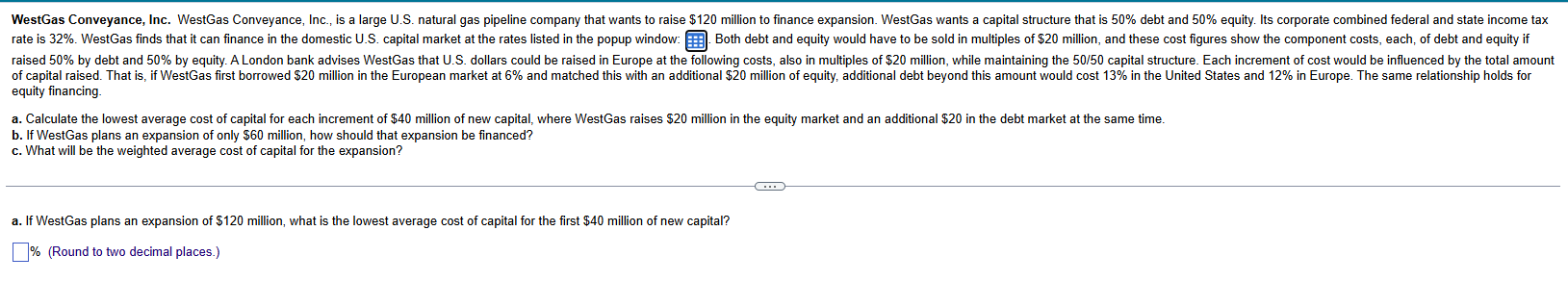

Question: rate is ( 3 2 % ) . WestGas finds that it can finance in the domestic U . S . capital

rate is WestGas finds that it can finance in the domestic US capital market at the rates listed in the popup window: Both debt and equity would have to be sold in multiples of $ million, and these cost figures show the component costs, each, of debt and equity if equity financing.

a Calculate the lowest average cost of capital for each increment of $ million of new capital, where WestGas raises $ million in the equity market and an additional $ in the debt market at the same time.

b If WestGas plans an expansion of only $ million, how should that expansion be financed?

c What will be the weighted average cost of capital for the expansion?

a If WestGas plans an expansion of $ million, what is the lowest average cost of capital for the first $ million of new capital?

Round to two decimal places.Click on the following icon in order to copy its contents into a spreadsheet.

begintabularlllll

hline Costs of Raising Capital in the Market & Cost of Domestic Equity & Cost of Domestic Debt & Cost of European Equity & Cost of European Debt

hline Up to $ million of new capital & & & &

hline $ million to $ million of new capital & & & &

hline Above $ million & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock