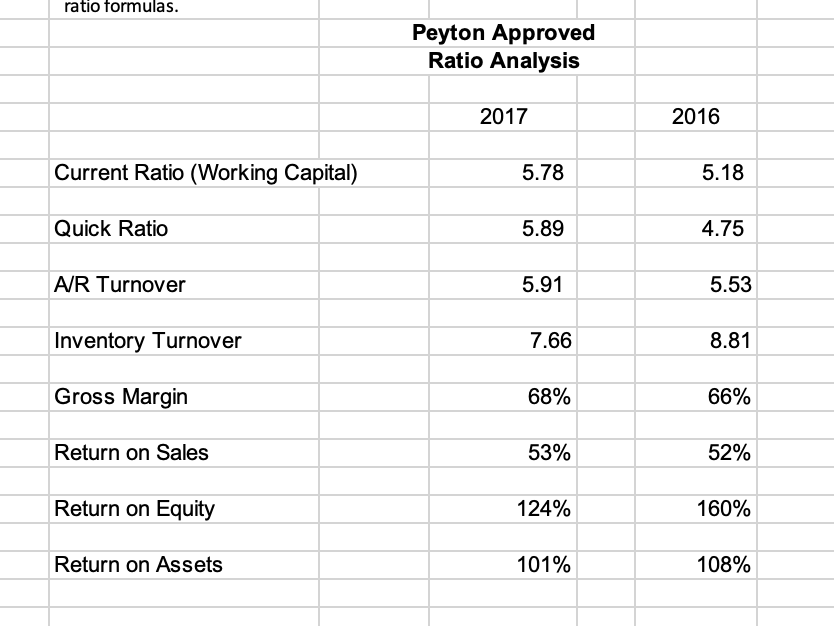

Question: ratio formulas. Peyton Approved Ratio Analysis 2017 2016 Current Ratio (Working Capital) 5.78 5.18 Quick Ratio 5.89 4.75 A/R Turnover 5.91 5.53 Inventory Turnover 7.66

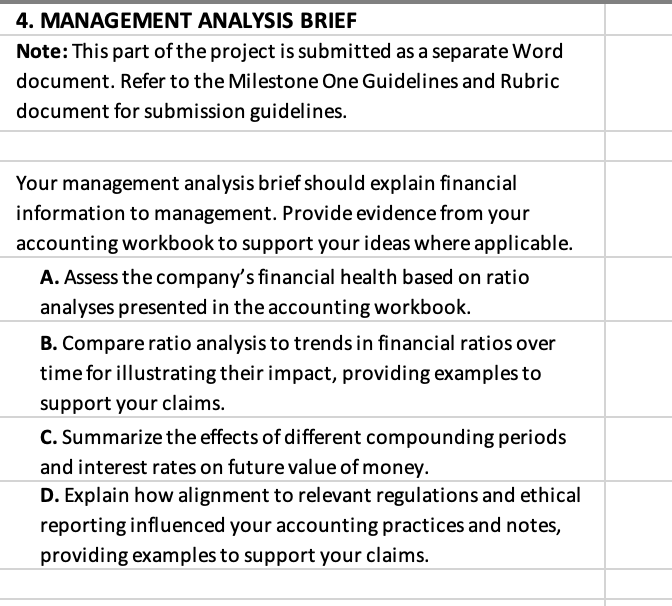

ratio formulas. Peyton Approved Ratio Analysis 2017 2016 Current Ratio (Working Capital) 5.78 5.18 Quick Ratio 5.89 4.75 A/R Turnover 5.91 5.53 Inventory Turnover 7.66 8.81 Gross Margin 68% 66% Return on Sales 53% 52% Return on Equity 124% 160% Return on Assets 101% 108% 4. MANAGEMENT ANALYSIS BRIEF Note: This part of the project is submitted as a separate Word document. Refer to the Milestone One Guidelines and Rubric document for submission guidelines. Your management analysis brief should explain financial information to management. Provide evidence from your accounting workbook to support your ideas where applicable. A. Assess the company's financial health based on ratio analyses presented in the accounting workbook. B. Compare ratio analysis to trends in financial ratios over time for illustrating their impact, providing examples to support your claims. C. Summarize the effects of different compounding periods and interest rates on future value of money. D. Explain how alignment to relevant regulations and ethical reporting influenced your accounting practices and notes, providing examples to support your claims. ratio formulas. Peyton Approved Ratio Analysis 2017 2016 Current Ratio (Working Capital) 5.78 5.18 Quick Ratio 5.89 4.75 A/R Turnover 5.91 5.53 Inventory Turnover 7.66 8.81 Gross Margin 68% 66% Return on Sales 53% 52% Return on Equity 124% 160% Return on Assets 101% 108% 4. MANAGEMENT ANALYSIS BRIEF Note: This part of the project is submitted as a separate Word document. Refer to the Milestone One Guidelines and Rubric document for submission guidelines. Your management analysis brief should explain financial information to management. Provide evidence from your accounting workbook to support your ideas where applicable. A. Assess the company's financial health based on ratio analyses presented in the accounting workbook. B. Compare ratio analysis to trends in financial ratios over time for illustrating their impact, providing examples to support your claims. C. Summarize the effects of different compounding periods and interest rates on future value of money. D. Explain how alignment to relevant regulations and ethical reporting influenced your accounting practices and notes, providing examples to support your claims

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts