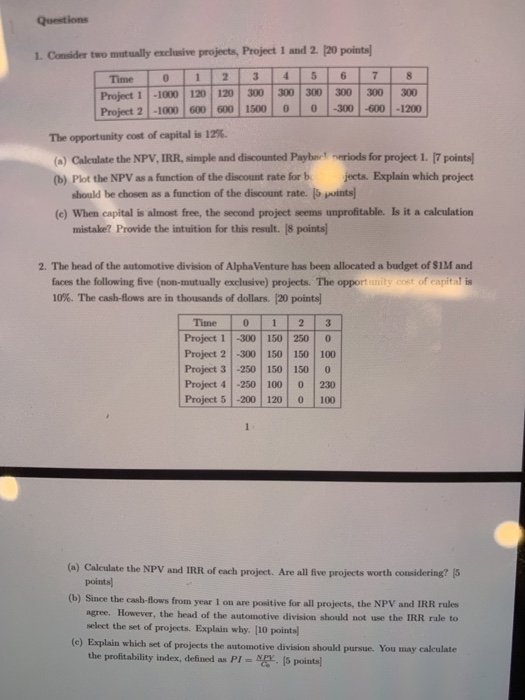

Question: Questions 1. Consider two mutually exclusive projects, Project 1 and 2. [20 points 7 8 4 5 2 Time Project 1-1000 120 120 Project 2

Questions 1. Consider two mutually exclusive projects, Project 1 and 2. [20 points 7 8 4 5 2 Time Project 1-1000 120 120 Project 2 -1000 600 600 1500 300 300 300 300 300 300 -300 -600-1200 The opportunity cost of capital is 12 % neriods for project 1. [7 points (a) Caleulate the NPV, IRR, simple and discounted Paybn (b) Plot the NPV as a function of the discount rate for b should be chosen as a function of the discount rate. [5 points (e) When capital is almost free, the second project seems unprofitable. Is it a caleulation mistake? Provide the intuition for this result. [8 points] jects. Explain which project 2. The head of the automotive division of AlphaVenture has been allocated a budget of $1M and faces the following five (non-mutually exclusive) projects. The opport unity cost of capital is 10 %. The cash-flows are in thousands of dollars. [20 points Time 1 3 Project 1 Project 2 -300 150 150 Project 3 -250 150 Project 4 -250 100 Project 5 -200 120 -300 150 250 0 100 0 150 0 230 0 100 1 (a) Caleulate the NPV and IRR of each project. Are all five projects worth considering? 5 points (b) Since the cash-flows from year 1 on are positive for all projects, the NPV and IRR rules agree. However, the head of the automotive division should not use the IRR rale to select the set of projects. Explain why. [10 points (e) Explain which set of projects the automotive division should pursue. You may calculate the profitability index, defined as PI N 5 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts