Question: Search this course ment: Chapter 8 Assignment Score: 73.07% s Problem 8-12 (Nonconstant Growth Stock Valuation) Save Submit Assignment for Grading Question 7 of 13

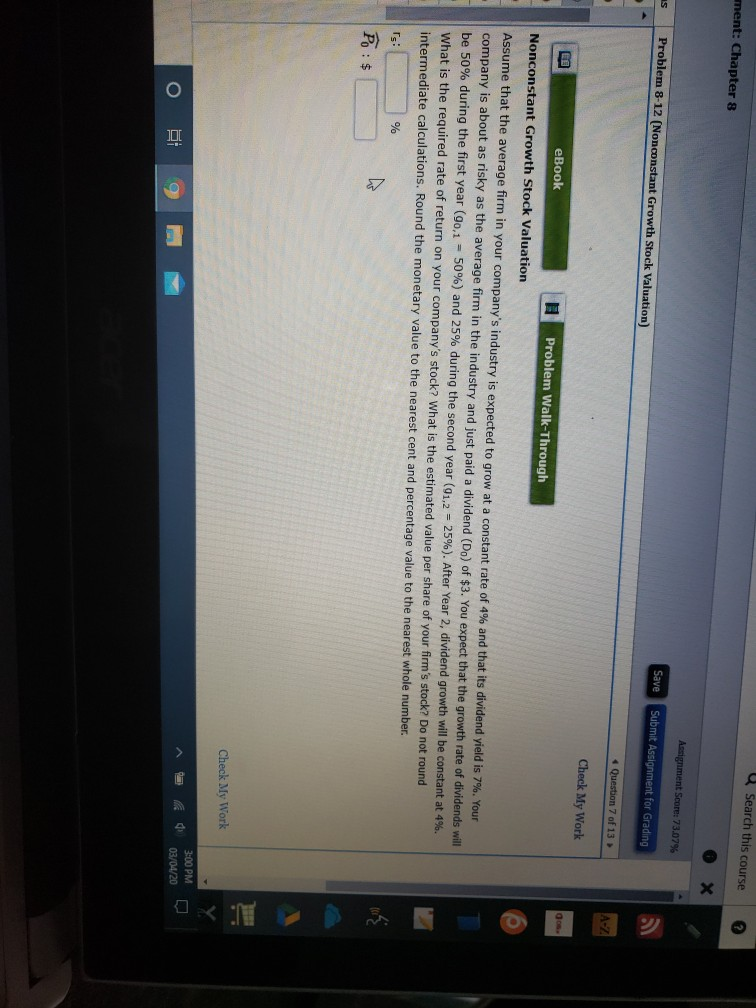

Search this course ment: Chapter 8 Assignment Score: 73.07% s Problem 8-12 (Nonconstant Growth Stock Valuation) Save Submit Assignment for Grading Question 7 of 13 Check My Work eBook Problem Walk-Through Nonconstant Growth Stock Valuation Assume that the average firm in your company's industry is expected to grow at a constant rate of 4% and that its dividend yield is 7%. Your company is about as risky as the average firm in the industry and just paid a dividend (Do) of $3. You expect that the growth rate of dividends will be 50% during the first year (90,1 - 50%) and 25% during the second year (01.2 = 25%). After Year 2, dividend growth will be constant at 4%. What is the required rate of return on your company's stock? What is the estimated value per share of your firm's stock? Do not round intermediate calculations. Round the monetary value to the nearest cent and percentage value to the nearest whole number. rs: % Po : $ Check My Work a la 3:00 PM o 9 03/04/20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts