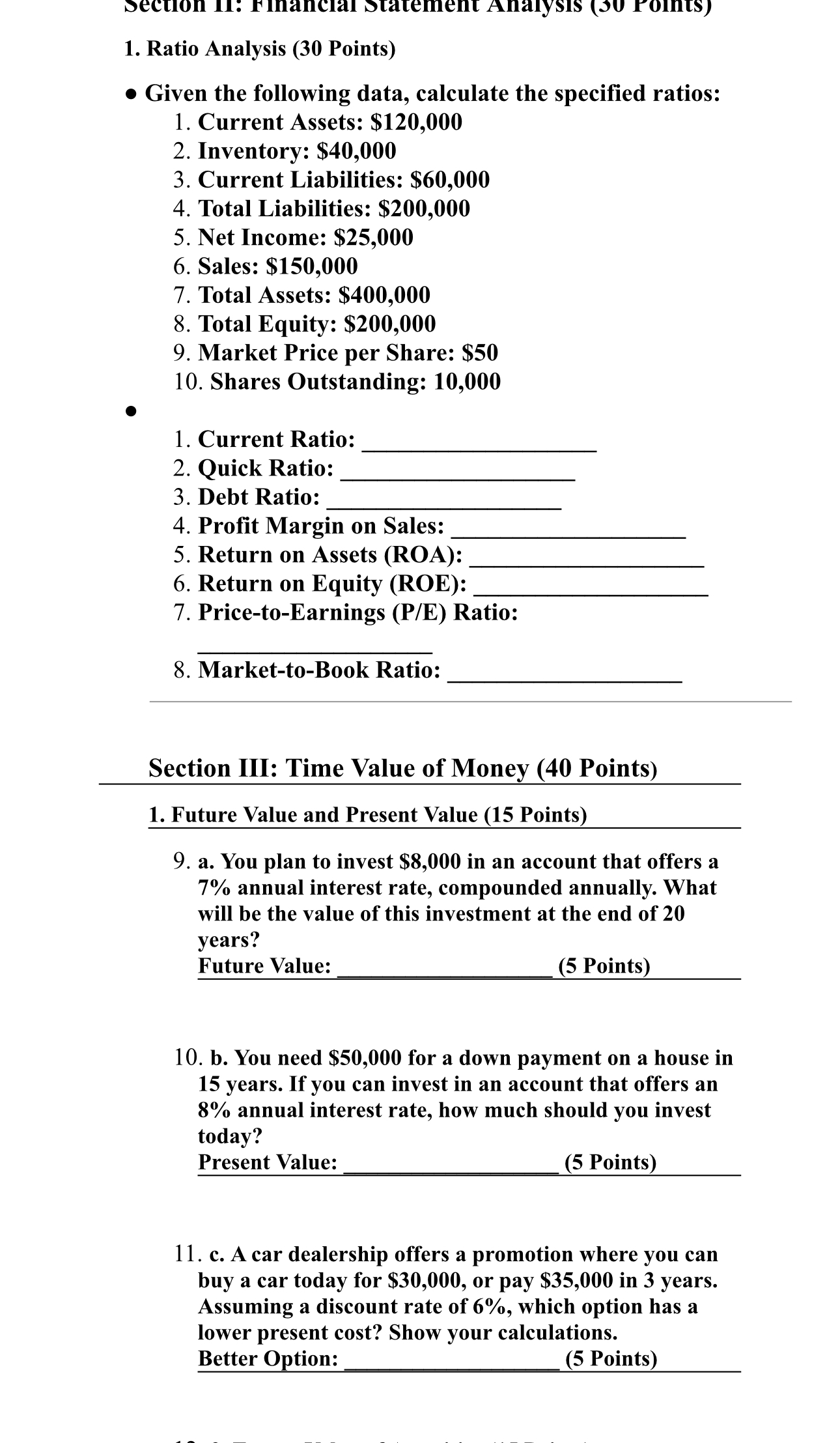

Question: Ratio Analysis ( 3 0 Points ) Given the following data, calculate the specified ratios: Current Assets: $ 1 2 0 , 0 0 0

Ratio Analysis Points

Given the following data, calculate the specified ratios:

Current Assets: $

Inventory: $

Current Liabilities: $

Total Liabilities: $

Net Income: $

Sales: $

Total Assets: $

Total Equity: $

Market Price per Share:

Shares Outstanding:

Current Ratio:

Quick Ratio:

Debt Ratio:

Profit Margin on Sales:

Return on Assets ROA:

Return on Equity ROE:

PricetoEarnings PE Kautu:

MarkettoBook Ratio:

Section III: Time Value of Money Points

Future Value and Present Value Points

a You plan to invest $ in an account that offers a

annual interest rate, compounded annually. What

will be the value of this investment at the end of

years?

Future Value:

Points

b You need $ for a down payment on a house in

years. If you can invest in an account that offers an

annual interest rate, how much should you invest

today?

Present Value:

Points

c A car dealership offers a promotion where you can

buy a car today for $ or pay $ in years.

Assuming a discount rate of which option has a

lower present cost? Show your calculations.

Better Option:

Points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock