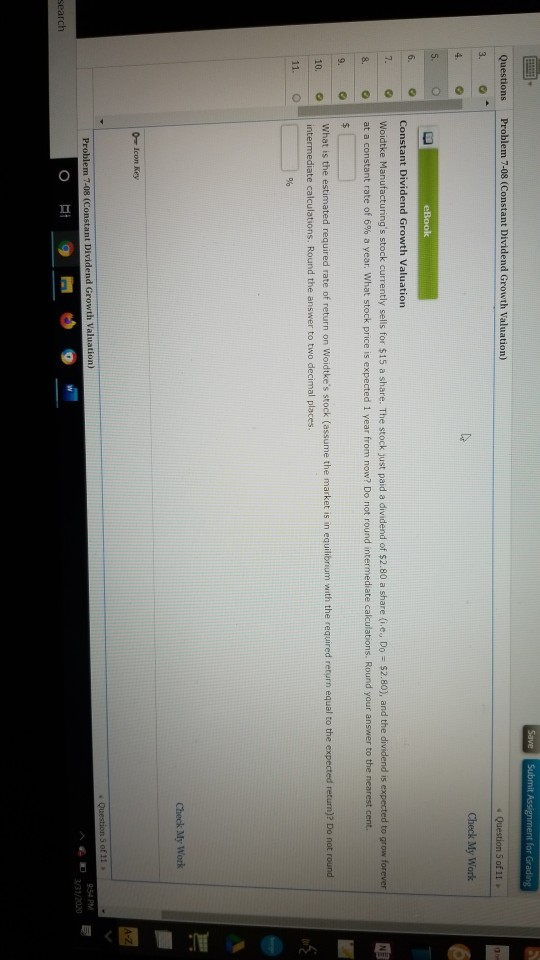

Question: Questions Problem 7-08 (Constant Dividend Growth Valuation) Save Submit Assignment for Grading Question 5 of 11 Check My Work eBook Constant Dividend Growth Valuation Woidtke

Questions Problem 7-08 (Constant Dividend Growth Valuation) Save Submit Assignment for Grading Question 5 of 11 Check My Work eBook Constant Dividend Growth Valuation Woidtke Manufacturing's stock currently sells for $15 a share. The stock just paid a dividend of $2.80 a share 1.e. Do = $2.80), and the dividend is expected to grow forever at a constant rate of 6% a year. What stock price is expected 1 year from now? Do not round intermediate calculations. Round your answer to the nearest cent. What is the estimated required rate of return on Woldtke's stock (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round the answer to two decimal places. Check y Work 0-Icon Key Problem 7-08 (Constant Dividend Growth Valuation) arch Questions of 11 954 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts