Question: rds 2 DO FINC 3733 Excel Assignment #3 Your company is considering two mutually exclusive, equally risky, and not repeatable projects, A and B. Their

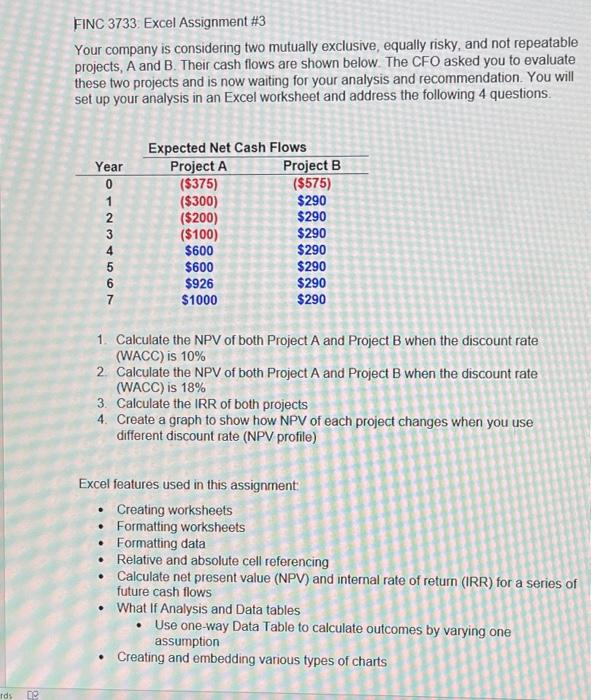

rds 2 DO FINC 3733 Excel Assignment #3 Your company is considering two mutually exclusive, equally risky, and not repeatable projects, A and B. Their cash flows are shown below. The CFO asked you to evaluate these two projects and is now waiting for your analysis and recommendation. You will set up your analysis in an Excel worksheet and address the following 4 questions. Expected Net Cash Flows Year Project A Project B 0 ($375) ($575) ($300) $290 ($200) $290 ($100) $290 $600 $290 $600 $290 $926 $290 $1000 $290 1. Calculate the NPV of both Project A and Project B when the discount rate (WACC) is 10% 2. Calculate the NPV of both Project A and Project B when the discount rate (WACC) is 18% 3. Calculate the IRR of both projects 4. Create a graph to show how NPV of each project changes when you use different discount rate (NPV profile) Excel features used in this assignment: Creating worksheets Formatting worksheets Formatting data Relative and absolute cell referencing Calculate net present value (NPV) and internal rate of return (IRR) for a series of future cash flows What If Analysis and Data tables Use one-way Data Table to calculate outcomes by varying one assumption Creating and embedding various types of charts 123 50 607 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts