Question: Ramirez Company is completing the information processing cycle at its fiscal year-end, December 31, 2015. Following are the correct balances at December 31, 2015, for

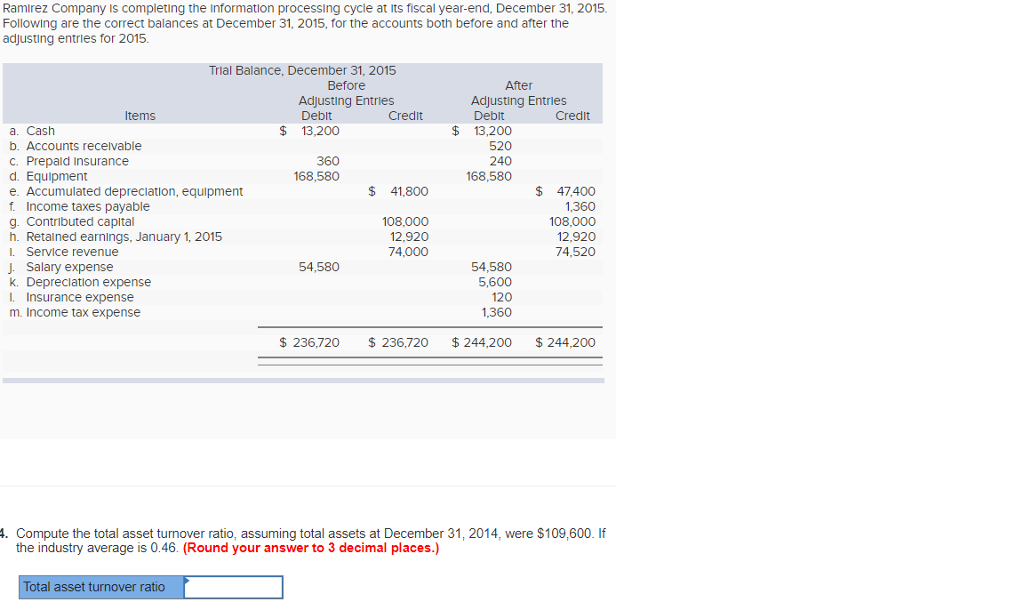

| Ramirez Company is completing the information processing cycle at its fiscal year-end, December 31, 2015. Following are the correct balances at December 31, 2015, for the accounts both before and after the adjusting entries for 2015.

|

Ramirez Company is completing the Information processing cycle at its fiscal year-end, December 31, 2015. Following are the correct balances at December 31, 2015, for the accounts both before and after the adjusting entries for 2015 Trial Balance, December 31. 2015 Before After Adjusting Entries Deblt Adjusting Entries Debit ltems Credit Credit a. Cash b. Accounts recelvable C. Prepald Insurance d. Equipment e. Accumulated depreciation, equipment f. Income taxes payable g. Contributed capital h. Retained earnings, January 1, 2015 l. Service revenue J. Salary expense k. Depreciation expense I. Insurance expense m. Income tax expense $ 13,200 $13,200 520 240 168,580 360 168,580 $ 41.800 08,000 12,920 74,000 $ 47400 1,360 08,000 12,920 74,520 54,580 54,580 5,600 120 1.360 $ 236,720 236,720 $244,200 244,200 4. Compute the total asset turnover ratio, assuming total assets at December 31, 2014, were $109,600. If the industry average is 0.46. (Round your answer to 3 decimal places.) Total asset turnover ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts