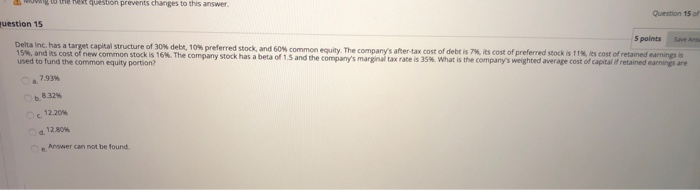

Question: questo prevents changes to the answer Question 15 uestion 15 Spoints Saver Delta Inc. has a target capital structure of 30% debt, 10% preferred stock,

questo prevents changes to the answer Question 15 uestion 15 Spoints Saver Delta Inc. has a target capital structure of 30% debt, 10% preferred stock, and 60% common equity. The company's after-tax cost of debt is cost of preferred stockis 11 cost of retained earning is 15%, and its cost of new common stock is 16. The company stock has a bea of 15 and the company's magnarate is 35What is the company's weighted average cost of capital retained earnings are used to fund the common equity portion? Oc 12.200 Answer can not be found

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts