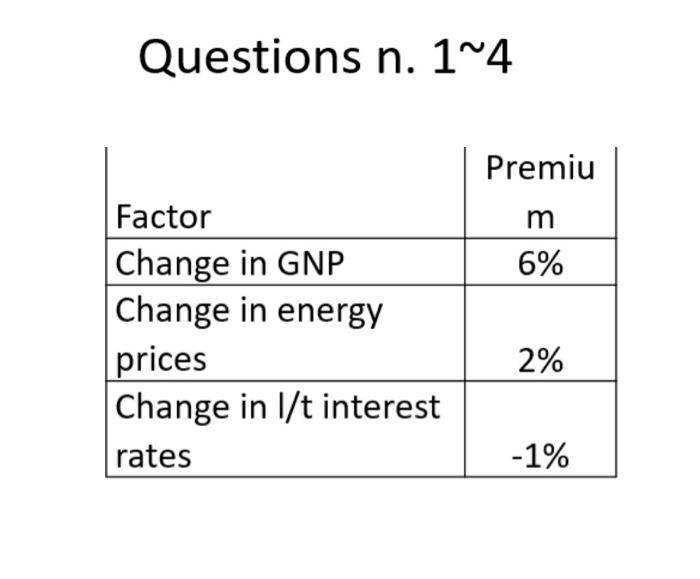

Question: Questions n. 1 4 1) Consider a three-factor APT model. The factors and associated premiums are defined in the foregoing table. The risk-free rate is

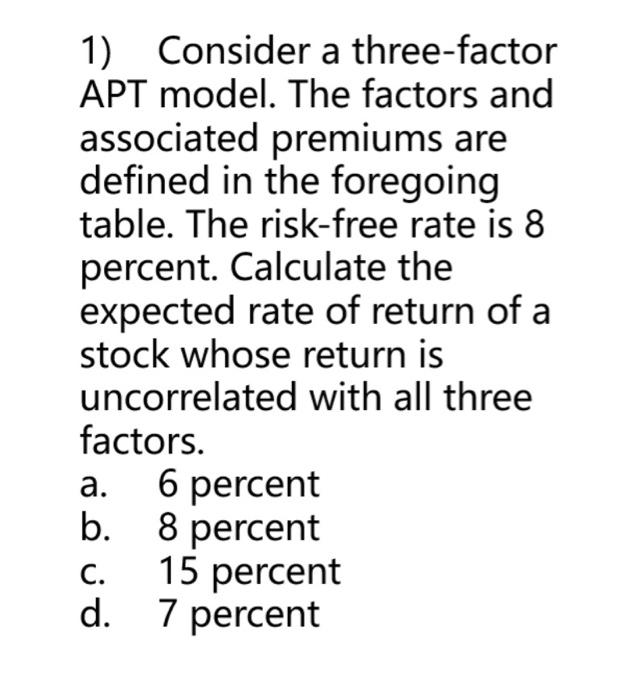

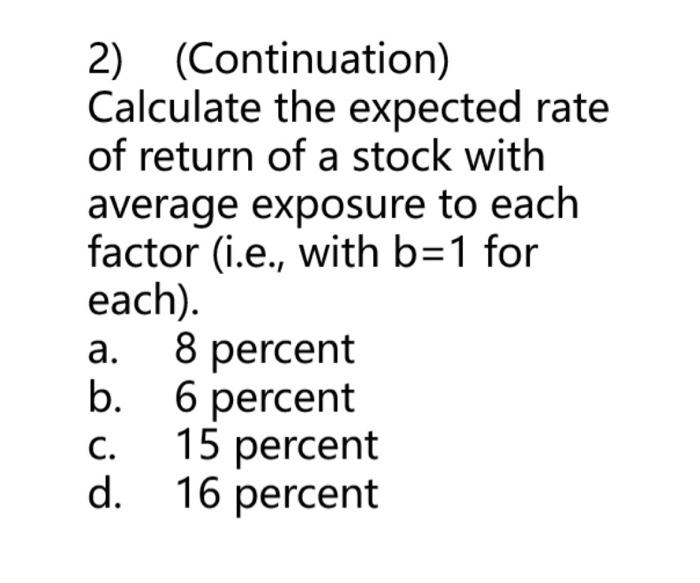

Questions n. 1 4 1) Consider a three-factor APT model. The factors and associated premiums are defined in the foregoing table. The risk-free rate is 8 percent. Calculate the expected rate of return of a stock whose return is uncorrelated with all three factors. a. 6 percent b. 8 percent c. 15 percent d. 7 percent 2) (Continuation) Calculate the expected rate of return of a stock with average exposure to each factor (i.e., with b=1 for each). a. 8 percent b. 6 percent c. 15 percent d. 16 percent 3) (Continuation) Calculate the expected rate of return of a pure-play energy stock with high exposure to the energy factor (b=2) but zero exposure to the other two factors. a. 12 percent b. 8 percent c. 6 percent d. 16 percent 4) (Continuation) Calculate the expected rate of return of an aluminum company stock with average sensitivity to changes in interest rates and GNP, but negative exposure of b=1.5 to the energy factor. a. 8 percent b. 6 percent c. 12 percent d. 10 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts