Question: questions required a required b required c required d required e required f required g required h required I required j h. Prepare a pro

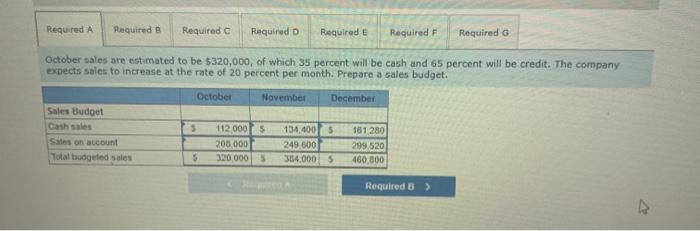

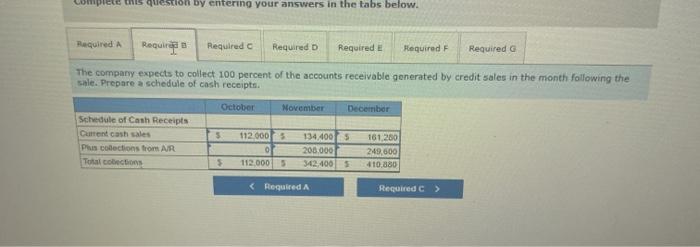

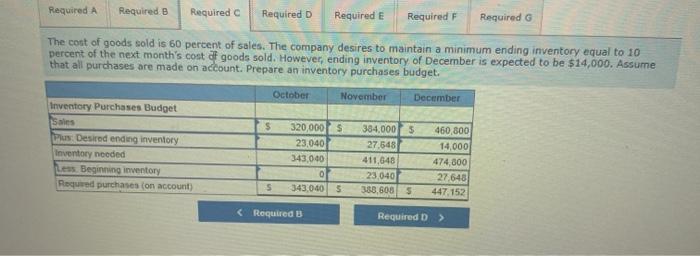

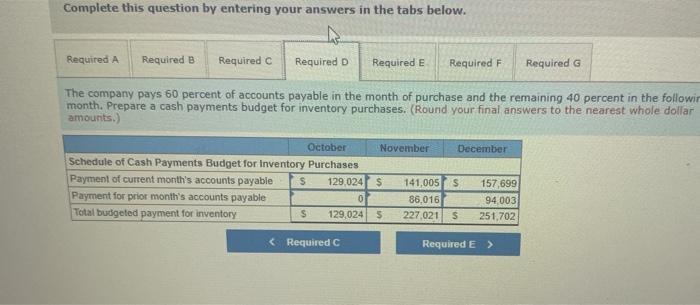

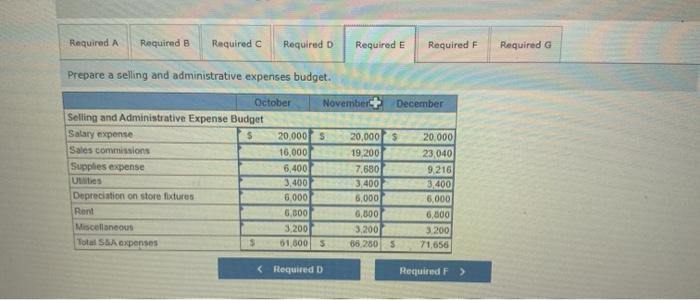

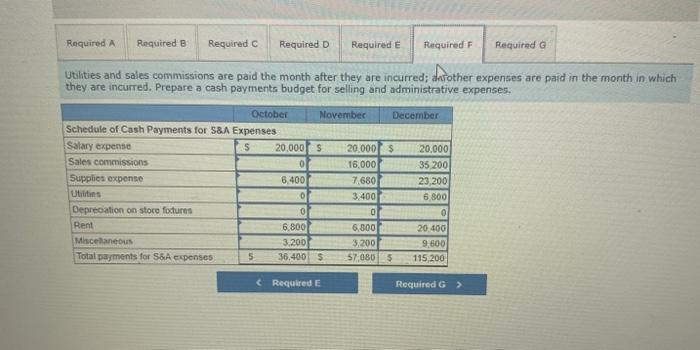

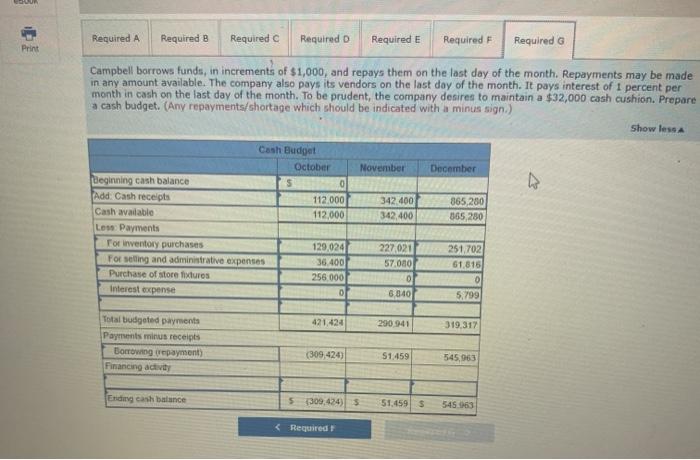

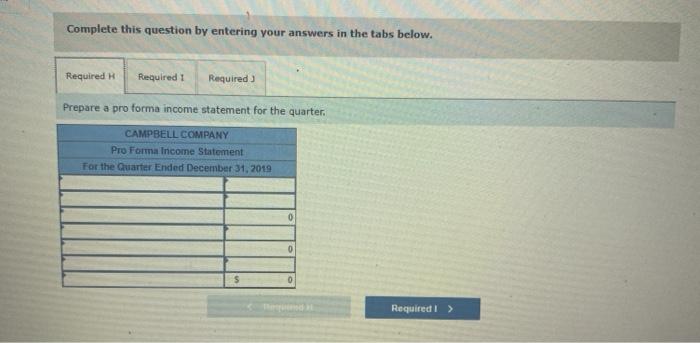

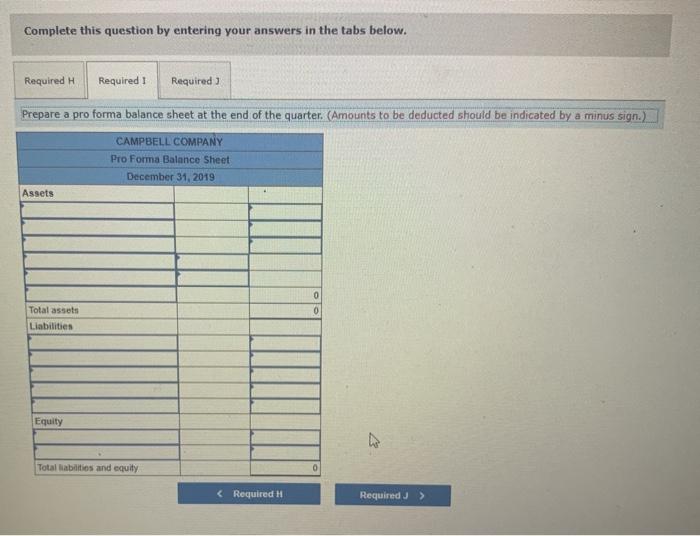

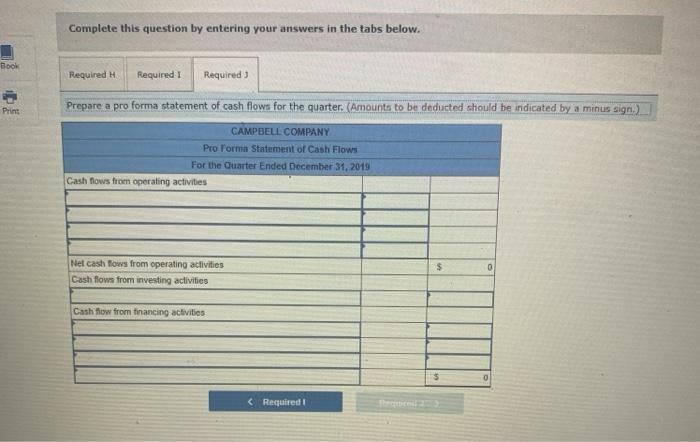

h. Prepare a pro forma Income statement for the quarter. 1. Prepare a pro forma balance sheet at the end of the quarter. J. Prepare a pro forma statement of cash flows for the quarter. Required A Required B Required c Required Required E Required Required G October sales are estimated to be $320,000, of which 35 percent will be cash and 65 percent will be credit. The company expects sales to increase at the rate of 20 percent per month. Prepare a sales budget. October November December Sales Budget $ $ Sales on account Total budgeted sales 112 0005 208,000 320,000 5 134.400 249.600 3:54.000 161,280 299.520 460,800 5 5 Required 3 > complete this question by entering your answers in the tabs below. Required A Requires Required Required D Required E Required Required The company expects to collect 100 percent of the accounts receivable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. October November December Schedule of Cash Receipts Current cash sales 112 000 134.400 161.280 Plus Collections from AR 0 200.000 249,600 Total cocos $ 112.000 5 342.400 5 410.880 Required A Required B Required Required D Required E Required F Required The cost of goods sold is 60 percent of sales. The company desires to maintain a minimum ending inventory equal to 10 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $14,000. Assume that all purchases are made on account. Prepare an inventory purchases budget. October November December $ Inventory Purchases Budget Sales Plus Desired ending inventory Inventory needed Less Beginning inventory Required purchases (on account) 320,000 $ 23.040 343040 0 343.0405 384,000 $ 27.548 411,648 23 040 388,6085 460,800 14,000 474,800 27.648 447.152 S Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required F Required G The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent in the followin month. Prepare a cash payments budget for inventory purchases. (Round your final answers to the nearest whole dollar amounts.) October November December Schedule of Cash Payments Budget for Inventory Purchases Payment of current month's accounts payable s 129,024 $ 141,005 s 157,699 Payment for prior month's accounts payable 0 86,016 94003 Total budgeted payment for inventory S 129,0245 227,021 S 251,702 Required A Required B Required c Required D Required E Required F Required G Prepare a selling and administrative expenses budget. October November December Selling and Administrative Expense Budget Salary expense $ 20.000 s 20,000 $ 20.000 Sales commissions 16,000 19 200 23040 Supplies expense 6,400 7,680 9.216 Us 3,400 3,400 3/400 Depreciation on store fixtures 6,000 6.000 6,000 Rent 6.000 6,000 6,800 Miscellaneous 3,200 3,200 3.200 Total S&A expenses 01.500 5 55.280 S 71,656 Required A Required B Required C Required D Required E Required Required G Utilities and sales commissions are paid the month after they are incurred; darother expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. October November December Schedule of Cash Payments for S&A Expenses Salary expense $ 20.000 s 20.000 $ 20,000 Sales commissions 16,000 35 200 Supplies expense 6.400 7.680 23.2001 Uits 0 3.400 6.800 Depreciation on store fodtures 0 0 Rent 6.800 6.800 20.400 Miscellaneous 3.200 3,200 9,600 Total payments for S&A expenses 5 36,400 $ 57 0805 115.200 Required E Required G> Required A Required B Required Required D Required E Required Required G Print Campbell borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $32,000 cash cushion. Prepare a cash budget. (Any repayments/shortage which should be indicated with a minus sign.) Show less November December Cash Budget October Beginning cash balance 0 Add: Cash receipts 112.000 Cash available 112,000 Low Payments For inwentary purchases 129,024 For selling and administrative expenses 36.400 Purchase of store fixtures 256.000 Interest expense 0 342.400 342,400 865,280 365 280 227,021 57.000 0 6340 251 702 61.816 0 5,799 421,424 290.941 319.317 Total budgeted payments Payments minus receipts Borrowing repayment) Financing activity (309,424) 51.459 545.963 Ending cash balance 5 (309.424) 5 51.459 $ 545 563 Complete this question by entering your answers in the tabs below. Required H Required 1 Required Prepare a pro forma balance sheet at the end of the quarter. (Amounts to be deducted should be indicated by a minus sign.) CAMPBELL COMPANY Pro Forma Balance Sheet December 31, 2019 Assets 0 0 Total assets Liabilities Equity Total abilities and equity Complete this question by entering your answers in the tabs below. Book Required H Required 1 Required) Prepare a pro forma statement of cash flows for the quarter. (Amounts to be deducted should be indicated by a minus sign) Print CAMPBELL COMPANY Pro Forma Statement of Cash Flows For the Quarter Ended December 31, 2019 Cash flows from operating activities $ Net cash flows from operating activities Cash flows from investing activities 0 Cash flow from financing activities $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts