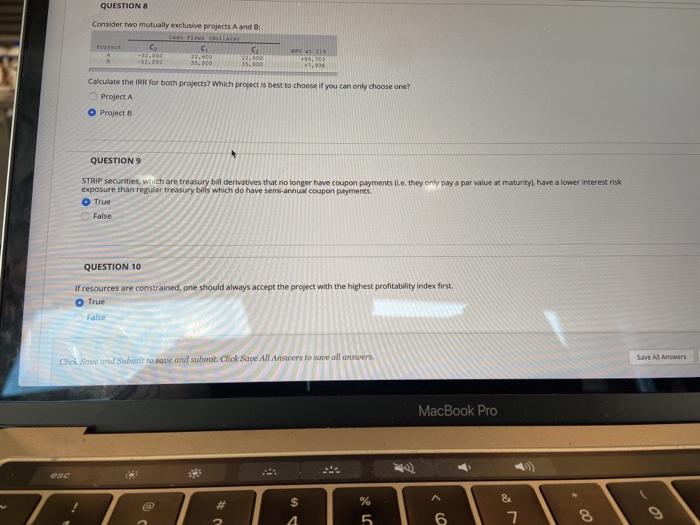

Question: QUESTIONS Consider two mutually exclusive projects And : VIR - 13.00 -3.00 32.60 200 5. 33.000 7. Calculate the IRR for both projects? Which project

QUESTIONS Consider two mutually exclusive projects And : VIR - 13.00 -3.00 32.60 200 5. 33.000 7. Calculate the IRR for both projects? Which project is best to choose it you can only choose one Project A Projects QUESTION 9 STRIP Securities wich are treasury bill derivatives that no longer have coupon payments, they only pay a par value at maturity, have a lower interest risk exposure than regular treasury bills which do have semi-annual coupon payments. O True False QUESTION 10 If resources are constrained, one should always accept the project with the highest profitability index first True Save Anwen Chord Sto.se and submit. Click Save All Answers to see all answers MacBook Pro ESC $ 4 & 7 6 8 9 QUESTIONS Consider two mutually exclusive projects And : VIR - 13.00 -3.00 32.60 200 5. 33.000 7. Calculate the IRR for both projects? Which project is best to choose it you can only choose one Project A Projects QUESTION 9 STRIP Securities wich are treasury bill derivatives that no longer have coupon payments, they only pay a par value at maturity, have a lower interest risk exposure than regular treasury bills which do have semi-annual coupon payments. O True False QUESTION 10 If resources are constrained, one should always accept the project with the highest profitability index first True Save Anwen Chord Sto.se and submit. Click Save All Answers to see all answers MacBook Pro ESC $ 4 & 7 6 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts