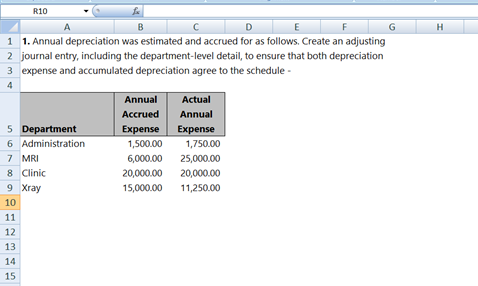

Question: R10 A B C D E F G H 1 1. Annual depreciation was estimated and accrued for as follows, Create an adjusting 2 journal

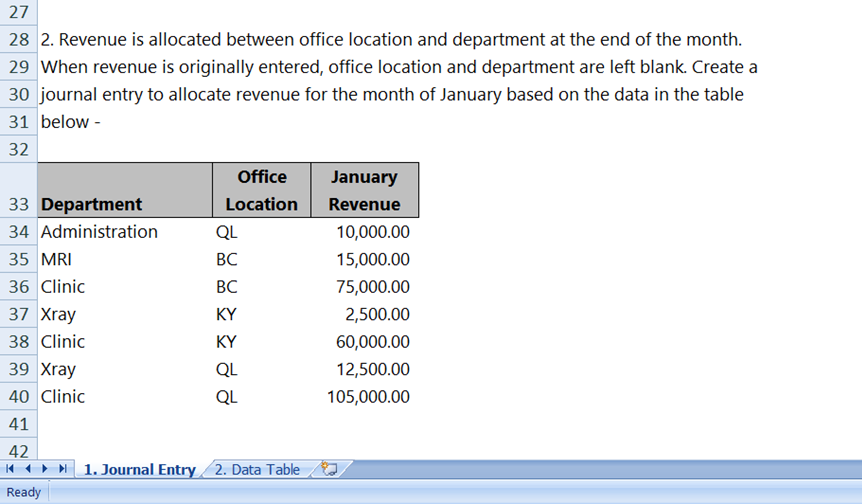

R10 A B C D E F G H 1 1. Annual depreciation was estimated and accrued for as follows, Create an adjusting 2 journal entry, including the department-level detail, to ensure that both depreciation 3 expense and accumulated depreciation agree to the schedule - Annual Actual Accrued Annual 5 Department Expense Expense 6 Administration 1,500.00 1,750.00 7 MRI 6,000.00 25,000.00 8 Clinic 20,000.00 20,000.00 9 Xray 15,000.00 11,250.00 10 11 12 13 14 1527 28 2. Revenue is allocated between office location and department at the end of the month. 29 When revenue is originally entered, office location and department are left blank. Create a 30 journal entry to allocate revenue for the month of January based on the data in the table 31 below - 32 Office January 33 Department Location Revenue 34 Administration QL 10,000.00 35 MRI BC 15,000.00 36 Clinic BC 75,000.00 37 Xray KY 2,500.00 38 Clinic 60,000.00 39 Xray 12,500.00 40 Clinic 105,000.00 41 42 1. Journal Entry 2. Data Table Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts