Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions What characteristics distinguish nonprofits from for-profit organizations? What characteristics distinguish government organizations from nonprofits? Q13-1. Q13-2. What financial statements must be prepared by

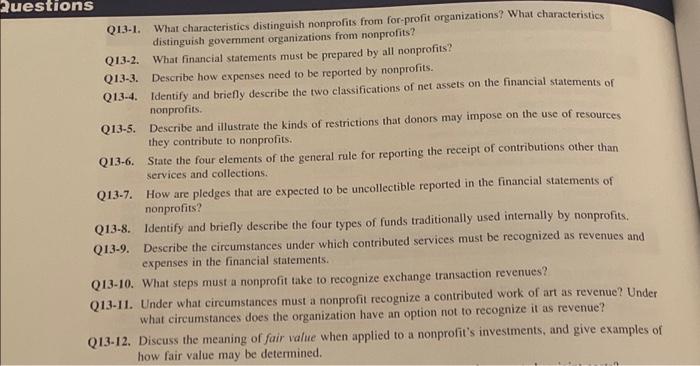

Questions What characteristics distinguish nonprofits from for-profit organizations? What characteristics distinguish government organizations from nonprofits? Q13-1. Q13-2. What financial statements must be prepared by all nonprofits? Q13-3. Describe how expenses need to be reported by nonprofits. Q13-4. Identify and briefly describe the two classifications of net assets on the financial statements of nonprofits. Q13-5. Describe and illustrate the kinds of restrictions that donors may impose on the use of resources they contribute to nonprofits. Q13-6. State the four elements of the general rule for reporting the receipt of contributions other than services and collections. Q13-7. How are pledges that are expected to be uncollectible reported in the financial statements of nonprofits? Q13-8. Identify and briefly describe the four types of funds traditionally used internally by nonprofits. Q13-9. Describe the circumstances under which contributed services must be recognized as revenues and expenses in the financial statements. Q13-10. What steps must a nonprofit take to recognize exchange transaction revenues? Q13-11. Under what circumstances must a nonprofit recognize a contributed work of art as revenue? Under what circumstances does the organization have an option not to recognize it as revenue? Q13-12. Discuss the meaning of fair value when applied to a nonprofit's investments, and give examples of how fair value may be determined.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The image youve provided appears to be a list of questions that pertain to financial accounting practices and reporting for nonprofit organizations Let me address each question step by step Q131 Nonpr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started