Question: Questions: Address all the questions. Include all the information required. Please no guess work. One of your friends has inherited a substantial investment in an

Questions:

Address all the questions. Include all the information required. Please no guess work.

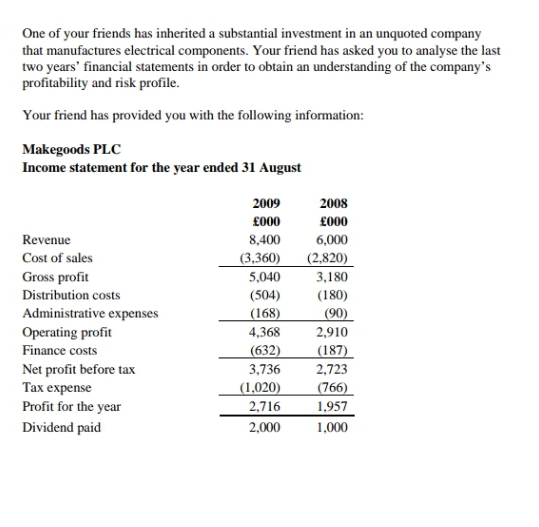

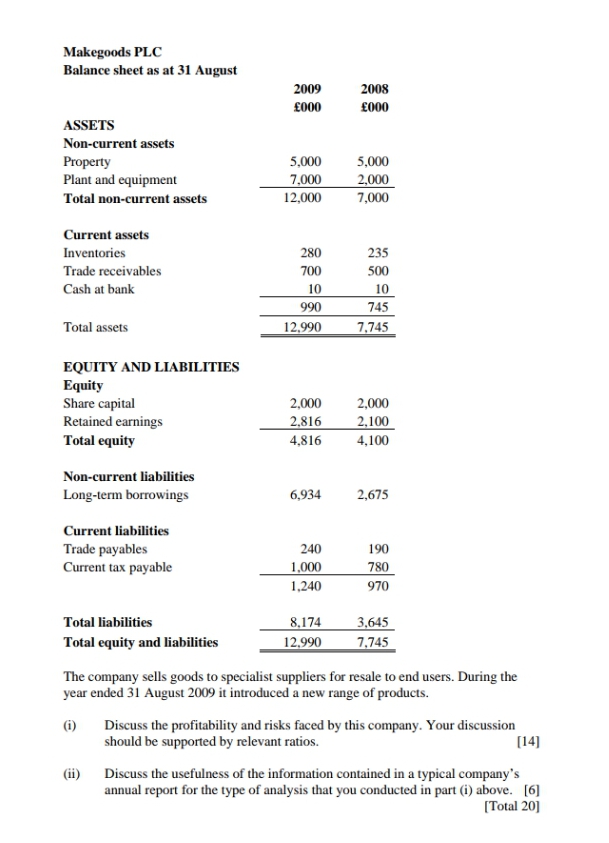

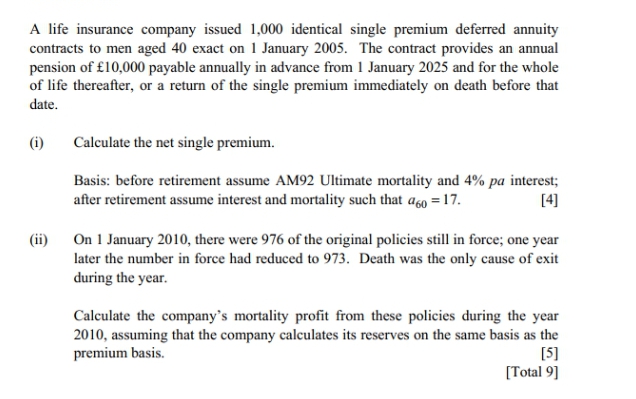

One of your friends has inherited a substantial investment in an unquoted company that manufactures electrical components. Your friend has asked you to analyse the last two years' financial statements in order to obtain an understanding of the company's profitability and risk profile. Your friend has provided you with the following information: Makegoods PLC Income statement for the year ended 31 August 2009 2008 EOOO EOOO Revenue 8,400 6,000 Cost of sales (3,360) (2,820) Gross profit 5,040 3,180 Distribution costs (504) (180) Administrative expenses (168) (90) Operating profit 4.368 2,910 Finance costs (632) (187) Net profit before tax 3,736 2,723 Tax expense (1,020) (766) Profit for the year 2,716 1,957 Dividend paid 2.000 1,000Makegoods PLC Balance sheet as at 31 August 2009 2008 EOOO EOOO ASSETS Non-current assets Property 5,000 5,000 Plant and equipment 7,000 2,000 Total non-current assets 12,000 7,000 Current assets Inventories 280 235 Trade receivables 700 500 Cash at bank 10 10 990 745 Total assets 12,990 7,745 EQUITY AND LIABILITIES Equity Share capital 2,000 2,000 Retained earnings 2,816 2,100 Total equity 4,816 4,100 Non-current liabilities Long-term borrowings 6,934 2,675 Current liabilities Trade payables 240 190 Current tax payable 1.000 780 1.240 970 Total liabilities 8,174 3,645 Total equity and liabilities 12,990 7,745 The company sells goods to specialist suppliers for resale to end users. During the year ended 31 August 2009 it introduced a new range of products. (i) Discuss the profitability and risks faced by this company. Your discussion should be supported by relevant ratios. [14] (ii) Discuss the usefulness of the information contained in a typical company's annual report for the type of analysis that you conducted in part (i) above. [6] [Total 20]A life insurance company issued 1,000 identical single premium deferred annuity contracts to men aged 40 exact on 1 January 2005. The contract provides an annual pension of f10,000 payable annually in advance from 1 January 2025 and for the whole of life thereafter, or a return of the single premium immediately on death before that date. (i) Calculate the net single premium. Basis: before retirement assume AM92 Ultimate mortality and 4% pa interest; after retirement assume interest and mortality such that a60 = 17. [4] (ii) On 1 January 2010, there were 976 of the original policies still in force; one year later the number in force had reduced to 973. Death was the only cause of exit during the year. Calculate the company's mortality profit from these policies during the year 2010, assuming that the company calculates its reserves on the same basis as the premium basis. [5] [Total 9]