Question: Questions and Exercises 3-1. Using the annual report obtained for Exercise 1-1, answer the following questions. a. Look at the Statement of Revenues, Expenditures,

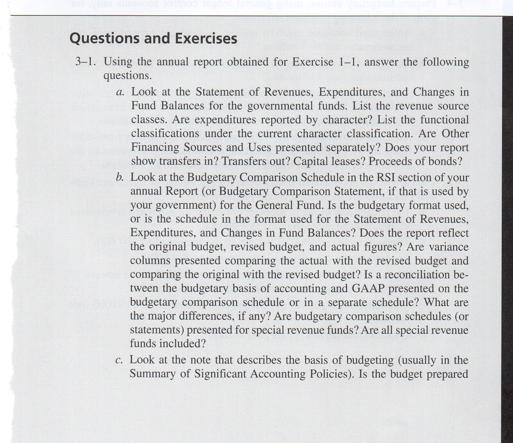

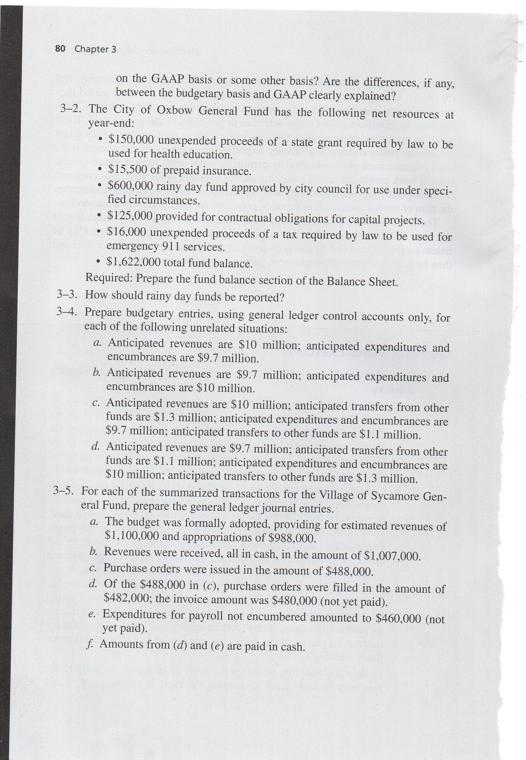

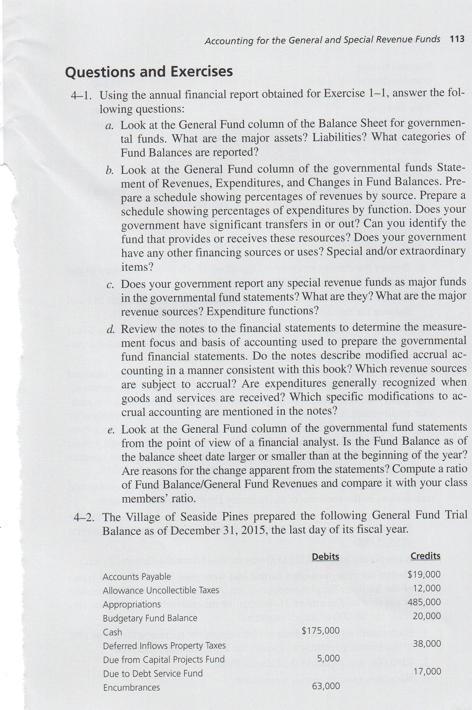

Questions and Exercises 3-1. Using the annual report obtained for Exercise 1-1, answer the following questions. a. Look at the Statement of Revenues, Expenditures, and Changes in Fund Balances for the governmental funds. List the revenue source classes. Are expenditures reported by character? List the functional classifications under the current character classification. Are Other Financing Sources and Uses presented separately? Does your report show transfers in? Transfers out? Capital leases? Proceeds of bonds? b. Look at the Budgetary Comparison Schedule in the RSI section of your annual Report (or Budgetary Comparison Statement, if that is used by your government) for the General Fund. Is the budgetary format used, or is the schedule in the format used for the Statement of Revenues, Expenditures, and Changes in Fund Balances? Does the report reflect the original budget, revised budget, and actual figures? Are variance columns presented comparing the actual with the revised budget and comparing the original with the revised budget? Is a reconciliation be- tween the budgetary basis of accounting and GAAP presented on the budgetary comparison schedule or in a separate schedule? What are the major differences, if any? Are budgetary comparison schedules (or statements) presented for special revenue funds? Are all special revenue funds included? c. Look at the note that describes the basis of budgeting (usually in the Summary of Significant Accounting Policies). Is the budget prepared 80 Chapter 3 on the GAAP basis or some other basis? Are the differences, if any, between the budgetary basis and GAAP clearly explained? 3-2. The City of Oxbow General Fund has the following net resources at year-end: $150,000 unexpended proceeds of a state grant required by law to be used for health education. . $125,000 provided for contractual obligations for capital projects. $16,000 unexpended proceeds of a tax required by law to be used for emergency 911 services. $1,622,000 total fund balance. Required: Prepare the fund balance section of the Balance Sheet. 3-3. How should rainy day funds be reported? 3-4. Prepare budgetary entries, using general ledger control accounts only, for each of the following unrelated situations: . $15,500 of prepaid insurance. $600,000 rainy day fund approved by city council for use under speci- fied circumstances. . a. Anticipated revenues are $10 million; anticipated expenditures and encumbrances are $9.7 million. b. Anticipated revenues are $9.7 million; anticipated expenditures and encumbrances are $10 million. c. Anticipated revenues are $10 million; anticipated transfers from other funds are $1.3 million; anticipated expenditures and encumbrances are $9.7 million; anticipated transfers to other funds are $1.1 million. d. Anticipated revenues are $9.7 million; anticipated transfers from other funds are $1.1 million; anticipated expenditures and encumbrances are $10 million; anticipated transfers to other funds are $1.3 million. 3-5. For each of the summarized transactions for the Village of Sycamore Gen- eral Fund, prepare the general ledger journal entries. a. The budget was formally adopted, providing for estimated revenues of $1,100,000 and appropriations of $988,000. b. Revenues were received, all in cash, in the amount of $1,007,000. c. Purchase orders were issued in the amount of $488,000. d. Of the $488,000 in (c), purchase orders were filled in the amount of $482,000; the invoice amount was $480,000 (not yet paid). e. Expenditures for payroll not encumbered amounted to $460,000 (not yet paid). f. Amounts from (d) and (e) are paid in cash. Accounting for the General and Special Revenue Funds 113 Questions and Exercises 4-1. Using the annual financial report obtained for Exercise 1-1, answer the fol- lowing questions: a. Look at the General Fund column of the Balance Sheet for governmen- tal funds. What are the major assets? Liabilities? What categories of Fund Balances are reported? b. Look at the General Fund column of the governmental funds State- ment of Revenues, Expenditures, and Changes in Fund Balances. Pre- pare a schedule showing percentages of revenues by source. Prepare a schedule showing percentages of expenditures by function. Does your government have significant transfers in or out? Can you identify the fund that provides or receives these resources? Does your government have any other financing sources or uses? Special and/or extraordinary items? c. Does your government report any special revenue funds as major funds in the governmental fund statements? What are they? What are the major revenue sources? Expenditure functions? d. Review the notes to the financial statements to determine the measure- ment focus and basis of accounting used to prepare the governmental fund financial statements. Do the notes describe modified accrual ac- counting in a manner consistent with this book? Which revenue sources are subject to accrual? Are expenditures generally recognized when goods and services are received? Which specific modifications to ac- crual accounting are mentioned in the notes? e. Look at the General Fund column of the governmental fund statements from the point of view of a financial analyst. Is the Fund Balance as of the balance sheet date larger or smaller than at the beginning of the year? Are reasons for the change apparent from the statements? Compute a ratio of Fund Balance/General Fund Revenues and compare it with your class members' ratio. 4-2. The Village of Seaside Pines prepared the following General Fund Trial Balance as of December 31, 2015, the last day of its fiscal year. Accounts Payable Allowance Uncollectible Taxes Appropriations Budgetary Fund Balance Cash Deferred Inflows Property Taxes Due from Capital Projects Fund Due to Debt Service Fund Encumbrances Debits $175,000 5,000 63,000 Credits $19,000 12,000 485,000 20,000 38,000 17,000

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Answer Answer 31 a iBy looking at the Statement of Revenues Expenditures and Changes in Fund Balance... View full answer

Get step-by-step solutions from verified subject matter experts