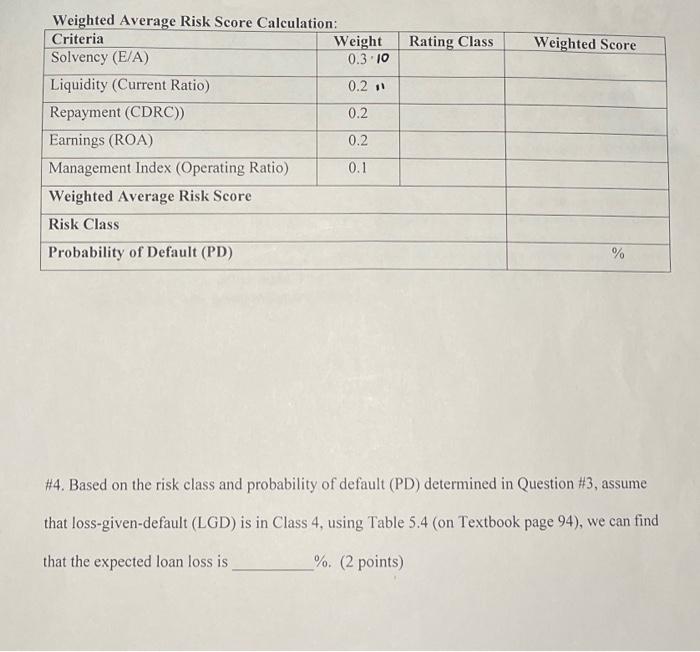

Question: Rating Class Weighted Score Weighted Average Risk Score Calculation: Criteria Weight Solvency (E/A) 0.3.10 Liquidity (Current Ratio) 0.2 11 Repayment (CDRC)) 0.2 Earnings (ROA) 0.2

Rating Class Weighted Score Weighted Average Risk Score Calculation: Criteria Weight Solvency (E/A) 0.3.10 Liquidity (Current Ratio) 0.2 11 Repayment (CDRC)) 0.2 Earnings (ROA) 0.2 Management Index (Operating Ratio) 0.1 Weighted Average Risk Score Risk Class Probability of Default (PD) % #4. Based on the risk class and probability of default (PD) determined in Question #3, assume that loss-given-default (LGD) is in Class 4, using Table 5.4 (on Textbook page 94), we can find that the expected loan loss is %. (2 points) Rating Class Weighted Score Weighted Average Risk Score Calculation: Criteria Weight Solvency (E/A) 0.3.10 Liquidity (Current Ratio) 0.2 11 Repayment (CDRC)) 0.2 Earnings (ROA) 0.2 Management Index (Operating Ratio) 0.1 Weighted Average Risk Score Risk Class Probability of Default (PD) % #4. Based on the risk class and probability of default (PD) determined in Question #3, assume that loss-given-default (LGD) is in Class 4, using Table 5.4 (on Textbook page 94), we can find that the expected loan loss is %. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts