Question: R e quir e d a. Prepare a schedule to show the balance in the Fair Value Adjustment at December 31, 2020 (after the adjusting

Required

a. Prepare a schedule to show the balance in the Fair Value Adjustment at December 31, 2020 (after the adjusting entry for 2020 is made).

b. Prepare a schedule which shows the aggregate cost and fair values for Jkerk's trading investments portfolio at 12/3112021.

c. Prepare the necessary adjusting entry based upon your analysis in b above.

d. Explain what is derivative and why speculators and arbitrageurs use derivatives.

e. Explain how derivatives can be adopted for hedging purposes and provide examples.

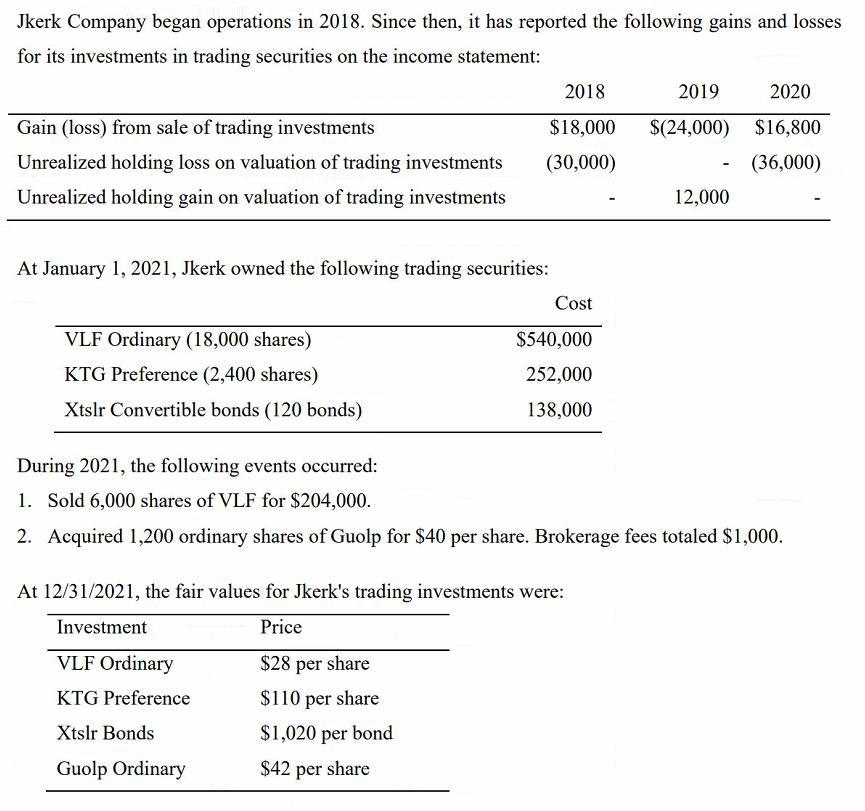

Jkerk Company began operations in 2018. Since then, it has reported the following gains and losses for its investments in trading securities on the income statement: 2018 2019 2020 Gain (loss) from sale of trading investments $18,000 $(24,000) $16,800 Unrealized holding loss on valuation of trading investments (30,000) (36,000) Unrealized holding gain on valuation of trading investments 12,000 At January 1, 2021, Jkerk owned the following trading securities: Cost VLF Ordinary (18,000 shares) KTG Preference (2,400 shares) Xtslr Convertible bonds (120 bonds) $540,000 252,000 138,000 During 2021, the following events occurred: 1. Sold 6,000 shares of VLF for $204,000. 2. Acquired 1,200 ordinary shares of Guolp for $40 per share. Brokerage fees totaled $1,000. At 12/31/2021, the fair values for Jkerk's trading investments were: Investment Price VLF Ordinary $28 per share KTG Preference $110 per share Xtslr Bonds $1,020 per bond Guolp Ordinary $42 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts