, 200, -90, +100, +40 d. A and C both

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts