Question: Ramirez Company has the following data for the weekly payroll ending January 31. Ramirez Company has the following data for the weekly payroll ending January

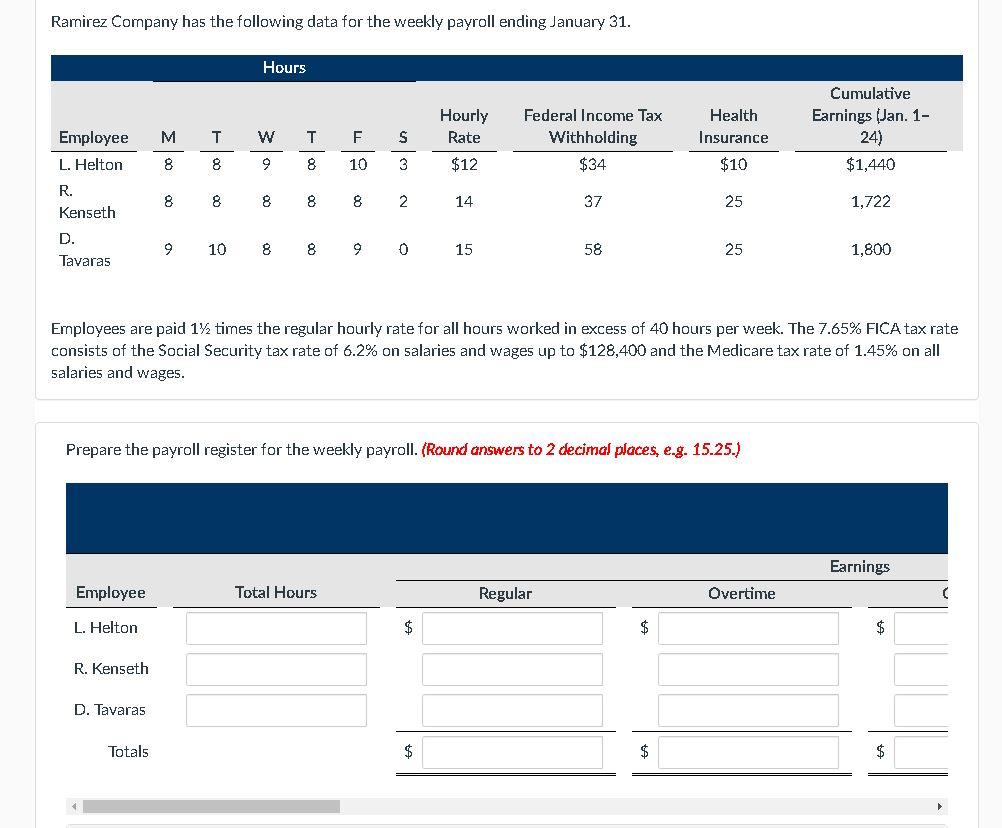

Ramirez Company has the following data for the weekly payroll ending January 31.

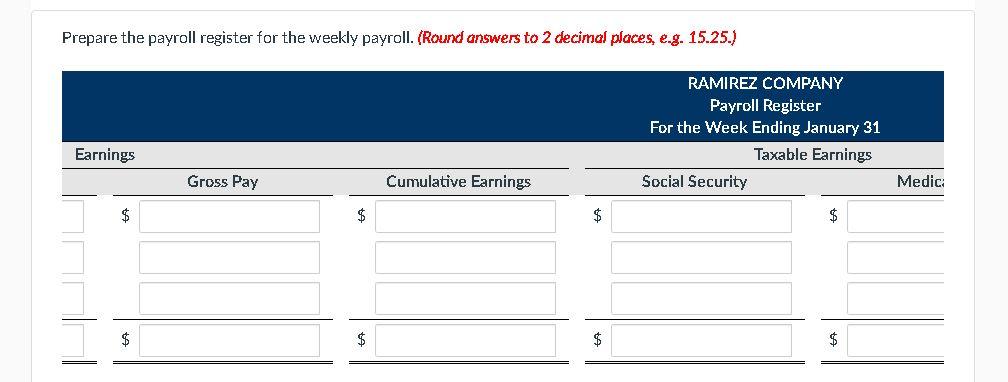

Ramirez Company has the following data for the weekly payroll ending January 31. Hours Cumulative Hourly Earnings (Jan. 1- 24) Federal Income Tax Health Employee M F. Rate Withholding Insurance L. Helton 8 8 10 3 $12 $34 $10 $1,440 R. 8 8 8 8 2 14 37 25 1,722 Kenseth D. 10 8 9 15 58 25 1,800 Tavaras Employees are paid 1% times the regular hourly rate for all hours worked in excess of 40 hours per week. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages. Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) Earnings Employee Total Hours Regular Overtime L. Helton $ $ R. Kenseth D. Tavaras Totals $ $ 2$

Step by Step Solution

3.62 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts