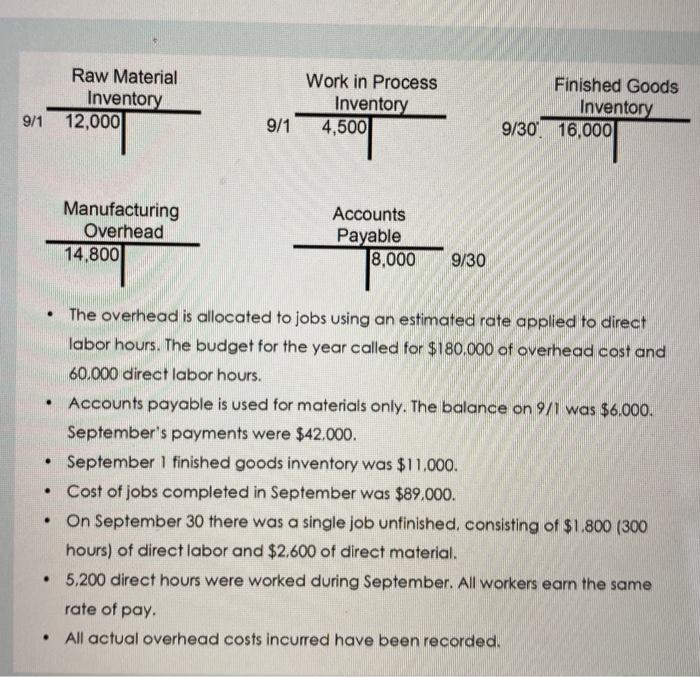

Question: Raw Material Inventory 9/1 12,000 Work in Process Inventory 4,500 Finished Goods Inventory 9/30 16,000 9/1 Manufacturing Overhead 14,800 Accounts Payable 8,000 9/30 . .

Raw Material Inventory 9/1 12,000 Work in Process Inventory 4,500 Finished Goods Inventory 9/30 16,000 9/1 Manufacturing Overhead 14,800 Accounts Payable 8,000 9/30 . . The overhead is allocated to jobs using an estimated rate applied to direct labor hours. The budget for the year called for $180.000 ot overhead cost and 60.000 direct labor hours. Accounts payable is used for materials only. The balance on 9/1 was $6.000. September's payments were $42.000. September 1 finished goods inventory was $11,000. Cost of jobs completed in September was $89.000. On September 30 there was a single job unfinished, consisting of $1.800 (300 hours) of direct labor and $2.600 of direct material. 5.200 direct hours were worked during September. All workers earn the same rate of pay. All actual overhead costs incurred have been recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts