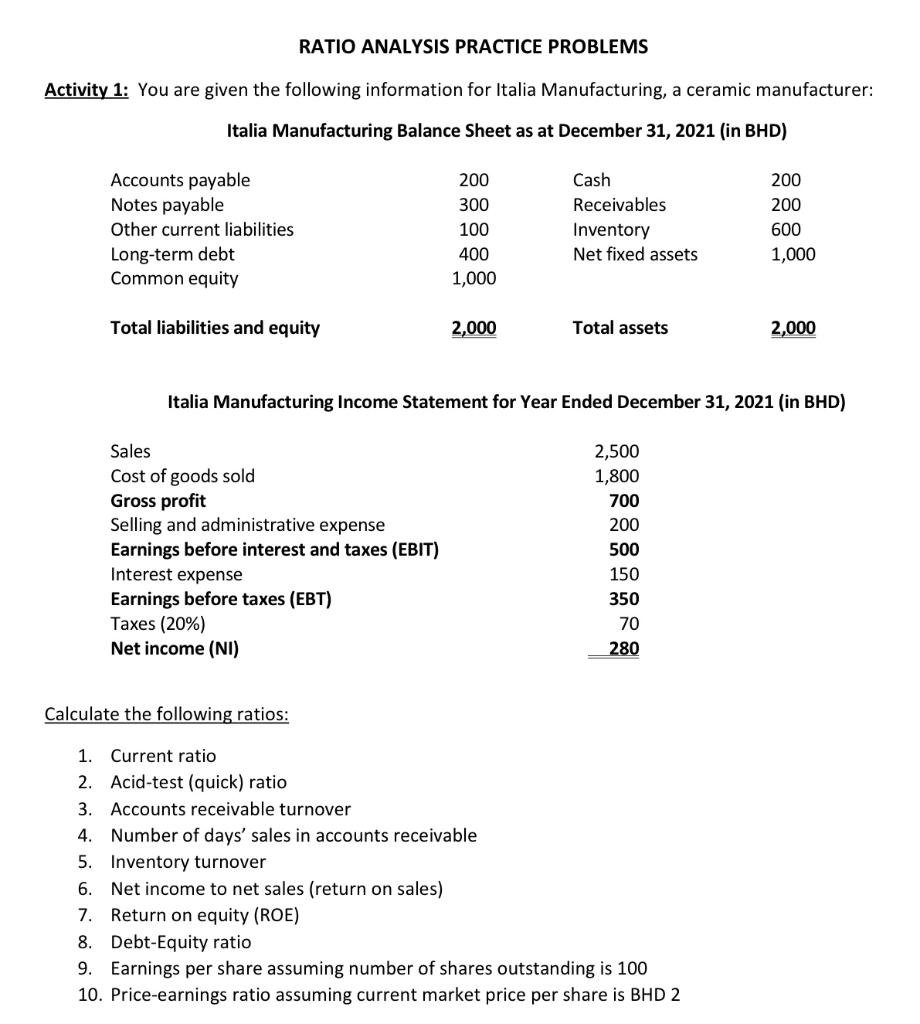

Question: RATIO ANALYSIS PRACTICE PROBLEMS Activity 1: You are given the following information for Italia Manufacturing, a ceramic manufacturer: Italia Manufacturing Balance Sheet as at December

RATIO ANALYSIS PRACTICE PROBLEMS Activity 1: You are given the following information for Italia Manufacturing, a ceramic manufacturer: Italia Manufacturing Balance Sheet as at December 31, 2021 (in BHD) Accounts payable Notes payable Other current liabilities Long-term debt Common equity 200 300 100 400 1,000 Cash Receivables Inventory Net fixed assets 200 200 600 1,000 Total liabilities and equity 2,000 Total assets 2,000 Italia Manufacturing Income Statement for Year Ended December 31, 2021 (in BHD) Sales Cost of goods sold Gross profit Selling and administrative expense Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (20%) Net income (NI) 2,500 1,800 700 200 500 150 350 70 280 Calculate the following ratios: 1. Current ratio 2. Acid-test (quick) ratio 3. Accounts receivable turnover 4. Number of days' sales in accounts receivable 5. Inventory turnover 6. Net income to net sales (return on sales) 7. Return on equity (ROE) 8. Debt-Equity ratio 9. Earnings per share assuming number of shares outstanding is 100 10. Price-earnings ratio assuming current market price per share is BHD 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts