Question: QUESTIONS: A.TRUE/FALSE (Each question 5 total 30 p) 1. The capital budgeting decision-making process involves measuring the incremental cash flows of an investment proposal and

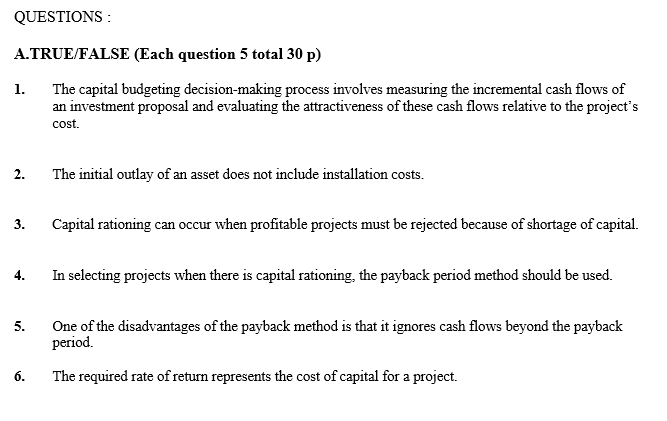

QUESTIONS: A.TRUE/FALSE (Each question 5 total 30 p) 1. The capital budgeting decision-making process involves measuring the incremental cash flows of an investment proposal and evaluating the attractiveness of these cash flows relative to the project's cost. 2. The initial outlay of an asset does not include installation costs. 3. Capital rationing can occur when profitable projects must be rejected because of shortage of capital. 4. In selecting projects when there is capital rationing, the payback period method should be used. 5. One of the disadvantages of the payback method is that it ignores cash flows beyond the payback period. 6. The required rate of return represents the cost of capital for a project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts