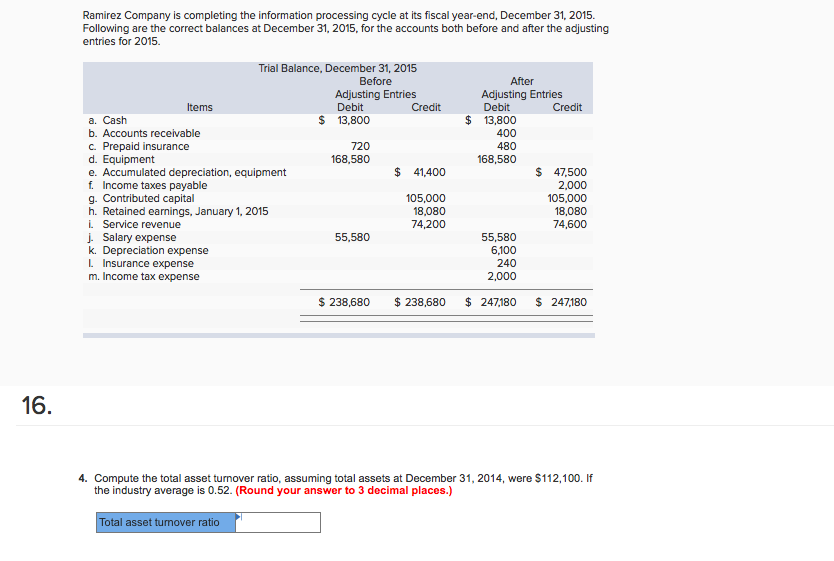

Question: Ramirez Company is completing the information processing cycle at its fiscal year-end, December 31, 2015 Following are the correct balances at December 31, 2015, for

Ramirez Company is completing the information processing cycle at its fiscal year-end, December 31, 2015 Following are the correct balances at December 31, 2015, for the accounts both before and after the adjusting entries for 2015. Trial Balance, December 31, 2015 Before After Adjusting Entries Adjusting Entries Debit Items $ 13,800 $ 13,800 a. Cash b. Accounts receivable c. Prepaid insurance d. Equipment e. Accumulated depreciation, equipment f. Income taxes payable g. Contributed capital h. Retained earnings, January 1, 2 i Service revenue j. Salary expense k. Depreciation expense L Insurance expense m. Income tax expense 720 168,580 480 168,580 $ 47,500 2,000 05,000 18,080 74,600 $41,400 105,000 18,080 74,200 015 55,580 55,580 2,000 $ 238,680 $238,680 $ 247180 247180 16 4. Compute the total asset turnover ratio, assuming total assets at December 31, 2014, were $112,100. If the industry average is 0.52. (Round your answer to 3 decimal places.) otal asset turnover ratio 5. Record the closing entry at December 31, 2015. (If no entry is required for a transaction/event, select No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record closing entry to transfer revenues and expenses to income summary. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts