Question: Quickly QUESTION ONE Background A construction company is planning ahead and will undertake one of four strategies dependent on the economic outlook. The data in

Quickly

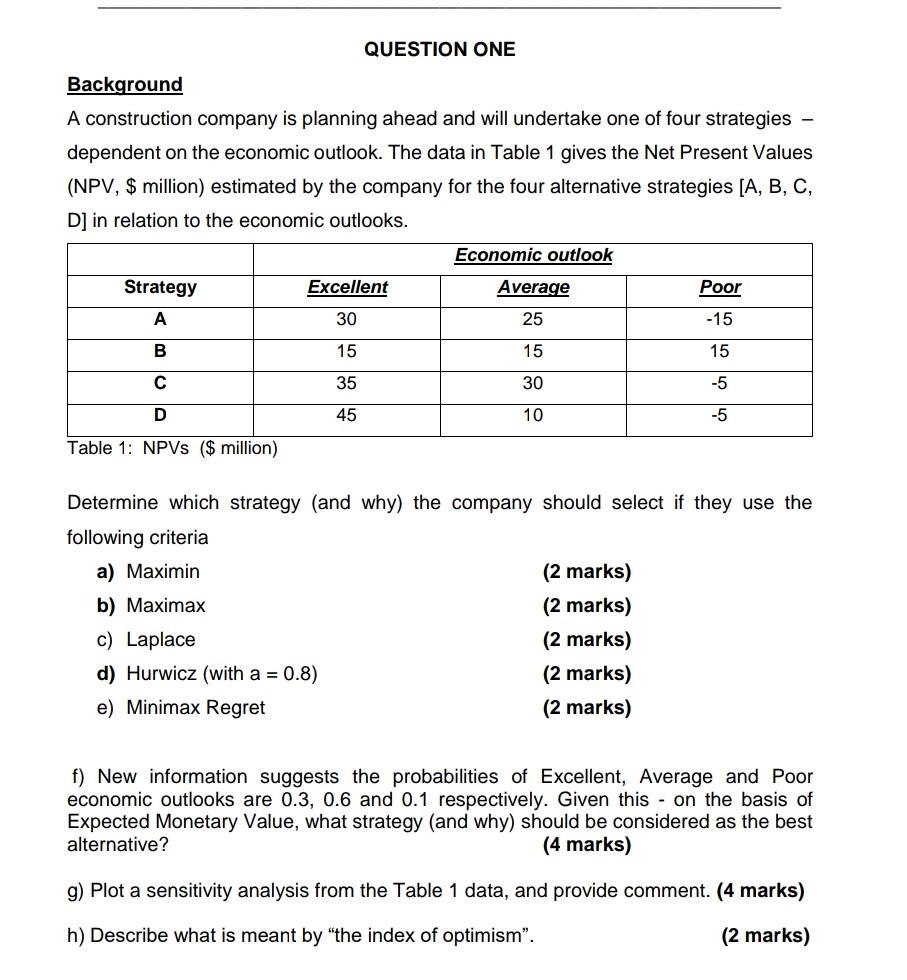

QUESTION ONE Background A construction company is planning ahead and will undertake one of four strategies dependent on the economic outlook. The data in Table 1 gives the Net Present Values (NPV, $ million) estimated by the company for the four alternative strategies (A, B, C, D] in relation to the economic outlooks. Economic outlook Strategy Average Poor Excellent 30 A 25 -15 B 15 15 15 C 35 30 -5 D 45 10 -5 Table 1: NPVs ($ million) Determine which strategy (and why) the company should select if they use the following criteria a) Maximin (2 marks) b) Maximax (2 marks) c) Laplace (2 marks) d) Hurwicz (with a = 0.8) (2 marks) e) Minimax Regret (2 marks) f) New information suggests the probabilities of Excellent, Average and Poor economic outlooks are 0.3, 0.6 and 0.1 respectively. Given this - on the basis of Expected Monetary Value, what strategy (and why) should be considered as the best alternative? (4 marks) g) Plot a sensitivity analysis from the Table 1 data, and provide comment. (4 marks) h) Describe what is meant by the index of optimism". (2 marks) QUESTION ONE Background A construction company is planning ahead and will undertake one of four strategies dependent on the economic outlook. The data in Table 1 gives the Net Present Values (NPV, $ million) estimated by the company for the four alternative strategies (A, B, C, D] in relation to the economic outlooks. Economic outlook Strategy Average Poor Excellent 30 A 25 -15 B 15 15 15 C 35 30 -5 D 45 10 -5 Table 1: NPVs ($ million) Determine which strategy (and why) the company should select if they use the following criteria a) Maximin (2 marks) b) Maximax (2 marks) c) Laplace (2 marks) d) Hurwicz (with a = 0.8) (2 marks) e) Minimax Regret (2 marks) f) New information suggests the probabilities of Excellent, Average and Poor economic outlooks are 0.3, 0.6 and 0.1 respectively. Given this - on the basis of Expected Monetary Value, what strategy (and why) should be considered as the best alternative? (4 marks) g) Plot a sensitivity analysis from the Table 1 data, and provide comment. (4 marks) h) Describe what is meant by the index of optimism". (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts