Question: Questions: Exercise: Calculating Net Present Value Web Technologies is deciding how best to use its limited capital and must choose between two different projects with

Questions:

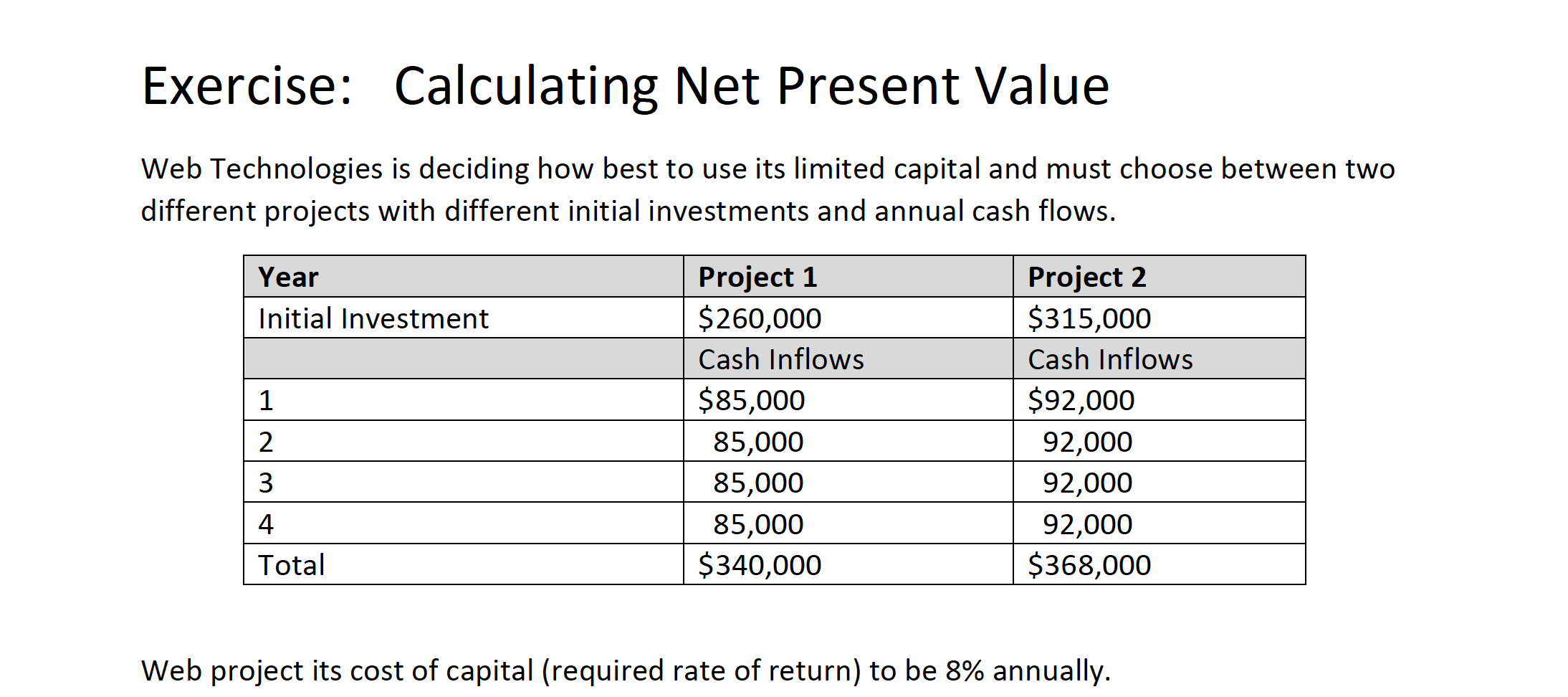

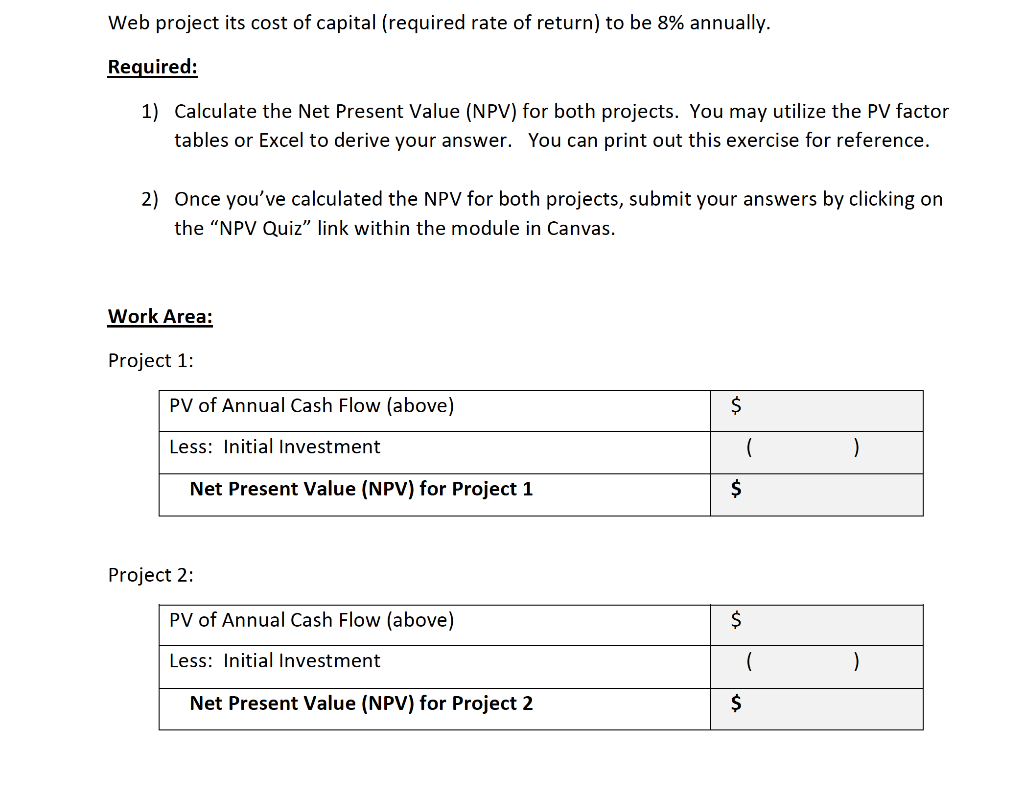

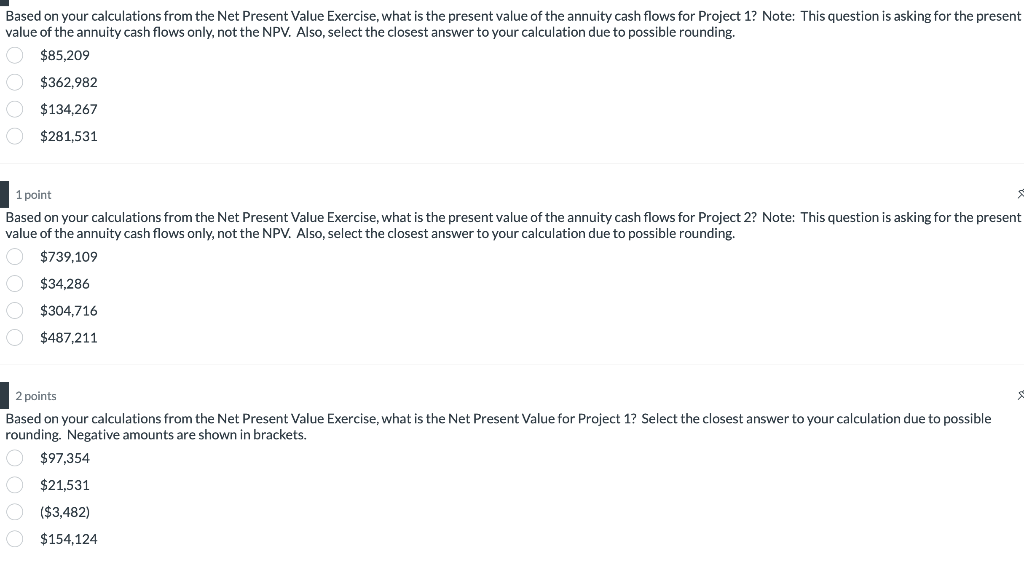

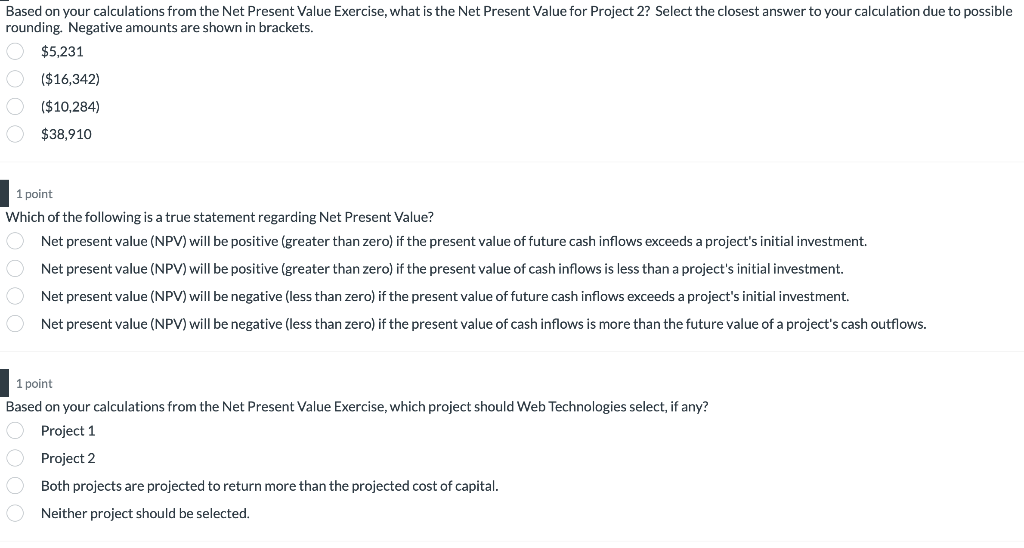

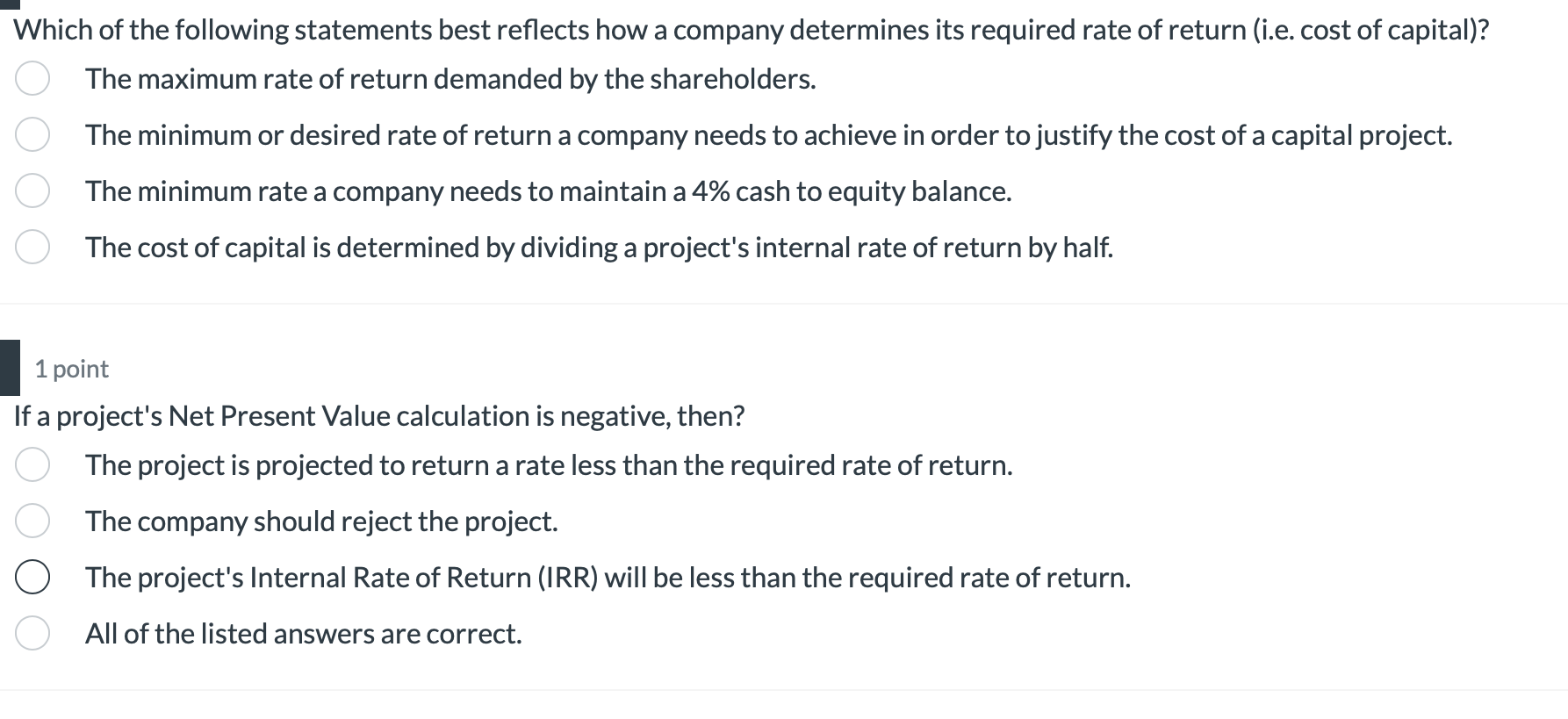

Exercise: Calculating Net Present Value Web Technologies is deciding how best to use its limited capital and must choose between two different projects with different initial investments and annual cash flows. Web project its cost of capital (required rate of return) to be 8% annually. Web project its cost of capital (required rate of return) to be 8% annually. Required: 1) Calculate the Net Present Value (NPV) for both projects. You may utilize the PV factor tables or Excel to derive your answer. You can print out this exercise for reference. 2) Once you've calculated the NPV for both projects, submit your answers by clicking on the "NPV Quiz" link within the module in Canvas. Work Area: Project 1: Project 2: Based on your calculations from the Net Present Value Exercise, what is the present value of the annuity cash flows for Project 1? Note: This question is asking for the present value of the annuity cash flows only, not the NPV. Also, select the closest answer to your calculation due to possible rounding. $85,209$362,982$134,267$281,531 1 point Based on your calculations from the Net Present Value Exercise, what is the present value of the annuity cash flows for Project 2? Note: This question is asking for the present value of the annuity cash flows only, not the NPV. Also, select the closest answer to your calculation due to possible rounding. $739,109$34,286$304,716$487,211 2 points Based on your calculations from the Net Present Value Exercise, what is the Net Present Value for Project 1? Select the closest answer to your calculation due to possible rounding. Negative amounts are shown in brackets. $97,354$21,531($3,482)$154,124 Based on your calculations from the Net Present Value Exercise, what is the Net Present Value for Project 2? Select the closest answer to your calculation due to possible rounding. Negative amounts are shown in brackets. $5,231($16,342)($10,284)$38,910 1 point Which of the following is a true statement regarding Net Present Value? Net present value (NPV) will be positive (greater than zero) if the present value of future cash inflows exceeds a project's initial investment. Net present value (NPV) will be positive (greater than zero) if the present value of cash inflows is less than a project's initial investment. Net present value (NPV) will be negative (less than zero) if the present value of future cash inflows exceeds a project's initial investment. Net present value (NPV) will be negative (less than zero) if the present value of cash inflows is more than the future value of a project's cash outflows. 1 point Based on your calculations from the Net Present Value Exercise, which project should Web Technologies select, if any? Project 1 Project 2 Both projects are projected to return more than the projected cost of capital. Neither project should be selected. Which of the following statements best reflects how a company determines its required rate of return (i.e. cost of capital)? The maximum rate of return demanded by the shareholders. The minimum or desired rate of return a company needs to achieve in order to justify the cost of a capital project. The minimum rate a company needs to maintain a 4% cash to equity balance. The cost of capital is determined by dividing a project's internal rate of return by half. 1 point If a project's Net Present Value calculation is negative, then? The project is projected to return a rate less than the required rate of return. The company should reject the project. The project's Internal Rate of Return (IRR) will be less than the required rate of return. All of the listed answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts