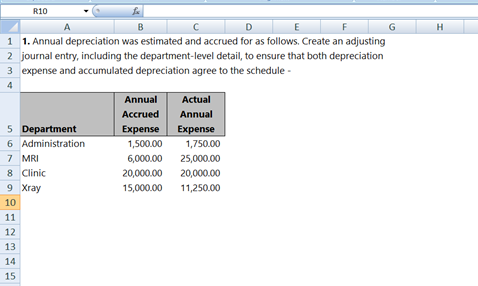

Question: R10 A B C D E F G H 1 1. Annual depreciation was estimated and accrued for as follows, Create an adjusting 2 journal

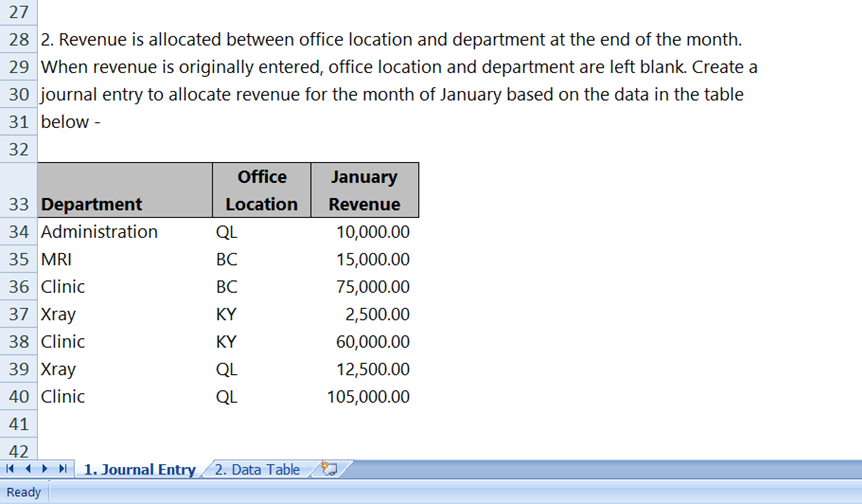

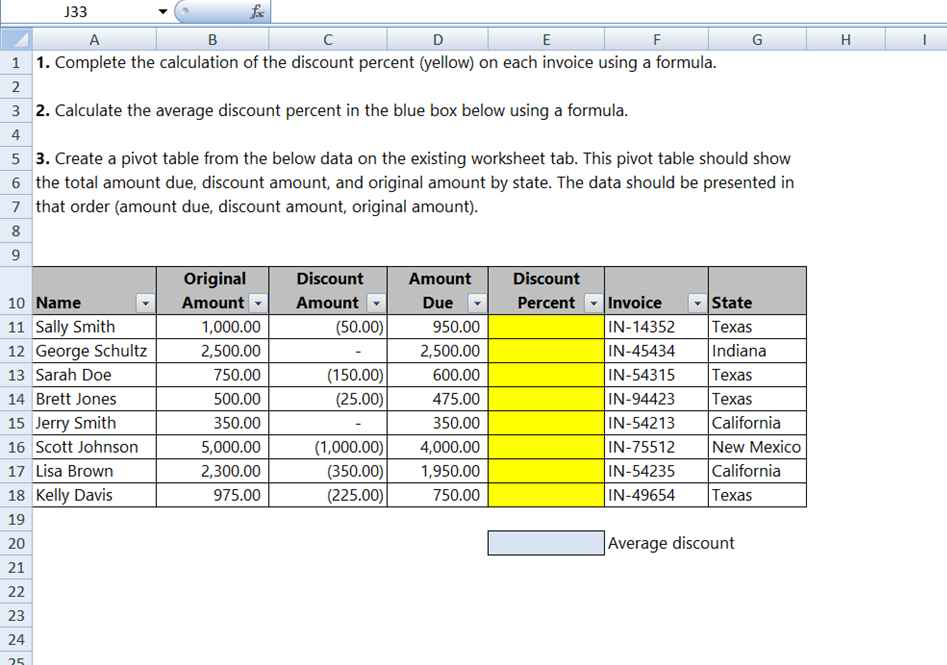

R10 A B C D E F G H 1 1. Annual depreciation was estimated and accrued for as follows, Create an adjusting 2 journal entry, including the department-level detail, to ensure that both depreciation 3 expense and accumulated depreciation agree to the schedule - Annual Actual Accrued Annual 5 Department Expense Expense 6 Administration 1,500.00 1,750.00 7 MRI 6,000.00 25,000.00 8 Clinic 20,000.00 20,000.00 9 Xray 15,000.00 11,250.00 10 11 12 13 14 1527 28 2. Revenue is allocated between office location and department at the end of the month. 29 When revenue is originally entered, office location and department are left blank. Create a 30 journal entry to allocate revenue for the month of January based on the data in the table 31 below - 32 Office January 33 Department Location Revenue 34 Administration QL 10,000.00 35 MRI BC 15,000.00 36 Clinic BC 75,000.00 37 Xray KY 2,500.00 38 Clinic 60,000.00 39 Xray 12,500.00 40 Clinic 105,000.00 41 42 1. Journal Entry 2. Data Table ReadyJ33 A B C D E F G H 1 1. Complete the calculation of the discount percent (yellow) on each invoice using a formula. 2 3 2. Calculate the average discount percent in the blue box below using a formula. 4 5 3. Create a pivot table from the below data on the existing worksheet tab. This pivot table should show 6 the total amount due, discount amount, and original amount by state. The data should be presented in 7 that order (amount due, discount amount, original amount). 8 g Original Discount Amount Discount 10 Name Amount Amount Due Percent . Invoice State 11 Sally Smith 1,000.00 (50.00) 950.00 IN-14352 Texas 12 George Schultz 2,500.00 2,500.00 IN-45434 Indiana 13 Sarah Doe 750.00 (150.00) 600.00 IN-54315 Texas 14 Brett Jones 500.00 (25.00) 475.00 IN-94423 Texas 15 Jerry Smith 350.00 350.00 IN-54213 California 16 Scott Johnson 5,000.00 (1,000.00) 4,000.00 IN-75512 New Mexico 17 Lisa Brown 2,300.00 (350.00) 1,950.00 IN-54235 California 18 Kelly Davis 975.00 (225.00) 750.00 IN-49654 Texas 19 20 Average discount 21 22 23 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts